Need cash in a flash? Aella’s got your back! They’re all about making loans super simple. Just whip out your phone, tap a few buttons, and voila! You’re on your way to financial bliss. Stick around, and I’ll break down how to get your hands on some cash, who can apply, what you’ll need, and why Aella rocks. Ready to roll? Let’s do this!

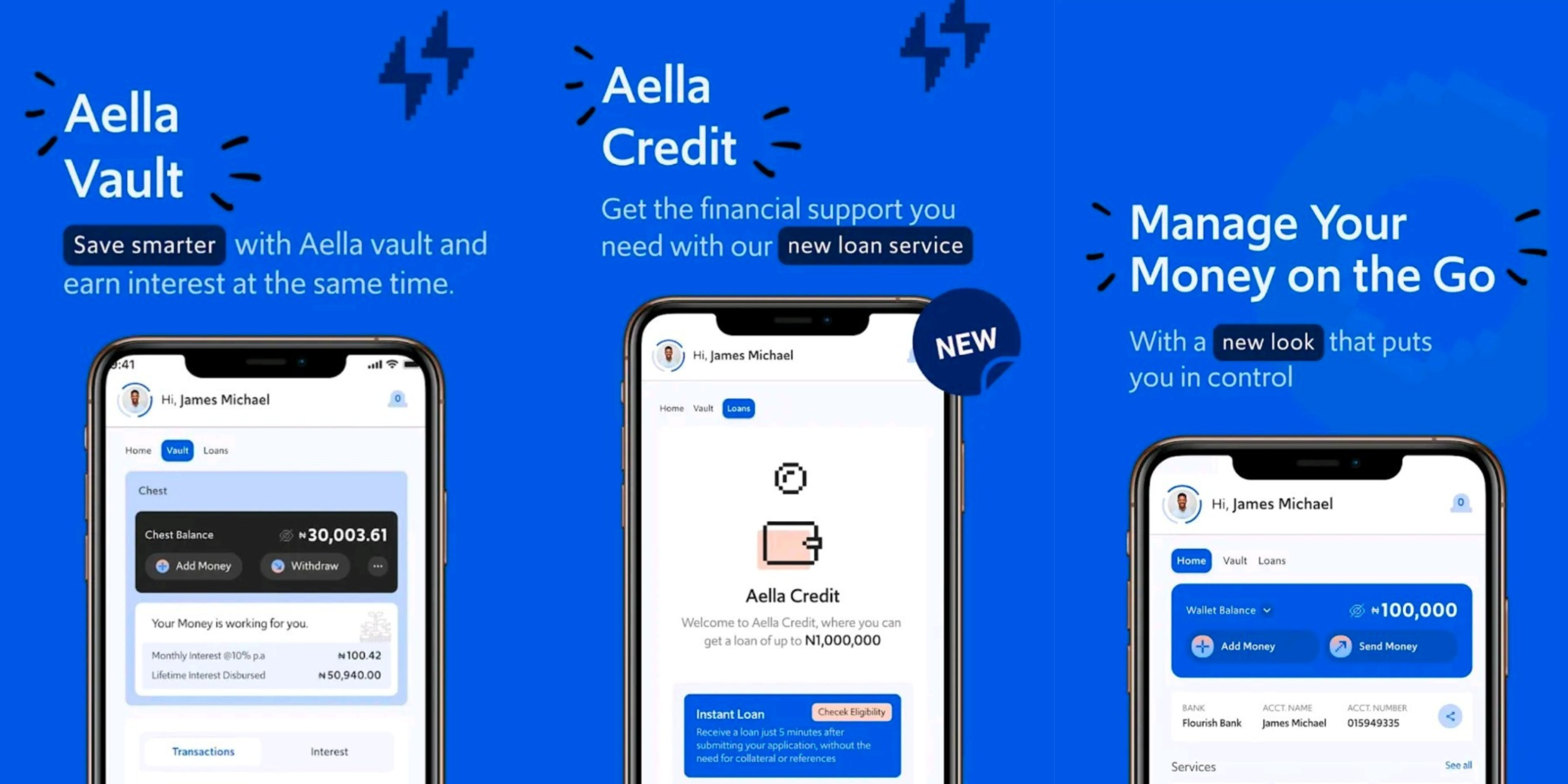

Firstly, lets understanding Aella and its Loan Services: Aella is a trusted financial platform that provides loans, insurance, payment solutions, and investment opportunities. With a strong presence in Nigeria, Aella aims to empower individuals and businesses by offering accessible and reliable financial services. The Aella mobile app, available on the Google Play Store, serves as a convenient gateway to access their loan products.

Eligibility Criteria for Aella loan

To apply for an Aella loan, you need to meet certain eligibility requirements, which typically include:

1. Residency: Must be a resident of a country where Aella operates (Nigeria).

2. Age: Must be at least 18 years old before applying for an Aella loan.

3. Account: Must have a valid bank account with either either a commercial or Microfinance bank.

4. Income: Having a reliable source of income.

How to apply for an Aella Loan: Complete guide

Applying for an Aella loan is a straightforward and hassle-free process. Follow these steps:

1. Download the Aella mobile app from the Google Play Store.

2. Install and open the app on your mobile device.

3. Create an account by providing the necessary information, including your name, email address, phone number and your bank verification number(BVN).

4. Complete the required Know Your Customer (KYC) verification process by submitting relevant identification documents.

5. Provide accurate information about your employment, income, and other requested details.

6. Select the loan amount and repayment duration that suits your needs.

7. Submit your application for review.

8. Once you have submitted your loan application, Aella’s automated system will review your information promptly. If approved, you will receive a notification within minutes. Upon acceptance of the loan offer, the funds will be disbursed directly to your bank account or mobile money wallet within five minutes.

Top Benefits of Aella Loans

Choosing Aella for your borrowing needs offers several advantages, including:

1. Quick and Convenient: Aella’s streamlined application process ensures that you can access funds swiftly, eliminating unnecessary delays.

2. Competitive Interest Rates: Aella offers loans with low interest rates, making it an affordable option for borrowers.

3. Flexible Repayment Options: Aella provides flexible repayment terms, allowing you to choose a duration that aligns with your financial capabilities.

4. No Collateral Required: Aella loans are unsecured, meaning you are not required to provide collateral or guarantors.

5. Credit Score Building: Timely repayment of Aella loans can help you establish a positive credit history, improving your future borrowing prospects.

6. Exceptional Customer Support: Aella prioritizes customer satisfaction, and their dedicated support team is available to assist you through the app or via email.

Aella Loan Contacts

Website

Email: support@aellacredit.com

MOBILE APPS: Playstore or Applestore

Aella Loan: Frequently Asked Questions (FAQs)

Considering an Aella Loan? Here’s a breakdown of key questions to help you decide if it’s the right fit for your financial needs:

Can I apply for an Aella loan if I have a low credit score?

Answer: Yes, Aella considers applicants with varying credit histories. While a positive credit history increases your chances of approval, having a low credit score does not automatically disqualify you from obtaining an Aella loan.

How long does it take to receive funds after loan approval?

Answer: Once your loan application is approved, you can expect to receive the funds within five minutes. Aella’s streamlined process ensures quick disbursal of funds to meet your financial needs promptly.

Are there any hidden fees or charges associated with Aella loans?

Answer: Aella is committed to transparency, and there are no hidden fees or charges associated with their loans. The interest rates and repayment terms are clearly communicated during the application process.

Can I repay my Aella loan before the scheduled repayment date?

Answer: Yes, Aella allows early repayment of loans without any penalties. If you have the means to repay your loan before the scheduled date, you can do so and save on interest charges.

What happens if I am unable to repay my Aella loan on time?

Answer: If you are unable to repay your Aella loan on time, it is essential to communicate with the Aella support team. They may provide options such as loan extensions or revised repayment plans to help you manage your financial obligations effectively.

What is the maximum and minimum loan amount I can borrow from Aella loan?

Answer: Aella offers loans ranging from ₦2,000 to ₦1,500,000, suitable for various needs.

How long does it take to get loan approval from Fitloan?

Answer: With Aella loan, you can expect loan approval in just 5 minutes, ensuring quick access to funds 24/7.

Conclusion

Aella loans offer a convenient and reliable solution for individuals and businesses seeking quick access to funds. With a user-friendly mobile app and a seamless application process, Aella ensures a hassle-free borrowing experience. By meeting the eligibility criteria, providing the necessary information, and following the steps outlined in this article, you can take advantage of Aella’s competitive interest rates, flexibility, and exceptional customer support. Apply for an Aella loan today and empower yourself financially.