In our modern society, where everything moves quickly, having a stable financial situation and easy access to cash is essential for both individuals and businesses. Fortunately, technology has evolved to offer a wide range of financial apps and platforms to meet these needs. One such app is Plenty Cash, a popular mobile application designed to provide users with a convenient and efficient way to access loans and financial assistance. In this article, we’ll take a closer look at everything you need to know about Plenty Cash, including how to apply, who’s eligible, the requirements, benefits, and more. Let’s dive into the world of Plenty Cash and explore how it can benefit you!

What is Plenty Cash?

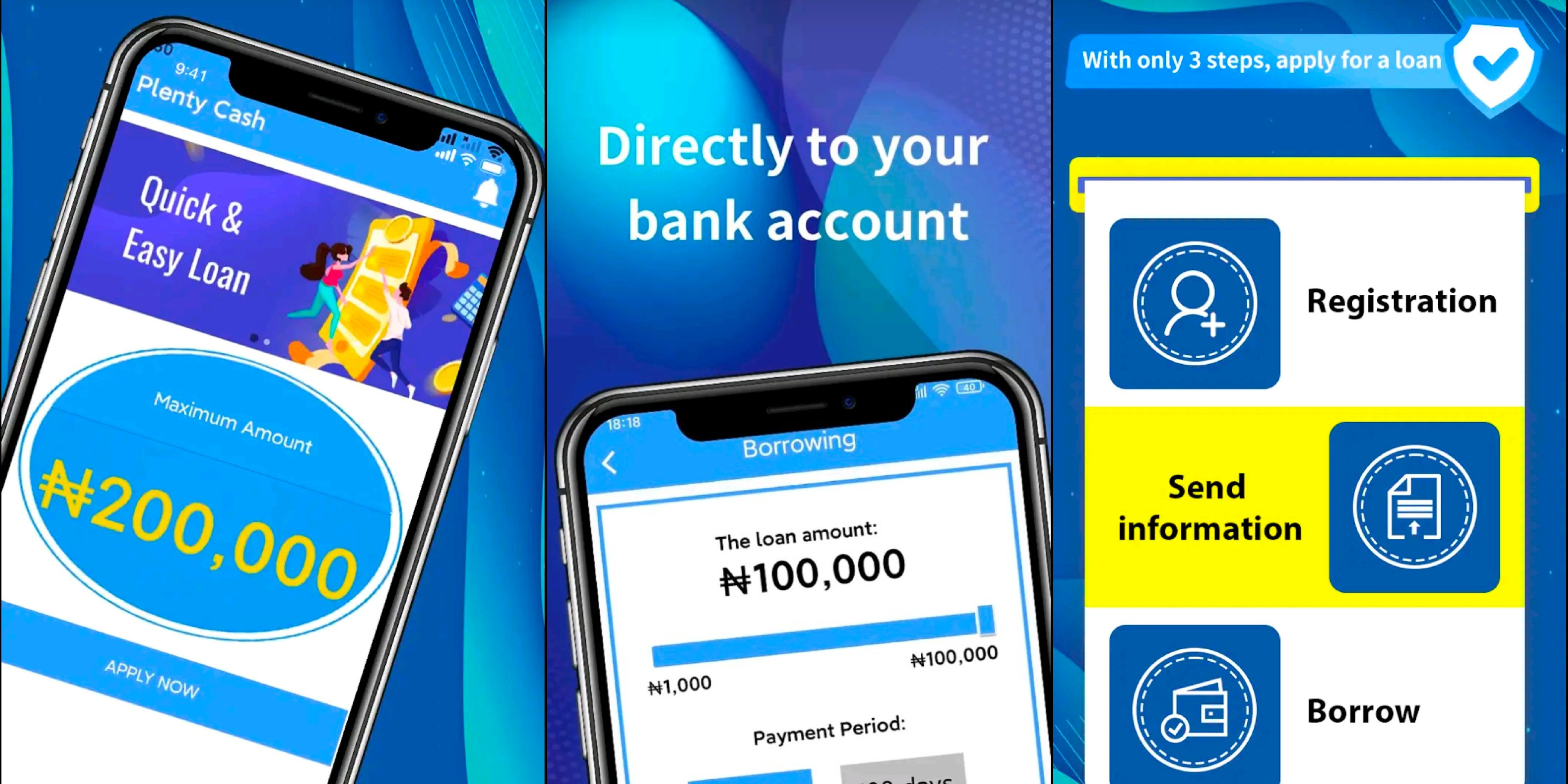

Plenty Cash is a mobile app available on the Google Play Store that offers a hassle-free way to apply for loans and access financial assistance. The app is designed to cater to the needs of individuals and businesses who require quick cash for various purposes, such as emergencies, business investments, personal expenses, and more. With Plenty Cash, users can conveniently apply for loans directly from their mobile devices, eliminating the need for lengthy paperwork and traditional loan application processes.

What are the Eligibility Criteria for Plenty Cash?

While Plenty Cash aims to provide financial assistance to a wide range of individuals and businesses, there are certain eligibility criteria that applicants must meet. The specific requirements may vary depending on the jurisdiction and regulations in your area. However, some common eligibility criteria for Plenty Cash may include:

1. Age: Being of legal age (18 years or older)

2. Citizenship: Must be a legal citizen of Nigeria

3. Document: Having a valid identification document (e.g.,national ID card, passport, driver’s license)

4. Income: Having a stable source of income (employment, business, etc.)

5. Credit Score: Meeting any credit score or credit history requirements set by Plenty Cash.

6. Mobile Number: You must have a registered sim card(number), for registration and SMS purposes.

Note: It is important to note that meeting the eligibility criteria does not guarantee loan approval. The final decision is based on various factors, including the app’s assessment of your financial situation and creditworthiness.

What are the Requirements for Plenty Cash Loan?

When applying for a loan through the Plenty Cash app, you will need to provide certain documents and information to complete the application process. The specific requirements may vary, but some common documents and information requested by Plenty Cash may include:

1. Personal identification documents (e.g., passport, driver’s license, national ID)

2. Proof of address (utility bills/NEPA Bills, bank statements, etc.)

3. Proof of income (bank statements, tax returns, etc.)

4. Bank account details for loan disbursement, either microfinance bank or commercial bank account.

5. You must have a registered sim card(number), for registration and SMS purposes.

Note: It is important to ensure that all the documents and information provided are accurate and up-to-date to avoid any delays or complications in the loan application process.

How To Apply for Plenty Cash: Step by Step Guide

Applying for a loan through the Plenty Cash app is a simple and straightforward process. To get started, follow these steps:

1. Download the Plenty Cash app from the Google Play Store or search for “Plent cash” on Google play store and Install the app on your mobile device and open it.

2. Create an account by providing the required information, such as your name, contact details, and identification documents(e.g. Government issued National Identification Card).

3. Once your account is set up, log in to the app using your credentials.

4. Navigate to the loan application section within the app.

5. Fill out the loan application form, providing accurate and complete information.

6. Submit your loan application and wait for the app to process your request.

If approved, the loan amount will be disbursed directly to your designated bank account.

What are the Benefits of Using Plenty Cash?

Plenty Cash offers several benefits to its users, making it a popular choice for those in need of quick financial assistance. Some of the key benefits of using Plenty Cash include:

1. Convenience: The app allows users to apply for loans directly from their mobile devices, eliminating the need for physical visits to banks or financial institutions.

2. Quick Loan Approval: Plenty Cash aims to provide quick loan approval, with some users receiving funds within a few hours of application submission.

3. Flexible Loan Options: The app offers a range of loan options to cater to different financial needs and repayment capabilities.

4. User-Friendly Interface: Plenty Cash features a user-friendly interface that makes it easy for users to navigate and complete the loan application process.

5. Security and Privacy: The app prioritizes the security and privacy of user data, implementing robust measures to protect sensitive information.

Understanding how PlentyCash Loan Works: Example

Let’s illustrate the fees associated with a four-month loan payment term using Plenty Cash. Suppose you process a loan with a principal amount of ₦6,000. Here’s how the fees would break down:

Interest Rate: The monthly interest rate is 2%. So, for a four-month period, the interest would be calculated as follows: ₦6,000 * 2% * 4 = ₦480.

Service Fee: Plenty Cash charges a service fee of 1%. For the same four-month period, the service fee would be calculated as: ₦6,000 * 1% * 4 = ₦240.

Total Amount Due: Adding up the principal, interest, and service fee, the total amount due would be: ₦6,000 (Principal) + ₦480 (Interest) + ₦240 (Service Fee) = ₦6,720.

Monthly Payment: To repay this loan, you would need to make monthly payments of ₦1,680.

PlentyCash Loan: Frequently Asked Questions (FAQ)

Is Plenty Cash available in my country?

Answer: The availability of Plenty Cash may vary depending on your country or region. It is recommended to check the Google Play Store or the official website of Plenty Cash for information on supported locations. But at the time of this writing this article PlentyCash Loan is available in Nigeria.

Can I apply for a loan with Plenty Cash if I have a low credit score?

Answer: Plenty Cash considers various factors when assessing loan applications, including credit scores. While a low credit score may impact your chances of approval, it is not necessarily a disqualifying factor. Plenty Cash takes into account the overall financial situation of the applicant.

How long does it takefor Plenty Cash to process a loan application?

Answer: The processing time for loan applications with Plenty Cash may vary depending on various factors, such as the completeness of the application and the volume of applications received. In some cases, users may receive loan approval within a few hours, while in others, it may take longer. It is recommended to check the app or contact Plenty Cash directly for more information on processing times.

What is the minimum and maximum loan amount available on Plenty Cash?

Answer: On Plenty Cash, the minimum loan amount available is NGN 3,000, while the maximum loan amount is NGN 600,000.

What happens if I am unable to repay the loan on time?

Answer: If you are unable to repay the loan on time, it is important to communicate with Plenty Cash as soon as possible. They may offer options such as loan extensions or revised repayment plans to help you manage your financial obligations. However, it is crucial to remember that late or missed payments may have consequences, such as additional fees or negative impacts on your credit score.

Is my personal and financial information safe with Plenty Cash?

Answer: Plenty Cash takes the security and privacy of user information seriously. The app implements robust security measures to protect sensitive data and follows industry best practices. However, it is always advisable to review the app’s privacy policy and terms of service to understand how your information is collected, used, and protected.

What is the service fee range on Plenty Cash?

Answer: The service fee on Plenty Cash ranges from 1% to 10%

What is the maximum Annual Percentage Rate (APR) and monthly interest rate on Plenty Cash?

Answer: The maximum Annual Percentage Rate (APR) on Plenty Cash is 30% per year, which translates to an interest rate ranging from 0.41% to 2.5% per month.

Is there a late fee charged for overdue payments on Plenty Cash?

Answer: Yes, there is a one-time late fee of 3% of the outstanding amount due.

What is the minimum and maximum repayment period offered by Plenty Cash?

Answer: The minimum repayment period offered by Plenty Cash is 91 days, while the maximum repayment period offered is 180 days.

Branch Nigeria Contact Information

Office Address: 82 Alebiosu street, Ile epo bustop, Egbeda Lagos, Nigeria

Website

Phone: +234 8168-505-208

E-mail: Plentycasha@outlook.com

Mobile App

Conclusion

Plenty Cash is a convenient and efficient mobile app that provides users with quick access to loans and financial assistance. By following the simple application process and meeting the eligibility criteria, individuals and businesses can benefit from the app’s features and enjoy the convenience of applying for loans directly from their mobile devices. With its user-friendly interface, flexible loan options, and commitment to security and privacy, Plenty Cash is a reliable choice for those in need of quick cash. Remember to always review the terms and conditions, as well as your repayment capabilities, before applying for a loan.