Navigating the world of financial services can be tricky. P2Vest, a Nigerian fintech company, seeks to change that by connecting borrowers, lenders, and offering a marketplace for insurance products. Think of them as your financial matchmaker!

What is P2Vest?

P2Vest is a mobile app designed to streamline accessing financial services in Nigeria and other parts of Africa. Their primary offerings include:

- Peer-to-Peer (P2P) Lending:Borrow money directly from lenders, cutting out traditional financial intermediaries.

- Insurance Aggregator:Compare and purchase insurance policies from various companies, finding the best deals for your needs.

- Insurance Parasol:P2Vest’s unique insurance product line, offering trustworthy coverage and seamless claim processes.

Eligibility Requirements for apply for P2Vest Loan

To qualify for a P2Vest loan, you must meet the following:

- African Residency:While primarily focused on Nigeria, P2Vest’s lending services extend to other African nations.

- Age:Be at least 18 years old or above the age of 18.

- Account Setup:Create a P2Vest account and complete your profile details.

- Creditworthiness:P2Vest uses a credit scoring system to evaluate loan eligibility.

- KYC (Know Your Customer):To access larger loans, you may need to complete KYC requirements.

How to Apply for a P2Vest Loan

- Download the App:Find P2Vest in your app store and install it on your device.

- Create an Account:Open the app and set up a free account with your basic information.

- Build Your Profile:Provide full details to improve your credit score and loan eligibility.

- Applyfor a Loan:Choose your desired loan amount and preferred repayment terms.

- Get Approved & Funded: If your credit score and application meet the criteria, you’ll receive your loan directly into your bank account.

Benefits of Using P2Vest

- Flexibility: P2Vest offers loan amounts between N5,000 and N100,000, with repayment tenors from 60 to 180 days.

- Choice: Select the loan terms that best suit your financial situation.

- Competitive Interest Rates:P2Vest’s interest rates (2%-20% monthly, APR of 24%-48%) are tailored to your creditworthiness.

- Insurance Options:Explore various insurance policies and find coverage that best fits your needs.

- Beyond Nigeria:P2Vest’s P2P lending services are available to users in other African nations.

P2Vest: More Than Just Loans

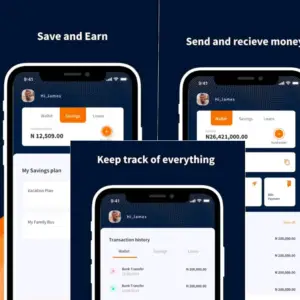

P2Vest provides a comprehensive suite of financial services:

- Lending:If you have money to spare, become a lender on the P2Vest platform and earn interest while helping others.

- Insurance Marketplace:Compare different insurance providers and purchase policies directly through the app.

- Claims Support:P2Vest assists with filing and tracking insurance claims for their “Insurance Parasol” products.

P2Vest’s Terms and Conditions

Before applying, understand P2Vest’s terms and conditions. Key points to keep in mind:

- Interest Rates: Rates vary based on your credit score (between 2%-20% monthly, translating to 24%- 48% APR).

- Platform Fees: P2Vest charges lenders a 30% platform fee on interest earned.

- Late Payments: Understand the consequences of delayed payments.

- False Information: Providing incorrect information may delay your loan or result in blacklisting for fraud.

Get in Touch with P2Vest

Email: support@p2vest.com

Website: https://www.p2vest.com/

Social Media: Find them on various social media platforms @p2vest

Important Notes

P2Vest’s focus is on smaller loans (microcredits), so consider this if you need significant funding.

Read the fine print carefully for any loan or insurance product offered by P2Vest or other providers.