Financial needs can arise unexpectedly, and having access to quick and reliable loans is essential in today’s fast-paced world. Whether you need funds for a business venture, medical expenses, or educational purposes, LendMe Loan is here to help. In this comprehensive guide, we will explore all the details of LendMe Loan, including how to apply, eligibility criteria, requirements, benefits, and more. So, let’s dive right in!

What is LendMe Loan?

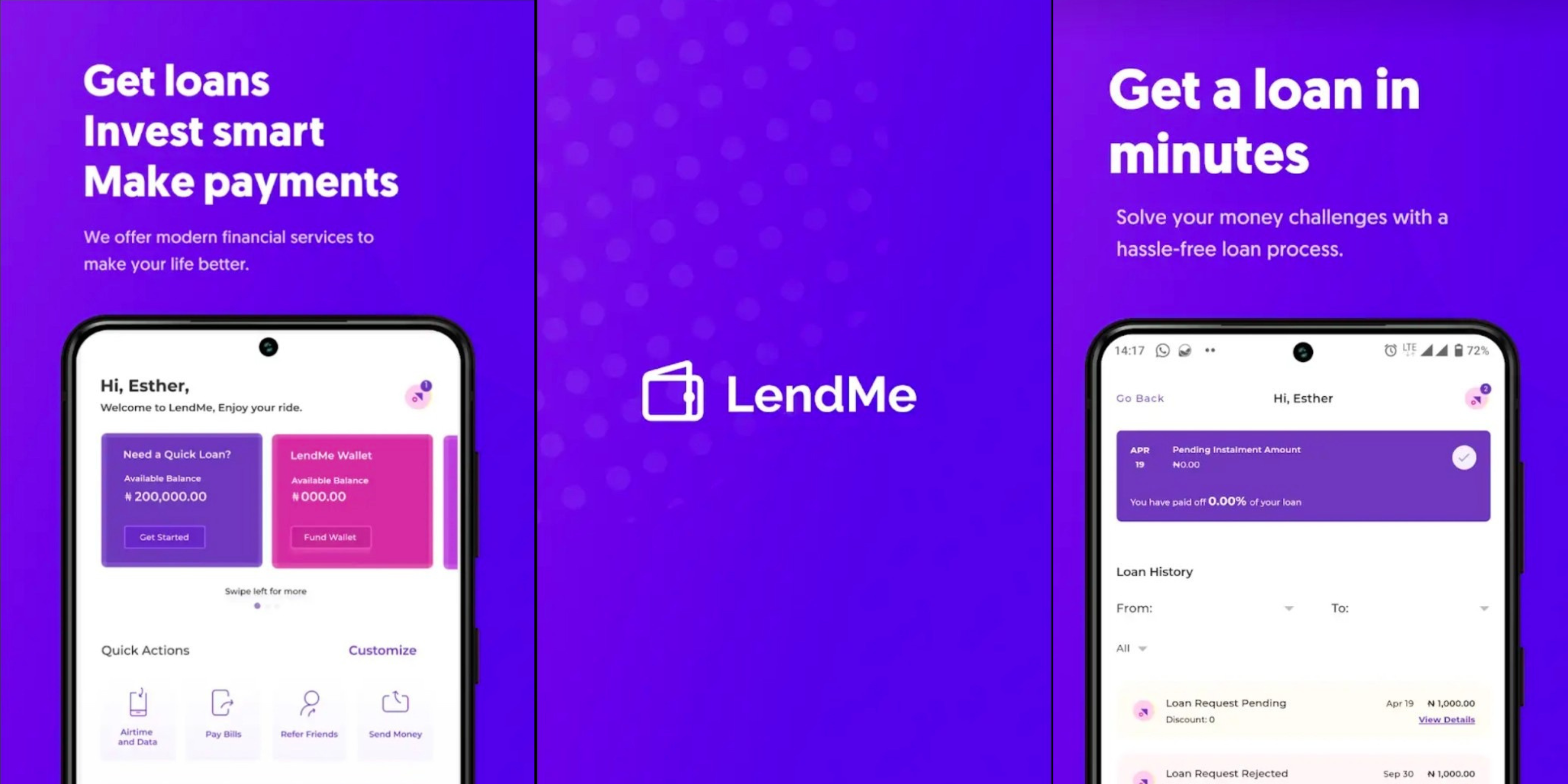

LendMe Loan is a leading financial application that provides individuals with a convenient and efficient way to borrow money. With its user-friendly interface and seamless functionality, LendMe Loan has become the go-to choice for many borrowers. Whether you need a small loan to cover unexpected expenses or a larger loan for a major investment, LendMe Loan offers flexible options to suit your needs.

Eligibility Criteria for LendMe Loan

To be eligible for a loan with LendMe Loan, you need to meet certain criteria. While specific requirements may vary, here are some common eligibility criteria:

1. Age: You must be at least 18 years old or the legal age of majority in your country of residence.

2. Income: LendMe Loan typically requires borrowers to have a stable source of income. This ensures that you have the means to repay the loan.

3. Credit History: While LendMe Loan considers applicants with various credit backgrounds, a positive credit history can increase your chances of approval.

4. Identification: You will need to provide valid identification documents, such as a passport or driver’s license, to verify your identity.

5. Residency: LendMe Loan operates in specific regions or countries. Ensure that you reside in an eligible location before applying.

Note: It’s important to note that meeting the eligibility criteria does not guarantee loan approval. LendMe Loan evaluates each application on a case-by-case basis.

What are the Requirements for LendMe Loan?

When applying for a loan with LendMe Loan, you will need to provide certain documents and information. While the exact requirements may vary, here are some common documents you may need to submit:

1. Identification Documents: Valid identification documents, such as a passport or driver’s license, to verify your identity.

2. Proof of Income: Documents that demonstrate your income, such as pay stubs, bank statements, or tax returns.

3. Bank Statements: Recent bank statements that provide an overview of your financial transactions and stability.

4. Address Verification: Proof of your residential address, such as utility bills or a lease agreement.

5. Employment Details: Information about your current employment, including your employer’s name, address, and contact details.

Note: It’s important to provide accurate and up-to-date information and documents to ensure a smooth loan application process.

How To Apply for LendMe Loan

Applying for a loan with LendMe Loan is a simple and straightforward process. Here are the steps you need to follow:

1. Download the LendMe Loan App: Visit the Google Play Store and download the LendMe Loan app to your mobile device, you can use this link or search for “LendMe”.

2. Create an Account: Once you have downloaded the app, create a new account by providing the required information. This may include your name, contact details, and identification documents.

3. Complete the Application: Fill out the loan application form within the app. Provide accurate information about your financial situation, employment details, and loan amount required.

4. Submit Documents: Upload the necessary documents to support your loan application. This may include identification documents, proof of income, and bank statements.

5. Wait for Approval: After submitting your application, the LendMe Loan team will review your information and assess your eligibility. You will receive a notification regarding the status of your application.

6. Accept the Loan Offer: If your application is approved, you will receive a loan offer detailing the terms and conditions. Carefully review the offer and accept it if you agree with the terms.

7. Receive Funds: Once you have accepted the loan offer, the funds will be disbursed to your designated bank account. Depending on your bank’s processing time, you can expect to receive the funds within a few business days.

Top Benefits of LendMe Loan

LendMe Loan offers several benefits that make it a preferred choice for borrowers. Here are some key advantages of using LendMe Loan:

1. Quick and Convenient: The LendMe Loan app allows you to apply for a loan anytime, anywhere, making it incredibly convenient. The application process is streamlined, ensuring a quick turnaround time.

2. Flexible Loan Options: LendMe Loan offers a range of loan options to suit different financial needs. Whetheryou need a small loan or a larger amount, LendMe Loan provides flexible terms and repayment options.

3. Competitive Interest Rates: LendMe Loan strives to offer competitive interest rates to its borrowers. This ensures that you can access funds at affordable rates, saving you money in the long run.

4. Transparent and Secure: LendMe Loan prioritizes transparency and security. The app provides clear information about loan terms, fees, and repayment schedules. Additionally, LendMe Loan employs robust security measures to protect your personal and financial information.

5. Customer Support: LendMe Loan understands the importance of excellent customer service. Their dedicated support team is available to assist you with any queries or concerns you may have throughout the loan process.

6. Credit Building Opportunities: Responsible borrowing and timely repayments with LendMe Loan can help improve your credit score over time. This can open doors to better loan options and financial opportunities in the future.

LendMe Loan: Frequently Asked Questions (FAQ)

Is LendMe Loan available in my country?

Answer: LendMe Loan operates in specific regions or countries. Please check the app’s availability in your country before proceeding with the application.

What is the Maximum and Minimum Loan Amount I Can Borrow with LendMe Loan?

Answer: With LendMe Loan, the loan amounts you can borrow range from a minimum of ₦1,000 to a maximum of ₦100,000. The exact amount you qualify for depends on factors such as your income, credit history, and LendMe Loan’s lending policies.

How long does it take to receive the loan funds?

Answer: Once your loan application is approved and you accept the loan offer, the funds are typically disbursed to your designated bank account within a few business days. However, the exact time may vary depending on your bank’s processing time.

Can I repay the loan before the scheduled repayment date?

Answer: Yes, LendMe Loan allows early repayment. However, it’s important to review the loan terms and conditions to understand any potential fees or penalties associated with early repayment.

What happens if I miss a loan repayment?

Answer: Missing a loan repayment can have consequences, including late payment fees and a negative impact on your credit score. It’s crucial to communicate with LendMe Loan and discuss any difficulties you may face in repaying the loan to explore possible solutions.

LendMe Contact Details

Website

Email: help@lendme.co

Mobile App

Conclusion

LendMe Loan provides a convenient and efficient way to access funds when you need them the most. With its user-friendly app, flexible loan options, competitive interest rates, and excellent customer support, LendMe Loan has become a trusted choice for borrowers. By following the simple application process and meeting the eligibility criteria, you can secure the funds you need to fulfill your financial goals. Remember to borrow responsibly and make timely repayments to build a positive credit history. So, download the LendMe Loan app today and take control of your financial future!