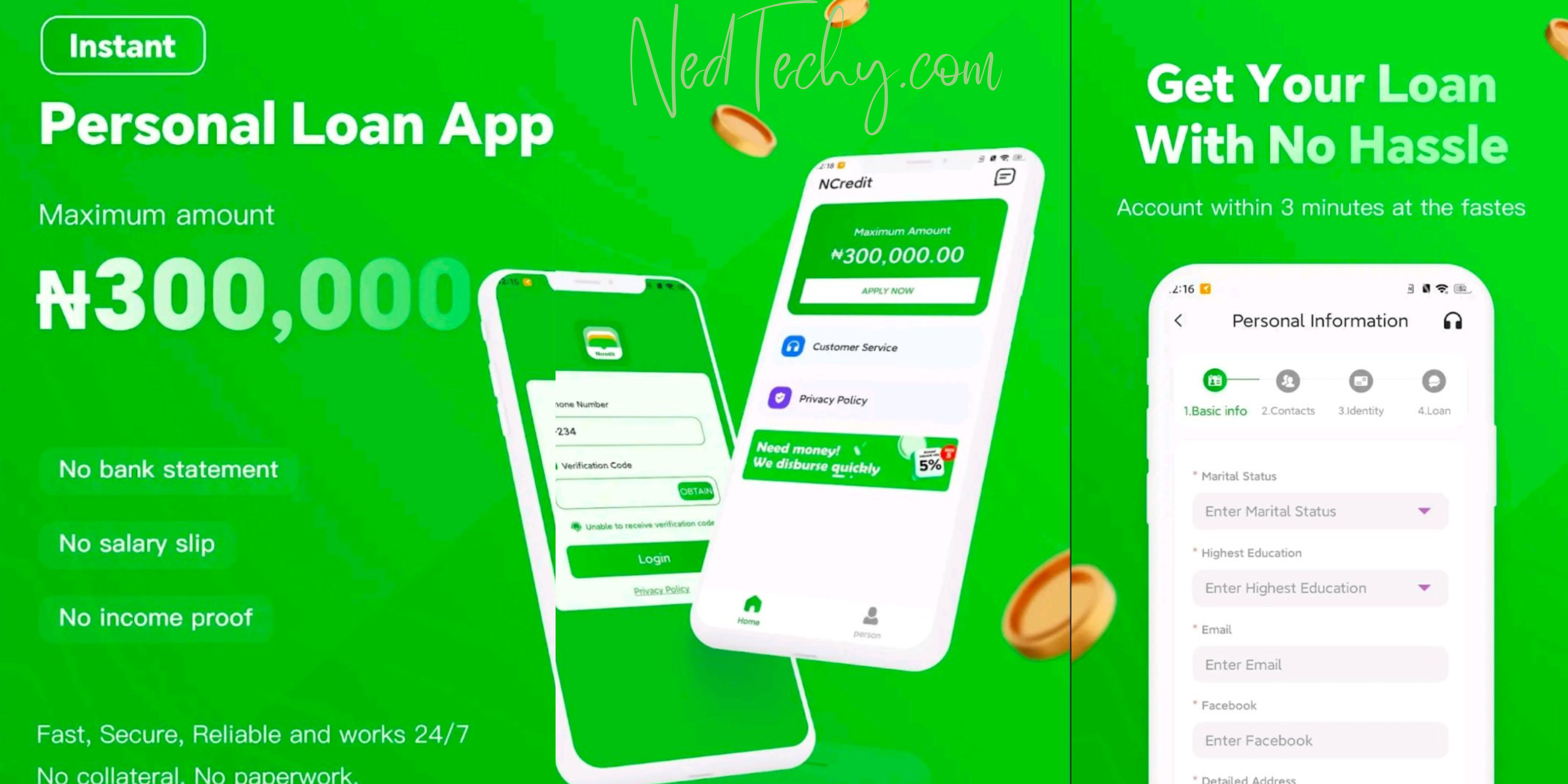

Yeah, financial flexibility is crucial. NCredit, a reliable loan app in Nigeria, that offers 24/7 access to easy-to-approve cash loan services. With a flexible repayment plan, no collateral or guarantor requirements, and a user-friendly interface, NCredit provides a hassle-free borrowing experience. In this article, we will guide you on how to apply for an NCredit loan, the eligibility requirements, and the benefits it offers. Additionally, we will provide an example to illustrate how the loan works, along with essential information on the minimum and maximum loan amounts and loan duration.

How to Apply for an NCredit Loan

1. Download and Install the NCredit App: Visit the Google Play Store and search for “NCredit – Reliable Loan Online.” Download and install the app on your mobile device.

2. Registration: Open the NCredit app and register your information. Provide accurate details to ensure a smooth application process.

3. Loan Application: Once registered, submit your loan application through the app. Choose your preferred loan amount from the available options.

4. Loan Approval: After submitting your application, wait for the loan result. NCredit aims to provide fast approval, ensuring a quick turnaround time.

5. Disbursement: Upon loan approval, the loan amount will be disbursed directly into your registered bank account. NCredit strives to provide a seamless and efficient disbursement process.

Eligibility/Requirements for an NCredit Loan

To be eligible for an NCredit loan, you need to meet the following requirements:

1. Age: You must be between 18 to 65 years old.

2. Bank Verification Number (BVN): A valid BVN is required for loan verification purposes.

3. Valid Mobile Number: Provide a valid mobile number for communication and emergency purposes related to your loan.

4. Valid Nigerian ID: You must possess a valid Nigerian ID issued by the local government.

Benefits of NCredit Loan

1. Quick and Easy Application Process: NCredit offers a user-friendly app interface, ensuring a smooth and hassle-free loan application experience.

2. Fast Registration: The registration process is swift, allowing you to get started on your loan application without delays.

3. No Collateral or Guarantor Required: NCredit eliminates the need for collateral or a guarantor, making it accessible to a wide range of individuals.

4. Flexible Repayment Options: NCredit provides flexible repayment methods, allowing you to choose a plan that suits your financial situation.

5. Data Protection: NCredit prioritizes data privacy and security. Personal information is safeguarded and used solely for verification and evaluation purposes.

How NCredit Loan Calculation works(Example)

Let’s consider an example to understand how an NCredit loan works:

Loan Amount: The loan amount ranges from ₦3,000 to ₦800,000.

Loan Term: The loan term starts from 91 days and can exceed this duration.

Interest Rate: The interest rate varies from 2.5% to 20%, with the maximum Annual Percentage Rate (APR) capped at 20%.

Service Fee: The service fee ranges from 0.1% to 0.5% of the loan amount.

NCredit Loan Example

Loan Amount: ₦4,000

Loan Term: 1 year

Interest/Charges: ₦4,000 * 15% = ₦600

Service Fee: ₦4,000 * 0.4% = ₦16

Gross Total Repayment Amount: ₦4,616

Minimum Loan Amount, Maximum Loan Amount, and Loan Duration

Minimum Loan Amount: The minimum loan amount offered by NCredit is ₦3,000.

Maximum Loan Amount: NCredit provides loans up to ₦800,000, depending on the borrower’s eligibility and creditworthiness.

Loan Duration: The loan duration can start from 91 days and can extend beyond this period, depending on the chosen loan terms and repayment capacity.

NCredit Contact Information

E-mail: ncredit@yahoo.com

Phone: +234 816-618-1224

Conclusion

NCredit is a reliable loan app in Nigeria that offers easy-to-approve cash loan services with a user-friendly interface. By following the simple steps outlined in this article, you can apply for an NCredit loan conveniently. With no collateral or guarantor requirements and flexible repayment options, NCredit provides financial assistance to individuals in need. Remember to meet the eligibility requirements and explore the benefits of NCredit’s reliable loan services. Empower yourself with financial flexibility through NCredit and take control of your financial journey.