In today’s fast-paced world, financial needs can arise unexpectedly. Whether it’s for a medical emergency, home renovation, or education expenses, having access to quick and convenient loans can be a lifesaver. WeCredit Loan is a leading financial service provider that offers hassle-free loans to individuals in need. In this comprehensive guide, we will explore how to apply for a WeCredit Loan, the eligibility criteria, the requirements, and the benefits of choosing WeCredit as your trusted lending partner.

How To Apply for a WeCredit Loan

Applying for a WeCredit Loan is a simple and straightforward process. Thanks to their user-friendly mobile application, you can complete the entire application process from the comfort of your own home. Here’s a step-by-step guide on how to apply:

1. Download the WeCredit Loan mobile app from the Google Play Store.

2. Install the app on your smartphone and create a new account.

3. Fill in the required personal and financial information accurately.

4. Provide the necessary documents, such as identification proof, income proof, and address proof.

5. Submit your application and wait for the approval process to be completed.

Eligibility Criteria for a WeCredit Loan

To ensure a seamless loan application process, WeCredit has set certain eligibility criteria that applicants must meet. These criteria are designed to assess the applicant’s creditworthiness and ability to repay the loan. Here are the key eligibility requirements:

1. Age: Applicants must be at least 18 years old.

2. Employment Status: Applicants should have a stable source of income, whether through employment or self-employment.

3. Credit History: A good credit history increases the chances of loan approval. However, WeCredit also considers applicants with limited or no credit history.

4. Citizenship: WeCredit loans are available to both citizens and permanent residents of the country.

Requirements for a WeCredit Loan

To complete the loan application process successfully, you will need to provide certain documents and information. These requirements help WeCredit assess your financial situation and determine your loan eligibility. Here are the common requirements:

1. Identification Proof: A valid government-issued ID card, such as a passport or driver’s license.

2. Income Proof: Recent pay stubs, bank statements, or tax returns to verify your income.

3. Address Proof: Documents like utility bills, rental agreements, or a bank statement with your current address.

4. Employment Details: Information about your current employer, including contact details and employment tenure.

5. Bank Account Details: You will need to provide your bank account information for loan disbursement and repayment purposes.

Benefits of Choosing WeCredit Loan

WeCredit Loan offers numerous benefits that make it an attractive choice for borrowers. Here are some of the key advantages of choosing WeCredit:

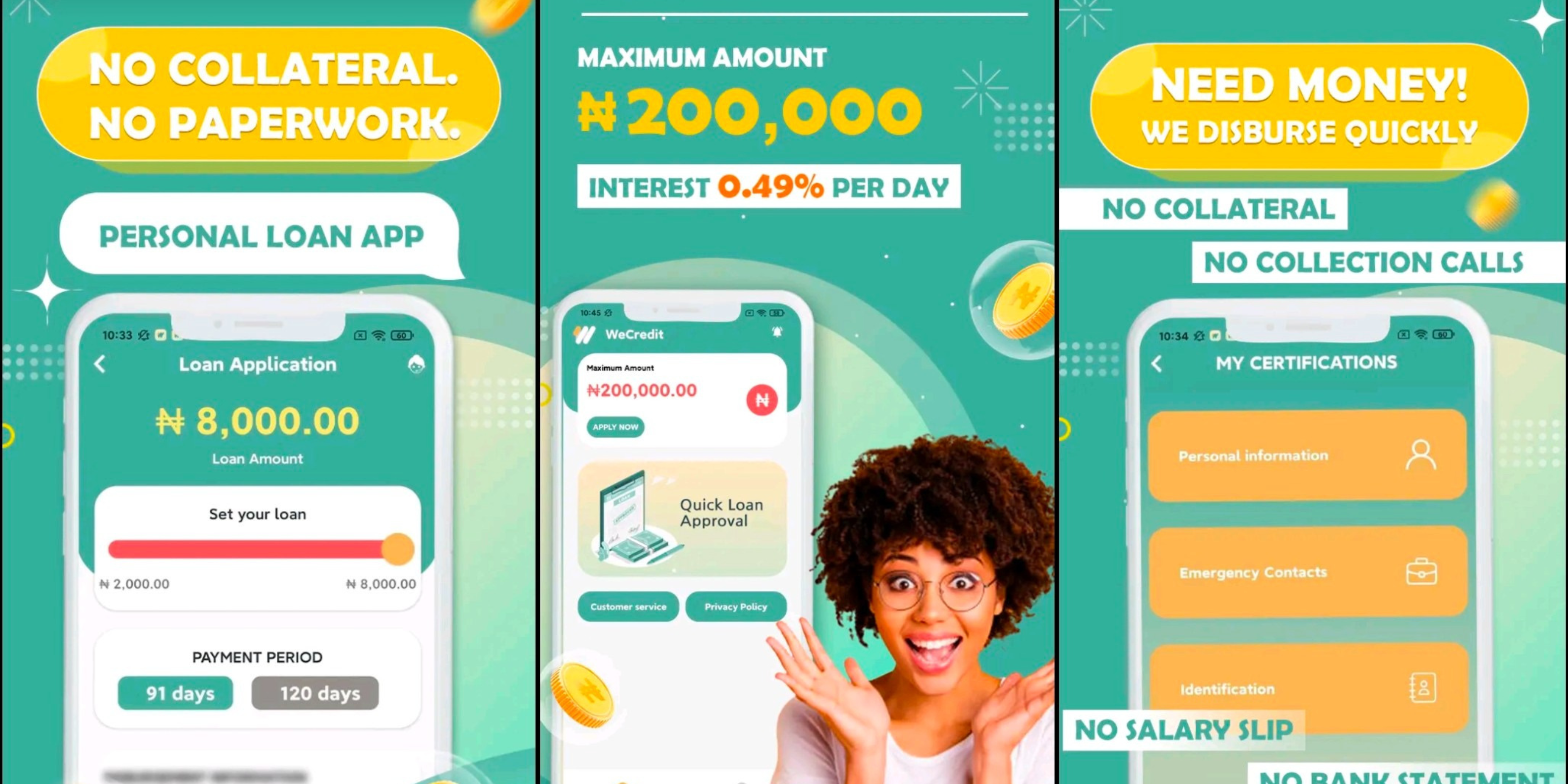

1. Quick and Convenient: With the WeCredit Loan mobile app, you can apply for a loan anytime, anywhere, without the need for lengthy paperwork or visiting a physical branch.

2. Flexible Loan Amounts: WeCredit offers a range of loan amounts to suit different financial needs. Whether you need a small loan or a larger amount, WeCredit has you covered.

3. Competitive Interest Rates: WeCredit strives to provide competitive interest rates, ensuring that borrowers can access funds at affordable rates.

4. Transparent Terms and Conditions: WeCredit believes in transparency and ensures that all terms and conditions are clearly communicated to borrowers, avoiding any hidden charges or surprises.

5. Quick Approval and Disbursement: Once your loan application is approved, WeCredit aims to disburse the funds to your bank account within a short period, allowing you to address your financial needs promptly.

Understanding how weCredit loan works: Example

Let’s say you have chosen a loan amount of NGN20000 at an APR of 12% with a term of 180 days.

Interest = NGN 20000 * 12% / 365 * 180 = NGN 1183.

Service fee = 0.

Interest on the loan = NGN 1183.

Total amount disbursed = NGN 20000.

Repayment = NGN 21183.

This example illustrates the calculation of interest and total repayment for a WeCredit Loan. Please note that the actual interest rates and loan terms may vary based on individual eligibility and loan amount.

Remember to carefully review the terms and conditions provided by WeCredit to understand the specific details of your loan agreement.

weCredit Loan: Frequently Asked Questions (FAQ)

Can I apply for a WeCredit Loan if I have a low credit score?

Answer: Yes, WeCredit considers applicants with all types of credit scores, including those with low credit scores or limited credit history.

How long does it take to get a loan approval from WeCredit?

Answer: The approval process typically takes a few business days. However, in some cases, it can be faster depending on the completeness of your application and the verification process.

What is the maximum loan amount I can apply for with WeCredit?

Answer: WeCredit offers loan amounts ranging from NGN10,000 to NGN200,000. Depending on your eligibility and financial profile.

Can I repay my WeCredit Loan before the tenure ends?

Answer: Yes, WeCredit allows borrowers to make early repayments without any penalty. In fact, early repayment can help you save on interest charges.

Is my personal and financial information safe with WeCredit?

Answer: WeCredit takes the security and privacy of your information seriously. They employ stringent security measures to protect your data and ensure confidentiality.

weCredit Contact Details

Phone: 09130712407

Email: wecredit_service@yahoo.com

Address: 23401, 23 Adeola Odeku St, Lagos.

Website

Conclusion

When you find yourself in need of a loan, WeCredit Loan is a reliable and convenient option to consider. With their user-friendly mobile app, flexible loan options, competitive interest rates, and quick approval process, WeCredit aims to provide a seamless borrowing experience. Remember to review the eligibility criteria and gather the necessary documents before applying for a loan. By choosing WeCredit, you can address your financial needs with confidence and convenience.

So, download the WeCredit Loan app from the Google Play Store today and take the first step towards securing the funds you need.