In today’s fast-paced world, access to quick and convenient financial solutions is vital. Irorun Loan is an innovative mobile application that aims to provide users with hassle-free access to loans directly from their Android devices. In this article, we will explore the features, eligibility requirements, application process, and benefits of Irorun Loan, helping you understand how this app can assist you in meeting your financial needs.

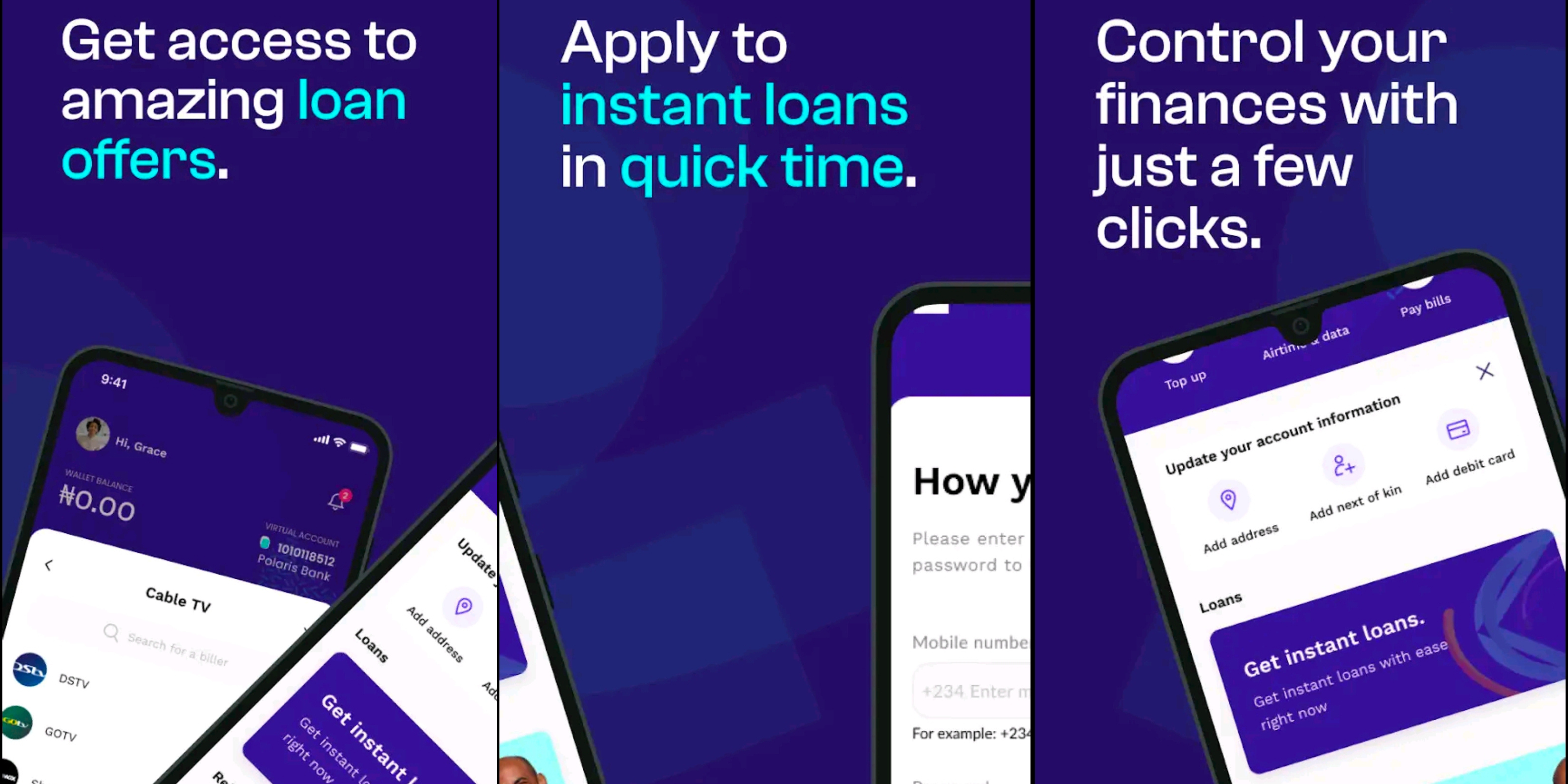

Irorun Loan is a user-friendly Android application that offers instant loans to individuals in need of financial assistance. Developed by a team of experts, this app simplifies the loan application and approval process, providing users with a convenient and efficient way to obtain funds for various purposes.

Features of Irorun Loan

- Quick and Convenient Application Process:Irorun Loan streamlines the loan application process, eliminating the need for lengthy paperwork and time-consuming visits to traditional financial institutions. With just a few taps on your Android device, you can complete the application process within minutes.

- Flexible Loan Amounts:The app offers a range of loan amounts to suit different financial requirements. Whether you need a small amount for emergency expenses or a larger sum for a significant investment, Irorun Loan has you covered.

- Competitive Interest Rates: Irorun Loan strives to provide its users with competitive interest rates, ensuring that borrowing remains affordable and manageable.

- Secure and Confidential:Irorun Loan takes data security seriously. The app incorporates robust security measures to protect users’ personal and financial information, ensuring confidentiality and peace of mind.

Requirements for Irorun Loan

To be eligible for an Irorun Loan, you need to meet the following requirements:

- Android Device: You must have an Android device to download and install the Irorun Loan app from the Google Play Store.

- Age:You should be at least 18 years old to apply for a loan through the app.

- Identification Documents:You will need to provide valid identification documents, such as a government-issued ID, to verify your identity.

- Employment or Income:Irorun Loan may require proof of employment or a stable source of income to assess your repayment capacity.

Benefits of Irorun Loan

- Instant Approval and Disbursement: The app offers a quick approval process, with funds disbursed directly to your bank account within a short period. This feature is particularly beneficial during emergencies or urgent financial needs.

- No Collateral Required: Irorun Loan is an unsecured loan, meaning you do not have to provide collateral to secure the loan amount. This makes it accessible to a wider range of individuals.

- Flexible Repayment Options:Irorun Loan offers flexible repayment options, allowing you to choose a repayment plan that suits your financial situation. You can opt for weekly or monthly installments, ensuring convenience and ease of repayment.

- Credit Building Opportunity:Timely repayment of loans through Irorun Loan can help establish a positive credit history, which may enhance your creditworthiness for future financial endeavors.

Irorun Contact Information

- mail: support@irorum.com

- Address: 4 Perez Dr, Lekki Phase 1, Lagos 106104, Lagos

- Phone: +234 809-666-8877

- Website: http://irorun.com/

Conclusion

Irorun Loan is a user-friendly Android application that provides a convenient and efficient way to access instant loans. With its quick application process, flexible loan amounts, competitive interest rates, and secure platform, Irorun Loan offers a reliable financial solution for individuals in need. Whether you require funds for emergencies, personal expenses, or investments, this app can assist you in meeting your financial goals.

Download Irorun Loan today from the Google Play Store and experience the convenience and flexibility of obtaining loans directly from your Android device. Take control of your financial future with Irorun Loan.