In our busy lives, we all know that unexpected expenses can pop up when we least expect them. Whether it’s a sudden medical cost, a needed car repair, or unexpected home repairs, having a quick and easy way to get a loan can make a big difference. That’s where KoboGo Loan steps in to help. KoboGo Loan is a handy mobile app that lets you apply for loans right from your phone. In this detailed guide, we’ll show you how to apply for a loan with KoboGo, go over what you need to be eligible, and highlight the perks of using this modern financial tool.

What is KoboGo Loan?

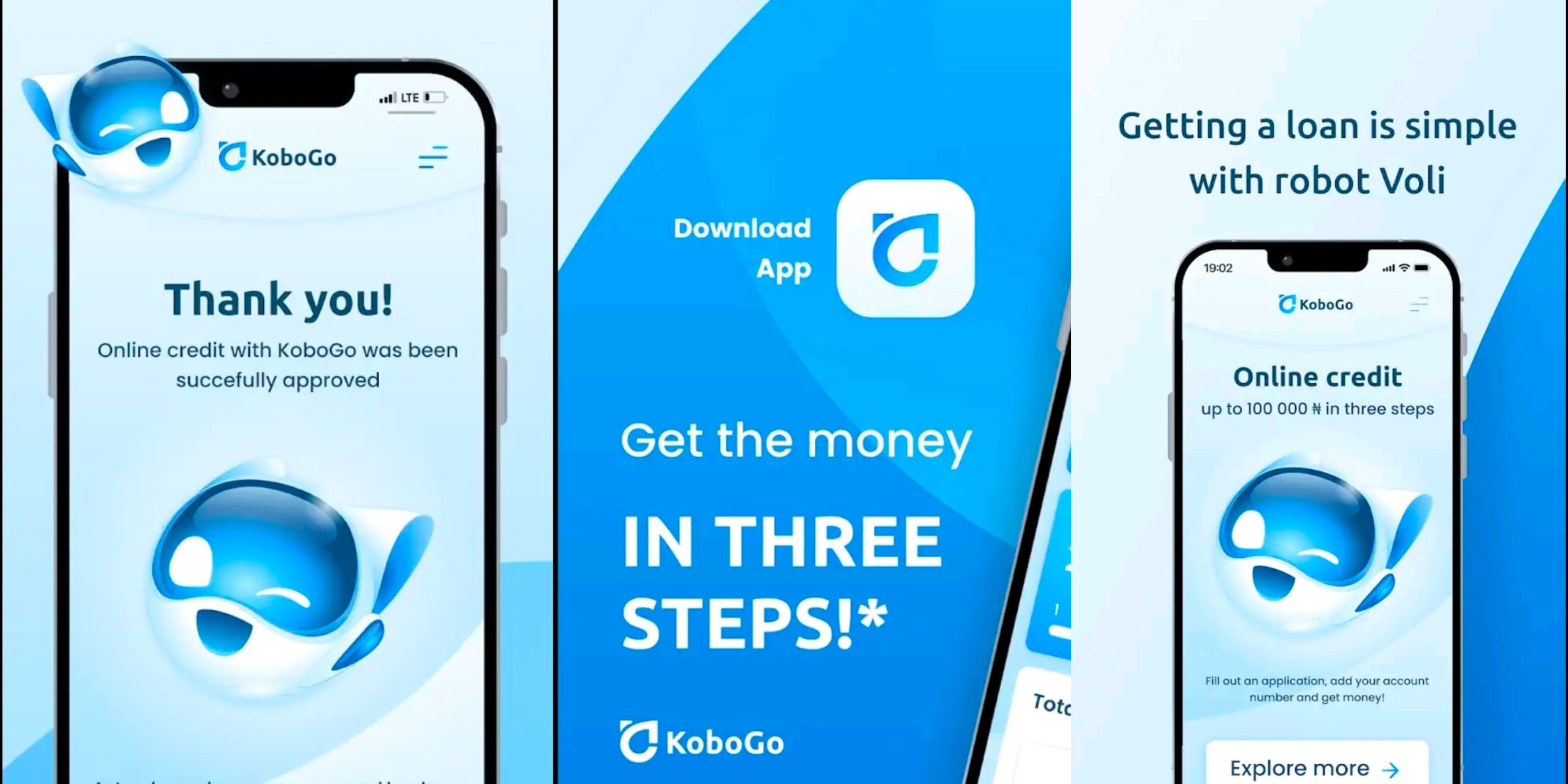

KoboGo Loan is a user-friendly mobile application available on the Google Play Store that offers instant loans to individuals in need of financial assistance. With KoboGo Loan, you can apply for a loan and receive the funds directly into your bank account within minutes. The application prides itself on its simplicity, convenience, and commitment to customer satisfaction.

How To Apply for a KoboGo Loan

Applying for a KoboGo Loan is a straightforward process that can be completed in a few simple steps. Here’s a step-by-step guide to help you get started:

1. Download the KoboGo Loan App: Visit the Google Play Store and search for “KoboGo Loan.” Download and install the application on your smartphone.

2. Register an Account: Open the KoboGo Loan app and register for an account. Provide the necessary information, including your name, email address, and phone number. Ensure that the information you provide is accurate and up-to-date.

3. Complete the Application: Once your account is created, log in to the app and complete the loan application form. The form will require you to provide details such as your employment status, monthly income, and loan amount.

4. Submit Required Documents: To verify your identity and eligibility, you may be asked to submit certain documents such as a valid ID card, proof of income, and bank statements. Ensure that you have these documents readily available for a smooth application process.

5. Review and Accept Loan Terms: After submitting your application and documents, carefully review the loan terms and conditions provided by KoboGo Loan. If you agree to the terms, proceed to accept the loan offer.

6. Receive Funds: Once your loan application is approved, the funds will be disbursed directly into your bank account. You can expect to receive the funds within minutes, allowing you to address your financial needs promptly.

Eligibility Requirements for KoboGo Loan

To be eligible for a KoboGo Loan, you need to meet certain criteria. While the specific requirements may vary, here are the general eligibility criteria:

1. Age: You must be at least 18 years old.

2. Nationality: You must be a Nigerian citizen or a legal resident of Nigeria.

3. Account: You must have a valid bank account.

4. Income: You must have a stable source of income.

Note: It’s important to note that meeting these eligibility requirements does not guarantee loan approval. The final decision is based on various factors, including your creditworthiness and the information provided during the application process.

Benefits of KoboGo Loan

KoboGo Loan offers several benefits to its users, making it an attractive option for individuals in need of quick financial assistance. Here are some of the key benefits:

1. Fast and Convenient: With KoboGo Loan, you can apply for a loan and receive the funds within minutes, eliminating the need for lengthy paperwork and waiting periods.

2. No Collateral Required: Unlike traditional loans, KoboGo Loan does not require any collateral. This means you can access funds without risking your valuable assets.

3. Flexible Loan Amounts: KoboGo Loan allows you to choose the loan amount that suits your needs. Whether you require a small loan or a larger sum, KoboGo Loan has you covered.

4. Transparent Terms and Conditions: KoboGo Loan prides itself on transparency. All loan terms and conditions are clearly stated, ensuring that you have a complete understanding of the repayment terms.

5. Improved Credit Rating: By repaying your KoboGo Loan on time, you can improve your credit rating, making it easier to access higher loan amounts and lower interest rates in the future.

Frequently Asked Questions (FAQs)

Is KoboGo Loan available to everyone?

KoboGo Loan is available to Nigerian citizens and legal residents of Nigeria who meet the eligibility requirements.

How long does it take to receive the loan funds?

Once your loan application is approved, you can expect to receive the funds directly into your bank account within minutes.

Are there any hidden fees or charges?

KoboGo Loan is committed to transparency. There are no hidden feesor additional charges associated with the loan. All fees and charges will be clearly stated in the loan terms and conditions.

Can I repay my KoboGo Loan before the due date?

Yes, you have the option to repay your KoboGo Loan before the due date. Early repayment can help improve your credit rating and may give you access to better loan terms in the future.

Is my personal information safe with KoboGo Loan?

KoboGo Loan takes data privacy and security seriously. All information you provide is encrypted and will never be transferred without your consent. For more details, please refer to their privacy policy on their official website.

What is the minimum loan amount I can apply for with KoboGo Loan?

The minimum loan amount you can apply for with KoboGo Loan is N10,000. Which typically varies depending on the loan product and your location.

What is the maximum loan amount I can borrow from KoboGo Loan?

The maximum loan amount you can borrow from KoboGo Loan is N100,000. This provides borrowers with the opportunity to address higher financial needs while still benefiting from the convenience and flexibility of KoboGo’s loan services.

What is the loan duration or repayment period for KoboGo Loan?

The loan duration or repayment period for KoboGo Loan is set at 30 days and above. This means that borrowers have one month to repay the loan amount, providing a short-term borrowing solution to meet immediate financial needs.

Remember, the specific loan amounts, durations, and terms may vary based on your location and the loan products available in your area. For accurate and detailed information, it’s always best to check the KoboGo app or website, or contact their customer support team directly.

How KoboGo Loan Works: Example

Understanding how KoboGo Loan works can help you make informed borrowing decisions. Here’s a simple example to illustrate how the interest rate is calculated and how the loan repayment works:

Example of Interest Rate Calculation:

Let’s say you take out your third loan with KoboGo Loan, which has an interest rate of 1.2% per day.

Loan Details:

– Principal Amount: N10,000

– Loan Duration: 65 days

Calculation:

1. Principal Debt:

– N10,000

2. Accrued Interest:

– Daily Interest = Principal Amount × Daily Interest Rate

– Daily Interest = N10,000 × 1.2% = N120

– Total Accrued Interest for 65 days = Daily Interest × Loan Duration

– Total Accrued Interest = N120/day × 65 days = N7,800

3. Total Amount to be Paid:

– Principal Amount + Accrued Interest

– Total Amount = N10,000 (Principal) + N7,800 (Accrued Interest) = N17,800

Total Amount to be Paid:

– N10,000 (Principal Debt) + N7,800 (Accrued Interest) = N17,800

So, if you borrow N10,000 from KoboGo Loan with an interest rate of 1.2% per day for a duration of 65 days, you would need to repay a total amount of N17,800. This includes the principal amount of N10,000 and accrued interest of N7,800.

It’s crucial to understand that the interest rate and total repayment amount may vary based on your loan duration, principal amount, and the specific terms and conditions of your loan agreement with KoboGo Loan. Always review the loan terms carefully before borrowing to ensure you understand the total cost and can comfortably repay the loan within the agreed-upon timeframe.

KoboGo Contact Information

E-mail: info@kobogo.ng

Phone: +234-1700-2464

Conclusion

KoboGo Loan is a reliable and convenient solution for individuals in need of quick financial assistance. With its user-friendly mobile application and transparent loan terms, KoboGo Loan offers a hassle-free borrowing experience. By following the simple application process and meeting the eligibility requirements, you can access funds within minutes and address your financial needs promptly. Take advantage of the benefits offered by KoboGo Loan and experience the convenience of instant loans at your fingertips.

Remember, financial decisions should be made responsibly. Before applying for any loan, carefully consider your financial situation and ensure that you can comfortably repay the borrowed amount within the agreed-upon terms.

For more information and to start your loan application, visit the official KoboGo Loan website at kobogo.ng.