As always, financial flexibility is key to achieving our goals and dreams. Whether it’s starting a business, pursuing higher education, or dealing with unexpected expenses, having access to quick and reliable loans can make all the difference. Lendigo Loan is a leading financial service provider that offers a seamless borrowing experience with competitive interest rates and flexible repayment options. In this comprehensive guide, we will explore everything you need to know about Lendigo Loan, including how to apply, eligibility criteria, requirements, benefits, and more.

What is Lendigo Loan?

Lendigo Loan is a mobile application available on the Google Play Store that provides individuals with access to personal loans. With Lendigo Loan, you can apply for a loan directly from your smartphone, making the borrowing process quick, convenient, and hassle-free.

How does Lendigo Loan work?

Answer: Lendigo Loan simplifies the loan application process by leveraging technology and data-driven algorithms. The app uses advanced algorithms to assess your creditworthiness and provide you with personalized loan offers. Once approved, the loan amount is disbursed directly to your bank account, allowing you to access funds instantly.

What are the benefits of Lendigo Loan?

Lendigo Loan offers numerous benefits to borrowers, including:

1. Convenience: With Lendigo Loan, you can apply for a loan anytime, anywhere, using your smartphone. There’s no need to visit a physical branch or go through lengthy paperwork.

2. Fast Approval: The app’s advanced algorithms enable quick loan approval, often within one week. This means you can get the funds you need without delay.

3. Flexible Repayment Options: Lendigo Loan offers flexible repayment options, allowing you to choose a repayment plan that suits your financial situation. You can opt for weekly, bi-weekly, or monthly installments.

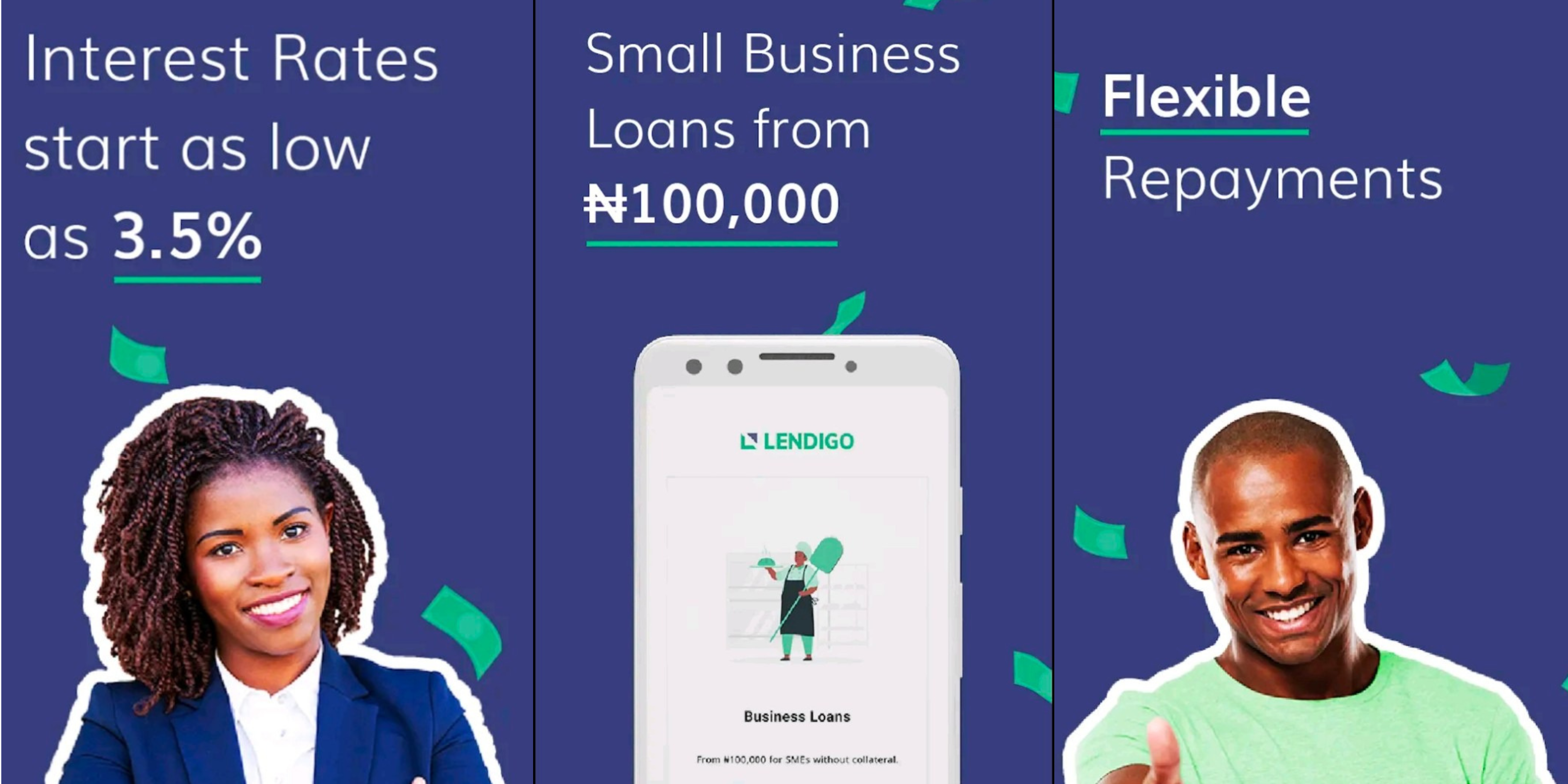

4. Competitive Interest Rates: Lendigo Loan strives to provide competitive interest rates, ensuring that you can borrow money at affordable rates.

5. Transparent Terms and Conditions: Lendigo Loan believes in transparency and provides clear terms and conditions, ensuring that you understand the loan agreement fully.

Is Lendigo Loan safe and secure?

Answer: Lendigo Loan prioritizes the security and privacy of its users. The app utilizes advanced encryption technology to safeguard your personal and financial information. Additionally, Lendigo Loan adheres to strict data protection regulations to ensure that your data remains confidential.

How to apply for a Lendigo Loan?

Applying for a Lendigo Loan is a simple and straightforward process. Follow these steps to apply:

1. Download the App: Visit the Google Play Store and search for “Lendigo Loan.” Download and install the app on your smartphone.

2. Create an Account: Open the app and create a new account by providing the required information, including your name, contact details, and identification documents.

3. Complete the Application: Fill out the loan application form within the app. Provide accurate information about your employment, income, and financial situation.

4. Submit Documents: Upload the necessary documents, such as proof of identity, address, and income, as requested by the app.

5. Review and Accept Loan Offers: Once your application is submitted, Lendigo Loan’s algorithms will assess your eligibility and provide you with personalized loan offers. Review the offers and select the one that best suits your needs.

6. Loan Disbursement: Upon accepting a loan offer, the approved loan amount will be disbursed directly to your designated bank account.

What are the eligibility criteria for a Lendigo Loan?

The eligibility criteria for a Lendigo Loan are designed to be clear-cut, ensuring accessibility for both small and large business owners seeking financial assistance. Applicants must be business owners, regardless of the scale of their ventures, to qualify for funding.

What are the requirements for a Lendigo Loan?

To complete your loan application, you will need to provide the following documents:

1. Proof of Identity: Valid government-issued identification document, such as a passport or driver’s license.

2. Proof of Address: Recent utility bill(e.g. Electricity bills Popularly referred as NEPA bills), bank statement, or any official document that verifies your residential address.

3. Proof of Income: Pay stubs, bank statements, or any document that shows your income and employment status.

4. Bank Account Details: Provide your bank account details for loan disbursement.

5. Bank Verification Number(BVN): Your BVN provides your unique identity for the purpose of achieving effective “Know Your Customer” (KYC) principle and fraud prevention

How to repay your Lendigo Loan?

Repaying your Lendigo Loan is simple and convenient. The app provides multiple repayment options to suit your preferences. Here’s how you can repay your loan:

1. Automatic Deductions: Set up automatic deductions from your bank account to ensure timely repayment. This eliminates the need for manual payments and helps you stay on track.

2. Manual Payments: If you prefer to make manual payments, you can do so through the app. Simply log in to your Lendigo Loan account and follow the prompts to make a payment.

3. Flexible Repayment Schedule: Lendigo Loan allows you to choose a repayment schedule that aligns with your financial situation. Whether you prefer weekly, bi-weekly, or monthly installments, you can customize your repayment plan accordingly.

What happens if you miss a payment?

If you miss a payment on your Lendigo Loan, it is important to take immediate action. Late or missed payments may result in additional fees and penalties. Here’s what you can do:

1. Contact Lendigo Loan: Reach out to Lendigo Loan’s customer support team as soon as possible. They can provide guidance on how to rectify the situation and avoid further consequences.

2. Understand the Terms: Familiarize yourself with the terms and conditions of your loan agreement. This will help you understand the repercussions of missed payments and any applicable fees.

3. Create a Repayment Plan: Work with Lendigo Loan to create a repayment plan that suits your financial situation. They may be able to offer flexible options to help you catch up on missed payments.

Can you apply for a second loan with Lendigo Loan?

Answer: Yes, Lendigo Loan allows borrowers to apply for a second loan once the first loan has been successfully repaid. However, it is important to note that approval for a second loan is subject to eligibility criteria and creditworthiness assessment.

How to contact Lendigo Loan customer support?

Answer: If you have any questions or need assistance with your Lendigo Loan, you can contact their customer support team through the app. Simply navigate to the “Contact Us” section and choose your preferred method of communication, whether it’s through phone, email, or live chat.

Website

Mobile APP

Email: support@lendigo.ng

Phone: 0812 289 1078

Office Address: 4th Floor, 13 Town Planning Way, Ilupeju, Lagos

What is the Minimum and maximum loan amounts available from Lendigo?

Answer: Lendigo offers loans ranging from ₦100,000 to ₦10,000,000, providing flexibility to meet varying financial needs.

What is the maximum tenure for a business loan with Lendigo?

Answer: At Lendigo, we offer short-term loans with a maximum tenure of 6 months. However, in certain cases, we may approve loans with a tenure of up to 12 months, subject to approval and based on additional criteria.

How long does it take for Lendigo to disburse your money(loan)?

Answer: Once Lendigo have received all your required documents, Lendigo aims to review them within 48 hours and present you with a loan proposal. If you accept our financing offer, the process of financing and disbursing your loan typically takes around one week on average. It’s important to note that the sooner you provide us with the necessary documents, the faster the application process progresses.

Does Lendigo require BVN for loan application?

Answer: Yes, the firm does require your BVN, but solely for the purpose of verifying your identity. According to the guidelines from the Central Bank of Nigeria (CBN), your BVN serves as your distinct identity for effective implementation of the “Know Your Customer” (KYC) principle and for preventing fraud. It’s important to note that your BVN is not a payment instrument nor an account number, so it cannot be utilized to access any of your accounts.

Conclusion

Lendigo Loan offers a convenient and efficient way to access personal loans. With its user-friendly mobile application and competitive interest rates, Lendigo Loan provides borrowers with a seamless borrowing experience. By understanding the application process, eligibility criteria, and repayment options, you can make the most of this financial service and achieve your goals with ease. Remember to borrow responsibly and only take out loans that align with your financial capabilities.