In today’s fast-paced world, unexpected financial needs can arise at any time. Whether you’re facing an emergency, funding education, or pursuing personal projects, quick and reliable loans can be a lifesaver. CayCredit Loan is a trusted lending platform that offers a convenient solution for meeting these financial demands. This comprehensive guide will walk you through the process of applying for a CayCredit Loan, explain the eligibility criteria, list the required documents, and highlight the benefits.

Understanding CayCredit Loan

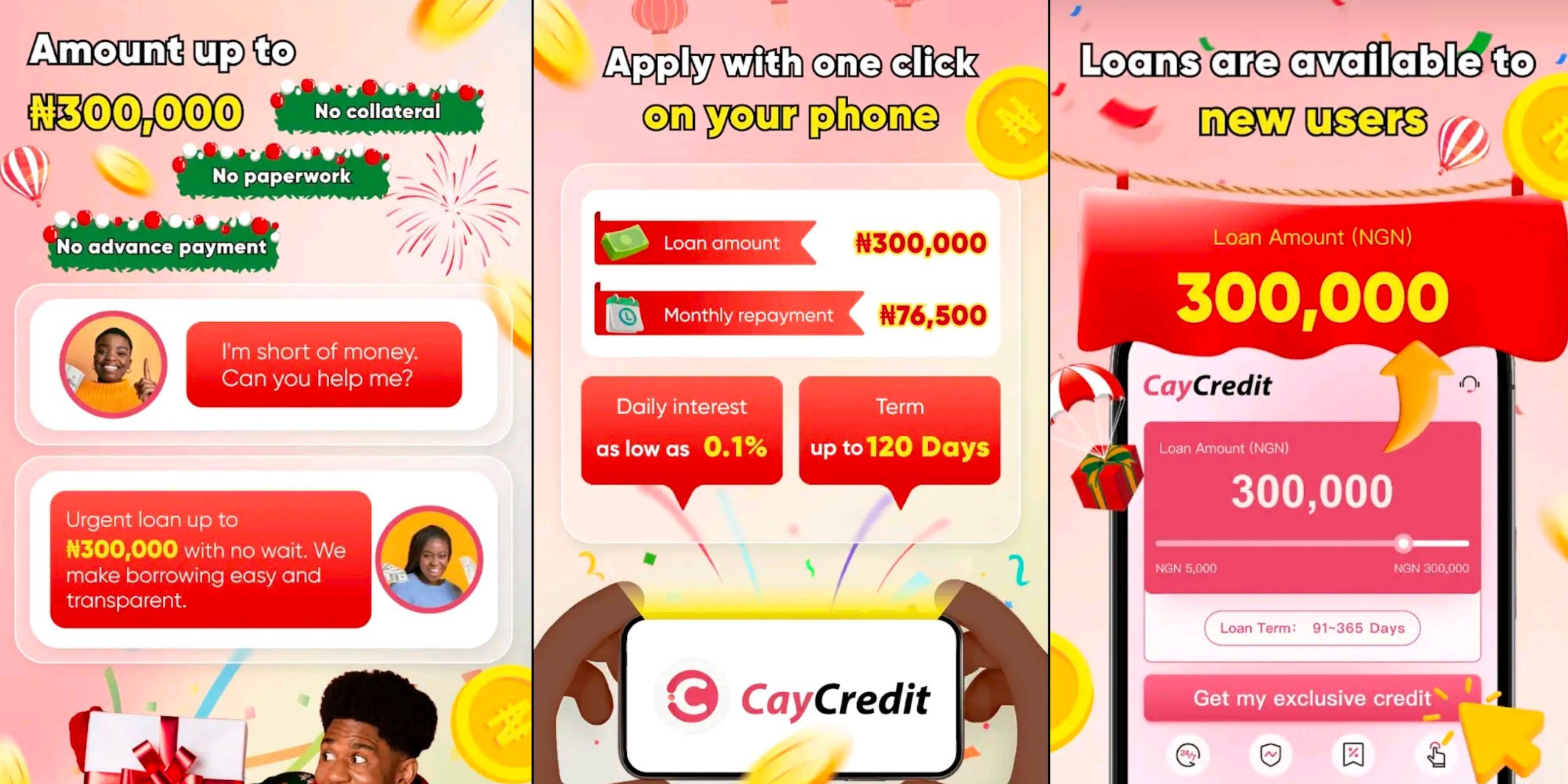

CayCredit Loan is a lending platform that offers hassle-free access to loans for individuals in need of financial assistance. With its user-friendly mobile application, CayCredit provides a seamless borrowing experience, allowing users to apply for loans anytime, anywhere. The platform is designed to cater to the diverse financial needs of individuals, providing flexible loan options and quick approval processes.

Eligibility Criteria for CayCredit Loan

To be eligible for a CayCredit Loan, you need to meet the following criteria:

- Residency: CayCredit loans are available to individuals who are residents of Nigeria.

- Age Requirement: Applicants must be at list 20 years old.

- Source of Income: CayCredit requires applicants to have a verifiable source of income. This can include salary, business income, or any other legitimate source of regular income.

- Bank Account: You must have an active bank account in your name to receive the loan disbursement.

Requirements for CayCredit Loan

When applying for a CayCredit Loan, you will need to submit the following documents:

- Valid ID Card: A government-issued identification document such as a National ID card, Permanent Voter’s Card, or International Passport.

- Proof of Address: A document that verifies your residential address, such as a utility bill or bank statement.

- Bank Statements: Recent bank statements that show your income and financial transactions.

- Proof of Income: Documents that demonstrate your source of income, such as payslips, employment letters, or business registration documents.

Note: The specific document requirements may vary depending on the loan amount and individual circumstances.

How to Apply for a CayCredit Loan

Applying for a CayCredit Loan is a simple and straightforward process. Here are the steps to follow:

- Download the CayCredit App: Visit the Google Play Store and search for “CayCredit Loan” or you click on this link. Download and install the app on your mobile device.

- Create an Account: Open the CayCredit App and create a new account by providing the required information. This typically includes your name, phone number, email address, and a password.

- Complete the Application: Once your account is created, log in to the CayCredit App and complete the loan application form. Provide accurate and up-to-date information, including your personal details, employment information, and loan amount requested.

- Submit Required Documents: CayCredit may require supporting documents to verify your identity, income, and other relevant information. These documents may include a valid ID card, bank statements, proof of address, and proof of income. Ensure that you have these documents ready for submission.

- Loan Approval and Disbursement: After submitting your application and documents, CayCredit will review your request. If approved, the loan amount will be disbursed directly to your registered bank account within a short period.

Benefits of CayCredit Loan

CayCredit Loan offers several benefits to borrowers, making it an attractive choice for those in need of quick financial assistance. Here are some key advantages:

- Fast Approval: CayCredit’s streamlined application process ensures quick loan approval, allowing borrowers to access funds promptly.

- Flexible Loan Options: CayCredit offers a range of loan options to suit different financial needs. Borrowers can choose the loan amount and repayment terms that work best for them.

- Convenience: With the CayCredit App, borrowers can apply for loans anytime, anywhere, using their mobile devices. This eliminates the need for physical visits to a bank or lending institution.

- No Collateral Required: CayCredit Loan does not require collateral or guarantors, making it accessible to a wider range of individuals.

- Competitive Interest Rates: CayCredit offers competitive interest rates, ensuring that borrowers can repay their loans without excessive financial burden.

- Credit Score Improvement: Timely repayment of CayCredit loans can help improve your credit score, making it easier to access credit in the future.

Frequently Asked Questions (FAQs)

- Can I apply for a CayCredit Loan if I have a low credit score?

Answer: Yes, CayCredit considers loan applications from individuals withlow credit scores. They take various factors into account when evaluating loan applications, including income and repayment capacity. While a low credit score may affect the loan terms, it does not necessarily disqualify you from obtaining a CayCredit Loan. - How long does it take to receive loan approval and disbursement?

Answer: CayCredit strives to provide fast loan approval and disbursement processes. Once you have submitted your application and all required documents, the approval process typically takes a few hours. Upon approval, the loan amount is disbursed directly to your registered bank account within a short period. - Can I repay my CayCredit Loan before the due date?

Answer: Yes, CayCredit allows borrowers to repay their loans before the due date without any penalties. Early repayment is encouraged as it can help save on interest charges and improve your creditworthiness. - What happens if I miss a loan repayment?

Answer: Missing a loan repayment can have consequences, including late payment fees and a negative impact on your credit score. It is important to ensure timely repayment to avoid these issues. If you anticipate difficulties in making a payment, it is recommended to contact CayCredit’s customer support as soon as possible to discuss possible solutions. - Can I apply for multiple loans with CayCredit simultaneously?

Answer: CayCredit allows borrowers to have only one active loan at a time. Once you have repaid your existing loan, you can apply for a new one if needed. - What is the loan tenure offered by CayCredit?

Answer: CayCredit offers flexible loan tenures ranging from 91 days to 365 days. This allows borrowers to choose a repayment period that aligns with their financial capabilities and preferences. - What is the maximum and minimum loan amount range for CayCredit loans?

Answer: CayCredit provides loan amounts starting from NGN 5,000 up to NGN 300,000. The specific loan amount you may be eligible for depends on various factors, including your income, creditworthiness, and the loan product you are applying for. - How is the Annual Percentage Rate (APR) calculated for CayCredit loans?

Answer: CayCredit calculates the Annual Percentage Rate (APR) for loans based on a daily interest rate. The APR can range from 6% to 35%, depending on factors such as the loan amount, tenure, and individual creditworthiness. - What is the service charge for CayCredit loans?

Answer: The service charge for CayCredit loans varies and is determined based on your credit profile. Generally, the service charge falls between 0% and 10%. It is important to review the loan terms and conditions or contact CayCredit directly for precise information regarding the service charge applicable to your loan. - Can I repay my CayCredit loan before the due date?

Answer: Yes, CayCredit allows borrowers to make early repayments without any penalties. Repaying your loan before the due date can help you save on interest charges and improve your creditworthiness.

CayCredit Contact Information

Phone: +234 7055487723

Email: support@caycredit.co

Website

Mobile App

CayCredit Office Address: 20 Bola Odupitan St, Amuwo Odofin 102102, Lagos

CayCredit Loan is a reliable and convenient lending platform that offers individuals the opportunity to meet their financial needs efficiently. By following the simple application process, meeting the eligibility criteria, and providing the necessary documents, you can access the funds you require in no time. Enjoy the benefits of CayCredit Loan, such as fast approval, flexible options, and competitive interest rates, while improving your financial well-being. Download the CayCredit App today and experience the convenience of borrowing at your fingertips.