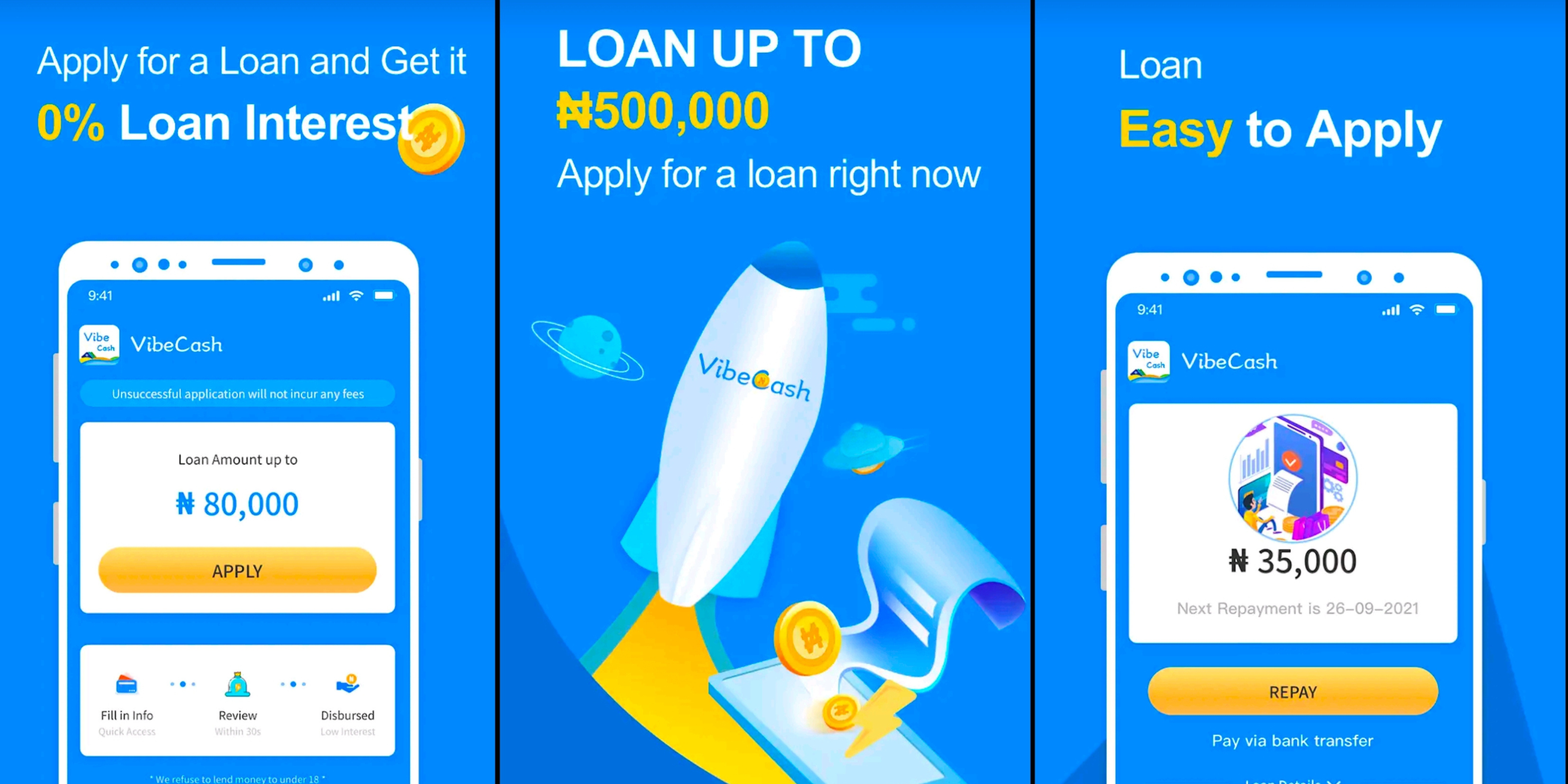

Vibe cashAre you looking for a hassle-free way to get a loan? VibeCash is the ultimate solution for your financial needs. With the VibeCash application, you can access online money loans anytime and anywhere, making the borrowing process more effective, easier, and safer than ever before. Whether you need quick cash for emergencies or to cover personal expenses, VibeCash has got you covered.

Key Features and Benefits of VibeCash loan:

- No Hidden Charges:VibeCash believes in transparency. Say goodbye to hidden fees and unexpected costs. With VibeCash, you only pay what you borrow, without any additional charges.

- No Collateral Needed: Unlock the power of unsecured loans. VibeCash offers loans without requiring collateral, allowing you to access funds quickly and conveniently.

- Flexible Loan Amount: Borrow up to NGN 100,000 based on your financial needs. VibeCash provides you with the flexibility to choose the loan amount that suits you best.

- Customizable Payment Tenure:Tailor your loan repayment to fit your financial situation. VibeCash allows you to select the payment tenure that works for you, giving you peace of mind and financial flexibility.

- Secure, Reliable, and Easy to Use:VibeCash prioritizes your data security and ensures a seamless borrowing experience. The app is designed to be user-friendly, making it easy for anyone to navigate and apply for a loan.

- AI-Powered Credit Scoring: VibeCash leverages advanced AI algorithms to assess your creditworthiness quickly and accurately, providing fair loan offers based on your financial profile.

- 24/7 Availability:VibeCash is ready to serve you round the clock. Whether it’s day or night, weekdays or weekends, you can access the app and apply for a loan whenever you need it most.

How to Get a Loan from VibeCash

- Download the VibeCash App:Visit the Google Play Store and search for “VibeCash.” Download and install the app on your Android device.

- Fill in Your Personal Data:Complete the registration process by providing your personal information as required by the app. Ensure accuracy and authenticity to expedite your loan application.

- Determine the Loan Amount:Assess your financial needs and choose the loan amount that suits your requirements. VibeCash offers loan amounts ranging from NGN 5,000 to NGN 100,000.

- Apply for a Loan:Once you’ve filled in your personal details and selected the loan amount, submit your application through the app. VibeCash will review your application promptly.

- Fast Money Transfer: If your loan application is approved, VibeCash will transfer the funds directly to your bank account. Say goodbye to lengthy waiting times and enjoy quick access to the cash you need.

VibeCash Loan Requirements

- NATIONALITY: Must a Nigerian Citizen

- AGE: Must Be at list 18 years Old and above before applying to Vibecash loan.

- Valid Documents:Provide necessary identification and possibly proof of income.

VibeCash Contact Information

For more information or assistance, you can reach out to VibeCash through the following channels:

Address: Bethel House, 6A, Akin Osiyemi Street, off Allen Avenue, Ikeja, Lagos, Nigeria

Email: Kashuangbyyyy824@gmail.com

Don’t let financial constraints hold you back. Experience the convenience and reliability of VibeCash today. Download the app and discover a world of quick and easy online loans, tailored to meet your needs.