In a world where financial emergencies can strike at any given moment, the need for swift and dependable loans becomes paramount. Whether it’s unforeseen medical expenses, home repairs, or educational fees, having access to a reliable source of funds can make all the difference. This is where BGLoan steps in. BGLoan is a cutting-edge loan application that offers individuals a seamless and convenient way to apply for loans. In this comprehensive guide, we will delve into the intricacies of BGLoan, providing you with all the essential information you need to know, from the application process to eligibility criteria, requirements, benefits, and beyond.

Eligibility Criteria for BGLoan

To be eligible for a loan through BGLoan, you need to meet the following criteria:

- Age: You must be within the age of 18 to 60 years old.

- Citizenship: You must be a citizen and permanent resident of Nigeria.

- Income: You must have a stable source of income to ensure timely repayment of the loan.

- Credit History: BGLoan considers applicants with both good and bad credit histories. However, a good credit history may increase your chances of approval.

- Valid Bank Account: You must have a valid bank account for loan disbursement.

Note: Please note that meeting the eligibility criteria does not guarantee loan approval. The final decision is based on various factors, including the information provided in your application.

Requirements for a BGLoan

When applying for a loan through BGLoan, you will need to provide the following documents and information:

1. Personal Information: This includes your full name, date of birth, address, and contact details.

2. Employment Information: You will need to provide details about your current employment, including your employer’s name, address, and contact information.

3. Income Verification: BGLoan requires proof of income, such as recent bank statements(preferable) or tax returns.

4. Identification Documents: You will need to provide a valid government-issued identification document, such as a passport, driver’s license or National ID card.

5. Bank Account Details: BGLoan requires your bank account information for loan disbursement purposes.

Make sure to have these documents and information readily available to hasten the loan application process.

How To Apply for BGLoan

Applying for a loan through BGLoan is a simple and straightforward process. Follow the steps below to get started:

1. Downloading the BGLoan App:

To begin your journey with BGLoan, the first step is to download the BGLoan app from the Google Play Store and install. You can do that by searching “BGloan” on Play store or by using this Link .

2. Creating an Account

Once you have successfully installed the BGLoan app, open it and proceed to create your account by providing your Phone number.

Note: Make sure you provide an active phone number, because a verification code will be sent to you via the number.

3. Completing the Profile Setup

After creating your account, the next step is to complete the profile setup. This entails entering your personal details, contact information, and employment information. BGLoan requires this information to assess your eligibility and determine the loan options that best suit your needs.

4. Providing Additional Information

Once you have completed the profile setup, BGLoan may request additional information to further evaluate your loan application. This may include details about your income, expenses, and the desired loan amount.

5. Submitting Your Application

Once you have provided all the necessary information, it’s time to submit your loan application for review. Double-check all the details to ensure accuracy before proceeding. Once submitted, the BGLoan team will carefully assess your application and begin the evaluation process.

6. Loan Decision Notification

After the review process is complete, the BGLoan team will notify you of the loan decision within a short period of time. This notification will inform you whether your loan application has been approved or declined.

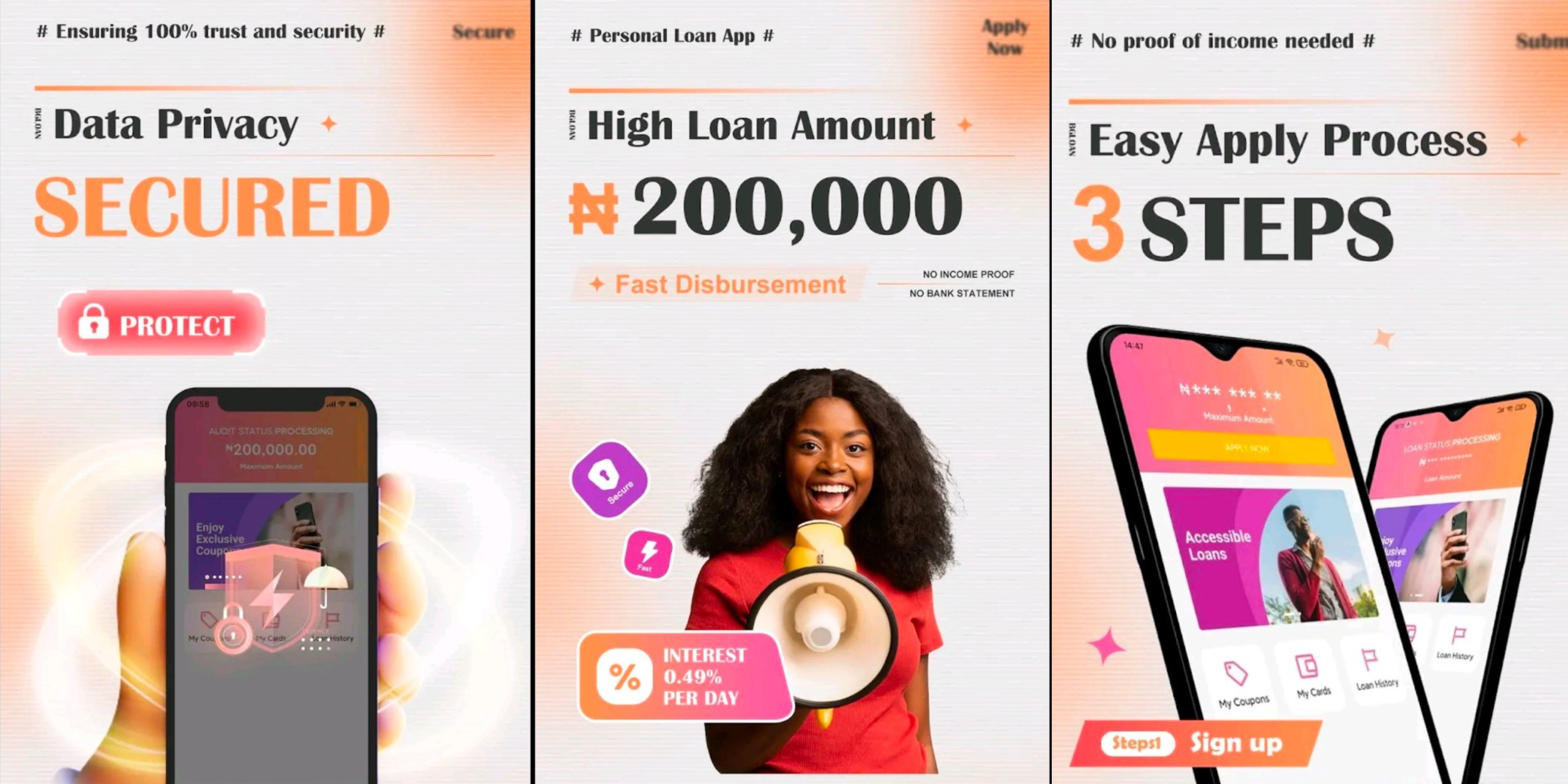

Top Benefits of BGLoan

When it comes to financial assistance, BGLoan offers a range of benefits that set it apart from traditional loan options. Let’s explore the advantages you can enjoy when using BGLoan:

- Fast Approval: BGLoan understands the urgency of your financial needs. With their advanced technology and streamlined processes, you can expect to receive loan approval within just 30 seconds. No more waiting for days or weeks to know the status of your application.

- Various Loan Amounts: BGLoan caters to individuals with diverse financial requirements. Whether you need a small loan to cover immediate expenses or a larger sum for a significant investment, BGLoan offers various loan amounts to suit your specific needs.

- No Extra Fees or No Hidden Fees: Transparency is a core value at BGLoan. When you choose BGLoan, you can rest assured that there are no extra or hidden fees involved. The loan terms and repayment structure are clearly communicated, allowing you to make informed decisions without any surprises.

- Flexible Repayment Period: BGLoan understands that everyone’s financial situation is unique. That’s why they offer a flexible repayment period that allows you to choose a timeframe that aligns with your ability to repay. This flexibility ensures that you can manage your loan comfortably and avoid unnecessary financial strain.

- No Collateral, No Paperwork, Easy and Fast: Unlike traditional loans that often require collateral and involve extensive paperwork, BGLoan simplifies the process. With BGLoan, you can enjoy the convenience of obtaining a loan without the need for collateral or burdensome paperwork. The application process is easy, fast, and hassle-free.

- Protect Your Information Security: BGLoan prioritizes the security of your personal and financial information. Their products are built with a high degree of security, ensuring that your data is protected throughout the loan application and approval process. You can have peace of mind knowing that your information is in safe hands.

- 24-Hour Service: BGLoan understands that financial needs can arise at any time. That’s why their service is available 24 hours a day, 7 days a week. Whether it’s early morning or late at night, you can apply for a loan through BGLoan whenever it is convenient for you.

With BGLoan, you can experience the benefits of quick approvals, various loan amounts, transparent fees, flexible repayment options, a simplified process, enhanced information security, and round-the-clock service. Take advantage of these benefits and empower yourself with the financial assistance you need, when you need it.

BGLoan: Frequently Asked Questions (FAQ)

Can I apply for a loan through BGLoan if I have bad credit?

Answer: Yes, BGLoan considers applicants with both good and bad credit histories. However, having a good credit history may increase your chances of approval.

How long does it take to receive a loan decision from BGLoan?

Answer: BGLoan aims to provide a loan decision within a short period of time, usually within 24 to 48 hours.

How can I repay my loan with BGLoan?

Answer: BGLoan offers flexible repayment options such as automatic deductions from your bank account or manual payments through the app.

Is my personal and financial information safe with BGLoan?

Answer: BGLoan takes the security and privacy of its users’ information seriously. They employ advanced encryption and security measures to safeguard your data.

1. What is the range of loan amounts offered by BGLoan?

Answer: BGLoan offers loan amounts ranging from ₦3,000 to ₦200,000. This wide range allows individuals to choose the loan amount that best suits their financial needs.

2. What is the duration of the loan repayment period?

Answer: The loan repayment period with BGLoan ranges between 91 and 180 days. This flexibility allows borrowers to select a timeframe that aligns with their financial capabilities.

3. What are the interest rates associated with BGLoan?

Answer: BGLoan offers competitive interest rates based on your credit rating. The interest rates range from 0.75% to 1.9% per month, which translates to an annual percentage rate (APR) of 9% to 23% per annum. The specific interest rate applicable to your loan will depend on your creditworthiness.

4. What is the highest loan interest rate charged by BGLoan?

The highest loan interest rate charged by BGLoan is 23% per annum (APR). It’s important to note that the interest rates are determined based on various factors, including your credit rating and the loan amount.

How BGLoan Works: Loan Example

Here’s an example to illustrate the loan calculation with BGLoan:

Let’s say you choose a loan amount of ₦5,000 with a loan term of 6 months. BGLoan offers a monthly interest rate of 1.9%.

To calculate the monthly interest, you multiply the loan amount by the monthly interest rate:

₦5,000 * 1.9% = ₦95

After 6 months, the total interest accrued would be:

₦95 * 6 = ₦570

Adding the principal amount to the total interest, you get:

₦5,000 + ₦570 = ₦5,570

In this example, the total amount to be repaid after the 6-month maturity period would be ₦5,570. This includes the principal amount of ₦5,000 and the accumulated interest of ₦570.

Note: The example provided above is for illustrative purposes only. The actual loan terms, interest rates, and repayment amounts may vary based on individual circumstances and creditworthiness.

BGLoan Contact Information

Email: bgloanhelp@yahoo.com

Phone: +234 9162-827-890

Office Address: 28 Ondo street, Ebute-Meta Lagos

Mobile App: Apple Store or Play Store

Conclusion

BGLoan is a reliable and convenient loan application that provides individuals with quick access to financial assistance. By following the simple steps outlined in this guide, you can easily apply for a loan through BGLoan and enjoy its numerous benefits. Remember to meet the eligibility criteria, gather the necessary documents, and provide accurate information to increase your chances of loan approval. With BGLoan, financial emergencies no longer need to be a cause for worry. Download the app today and experience the convenience of BGLoan for yourself.