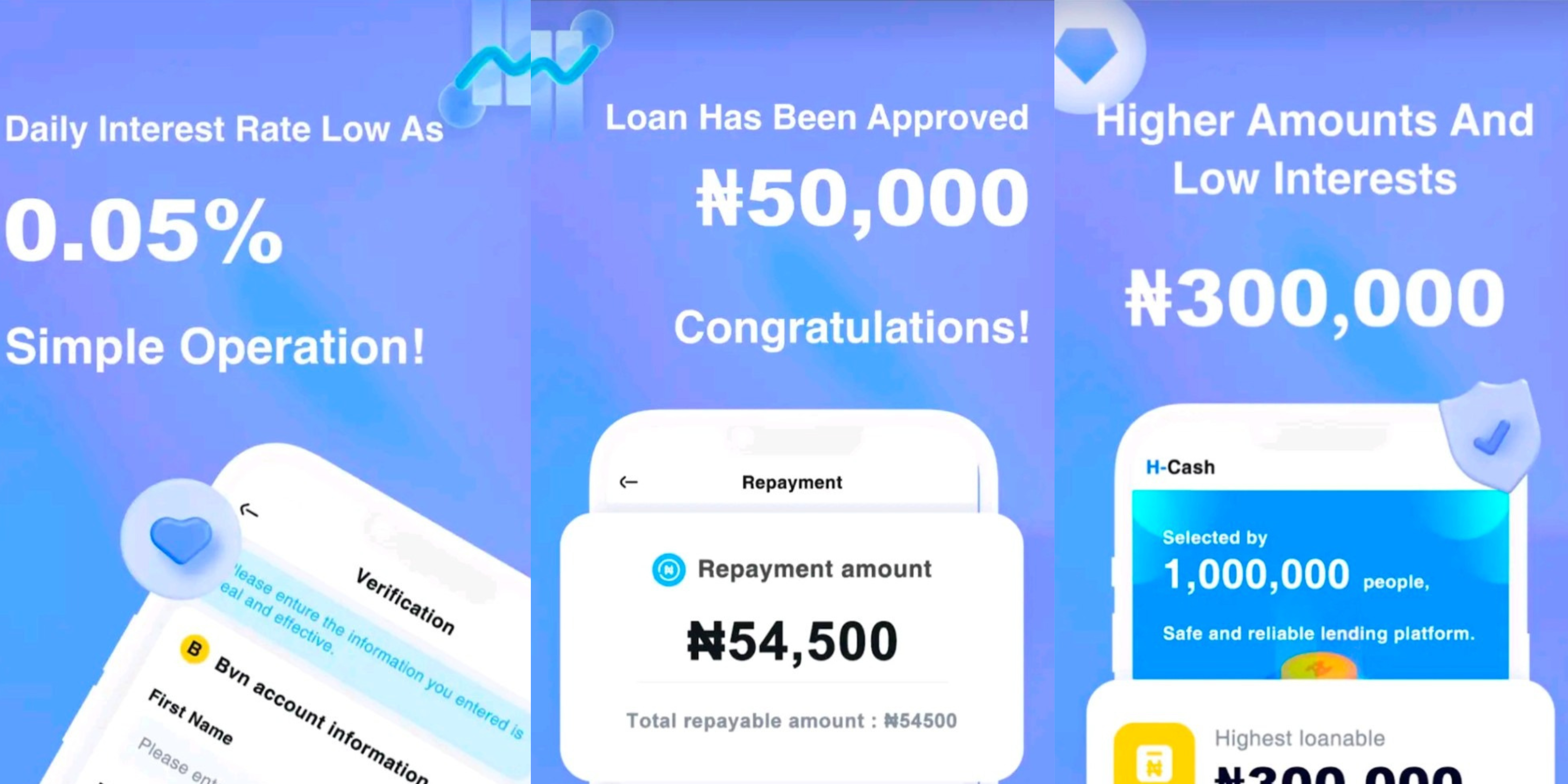

Introducing HCash Loan: HCash Loan is a mobile loan application designed to provide instant access to funds for individuals in need of financial assistance. With HCash Loan, you can apply for a loan directly from your smartphone, eliminating the need for lengthy paperwork and time-consuming bank visits. The application is available for download on the Google Play Store, making it easily accessible to Android users.

Why HCash Loan? In today’s fast-paced world, financial emergencies can arise when we least expect them. Whether it’s an unexpected medical expense, a car repair, or a sudden home renovation, having access to quick and convenient loans is actually a lifesaver. HCash Loan is a leading loan provider that offers hassle-free loans with competitive interest rates and flexible repayment options.

In this comprehensive guide, we will guide you on how to apply for a HCash Loan and also everything you need to know about HCash Loan, including how to apply, eligibility criteria, requirements, benefits, and many more. So, let’s dive in and discover how HCash Loan can help you meet your financial needs.

How Does HCash Loan Work?

HCash Loan operates on a simple and user-friendly platform. Once you download the app, you can create an account and complete the loan application process within minutes. The app utilizes advanced algorithms to assess your creditworthiness and determine your loan eligibility. Upon approval, the loan amount is disbursed directly to your bank account, ensuring quick access to funds when you need them the most.

HCash Loan Eligibility Criteria

To get a loan from HCash, you need to meet certain eligibility criteria. The requirements may vary depending on your location and the specific policies of HCash Loan. However, the general eligibility criteria include:

1. Residency: Must be a resident of Nigeria.

2. Age: Must be within the rage of 18 to 55 years old.

3. Account: Must have a valid bank account either commercia or micro-finance bank account for loan disbursement.

4. Phone Number: Must have an active phone number(for registration purpose)

How to apply for a HCach Loan: Step by step guide

Applying for an HCash Loan is a straightforward process that can be completed in a few simple steps:

1. Download the HCash: Open your play store, then search for Hcash Loan and install or use this link(HCash Loan App) .

2. Registration and Account creation: After installing the HCash loan app, go ahead Register with your phone number.

3. Loan Application Process: Fill in the loan application form, providing an accurate and up-to-date information(Including your desired loan amount) and submit the loan application.

4. Approval and Disbursement: Ones your loan application is approved, the money will be disbursed into your bank account and notify you via SMS. So is very import you provide an active the accurate bank account details and active mobile/phone number.

Advice: Review the loan terms and conditions, including the interest rate, repayment period, and any additional fees.

HCash Loan Requirements

When applying for an HCash Loan, you will need to provide certain documents to verify your identity and income. The required documents may include:

1. Valid identification document (e.g., national ID card, passport)

2. Proof of address (e.g., utility bill, bank statement)

3. Proof of income (e.g., pay stubs, bank statements)

Benefits of HCash Loan

1. Quick and Convenient

HCash Loan offers a quick and convenient solution to your financial needs. With the mobile app, you can apply for a loan anytime, anywhere, without the need for lengthy paperwork or bank visits. The loan approval process is fast, and the funds are disbursed directly to your bank account, ensuring immediate access to the funds.

2. Flexible Repayment Options

HCash Loan understands that everyone’s financial situation is unique. That’s why they offer flexible repayment options to suit your needs. You can choose the repayment period that works best for you, whether it’s a few weeks or several months. This flexibility allows you to manage your finances effectively and repay the loan without unnecessary stress.

3. Competitive Interest Rates

HCash Loan strives to provide affordable loans with competitive interest rates. They understand the importance of responsible lending and aim to offer loans that are within your financial means. By offering competitive interest rates, HCash Loan ensures that you can borrow the funds you need without falling into a cycle of debt.

4. Data Protection

The application is safe and reliable, HCash protect your personal data, and do not share your information with any third parties.

5. Keeping in touch

Don’t worry about forgetting to repay, HCash will send you a text message to remind you.

6. Building of credit score

Repaying your loan on time can increase loan amount and lower loan interest rate.

7. No hidden fee

HCash maintains transparency in its loan process.

HCash Contact Information

Email: whitthargrove@gmail.com

Office Address: Plot B, Block B, lkosi Residential Coadiz Plaza, lkeja-Lagos.

Website

Mobile App

HCash Loan: Frequently Asked Questions (FAQ)

How much can I borrow with HCash Loan?

Answer: The loan amount you can borrow with HCash Loan depends on various factors, including your income, creditworthiness, and the specific policies of HCash Loan. But the HCash loan amount rages from NGN 10, 000 to NGN 30, 000. It is best to download the app and complete the loan application process to determine the loan amount you are eligible for.

Can I apply for an HCash Loan if I have bad credit?

Answer: Yes, HCash Loan considers factors beyond just your credit score when assessing your loan eligibility. They take into account your income stability and repayment history. Even if you have bad credit, you may still be eligible for an HCash Loan.

How long does it take to get approved for an HCash Loan?

Answer: The approval process for an HCash Loan is typically fast. Once you submit your loan application, the app will process your request and provide you with a decision within a short period. In most cases, you can expect to receive the loan approval within a few hours.

What happens if I am unable to repay the loan on time?

Answer: If you are unable to repay the loan on time, it is important to contact HCash Loan as soon as possible. They may be able to provide you with alternative repayment options or work out a solution that suits your financial situation. However, it is crucial to communicate with them to avoid any negative consequences like your credit worthiness.

Can I repay my HCash Loan early?

Answer: Yes, HCash Loan allows early repayment of the loan. In fact, repaying the loan early can help you save on interest charges and also build your credit worthiness(Credit Score). If you wish to repay your loan before the agreed-upon repayment period, you can contact HCash Loan for further instructions on how to proceed.

What is the maximum and minimum loan amount I can borrow from HCash Loan?

Answer: HCash Loan offers loans ranging from ₦10,000 to ₦300,000, depending on your eligibility and repayment capacity.

Are there any hidden fees or charges with HCash Loan?

Answer: No, Hcash Loan maintains transparency in its loan process. The transaction fee ranges from 0.1% to as high as 30%(annual interest rate), and all fees are clearly communicated to borrowers.

Conclusion

HCash Loan offers a convenient and accessible solution for individuals in need of quick financial assistance. With their user-friendly mobile app and flexible repayment options, HCash Loan aims to provide a seamless borrowing experience. By understanding the eligibility criteria, requirements, and benefits of HCash Loan, you can make an informed decision when applying for a loan. Remember to borrow responsibly and only take out a loan if you are confident in your ability to repay it. Download the HCash Loan app today and experience the convenience of instant access to funds when you need them the most.