In today’s fast-paced world, maintaining financial stability is essential. Whether it’s covering personal expenses, funding education, or launching a business, we all sometimes need a little extra support to achieve our goals. That’s where NewCredit Loan comes in. NewCredit Loan offers a reliable and convenient financial solution, empowering individuals to fulfill their dreams. This comprehensive guide will walk you through everything you need to know about NewCredit Loan, including the application process, eligibility criteria, requirements, benefits, and more.

What is NewCredit Loan?

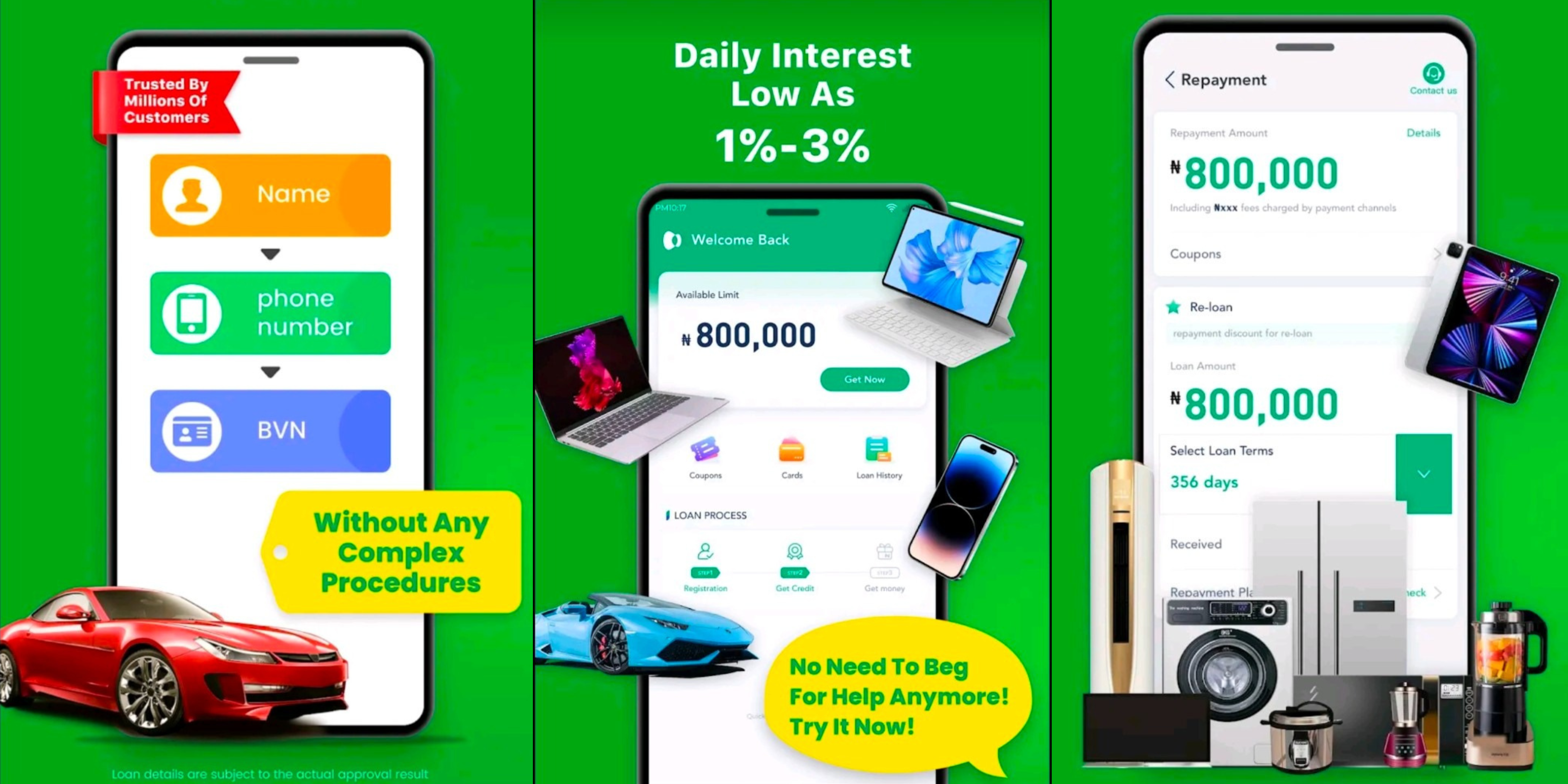

NewCredit Loan is a popular loan service offered by NewCredit, a trusted financial institution known for its customer-centric approach and competitive interest rates. This loan service is designed to provide individuals with quick and hassle-free access to funds, allowing them to meet their financial needs with ease. Whether you’re looking to consolidate your debts, cover unexpected expenses, or fund a major purchase, NewCredit Loan offers a flexible solution tailored to your specific requirements.

Eligibility Criteria a for NewCredit Loan in Nigeria

NewCredit Loan is available to residents of Nigeria who meet certain eligibility criteria. To ensure a smooth application process, it is important to understand the eligibility requirements set by NewCredit. Here are the key eligibility criteria for NewCredit Loan in Nigeria:

- Nigeria Resident: To be eligible for a NewCredit Loan, you must be a resident of Nigeria. This means that you should have a valid Nigerian address and be able to provide proof of residency, such as a utility bill or rental agreement.

- Age Requirement: The minimum age to apply for a NewCredit Loan is 18 years old, while the maximum age is 60 years old. Applicants must fall within this age range to be considered eligible for a loan.

- Valid Documents and Proofs: NewCredit requires applicants to provide valid identification documents and proofs. This typically includes a government-issued ID card, such as a national ID card, driver’s license, or international passport. These documents are necessary to verify your identity and ensure that you meet the legal requirements for obtaining a loan.

- Credit Score: While NewCredit considers applications from individuals with varying credit scores, having a good credit score can increase your chances of loan approval and may result in more favorable loan terms. Your credit score is a reflection of your creditworthiness and is determined by your past credit history. A higher credit score indicates a lower risk for the lender.

Note: It is important to note that meeting the eligibility criteria does not guarantee loan approval. NewCredit takes into account various factors, including income stability and repayment capacity, when assessing loan applications. Additionally, NewCredit may have specific requirements and policies that applicants need to fulfill.

Requirements for NewCredit Loan

To apply for a NewCredit Loan, you will need to provide certain documents and fulfill specific requirements. While the exact requirements may vary based on the loan amount and individual circumstances, here are some common requirements to keep in mind:

- Identification Proof: Valid government-issued identification such as a passport, driver’s license, or national ID card.

- Income Statements: Recent income statements or salary slips to verify your income.

- Bank Statements: Bank statements for the past few months to assess your financial stability.

- Address Proof: Documents such as utility bills or rental agreements to verify your residential address.

- Employment Proof: Employment verification letter or any other document to validate your current employment status.

Note: It’s important to note that NewCredit may request additional documents or information during the loan application process. Make sure to have all the necessary documents ready to aid the application process.

Hoping you now have the required documents ready and you’re eligible for a Newcredit Loan. Let’s now move over to the application process.

How to Apply for NewCredit Loan

Applying for a NewCredit Loan is a simple and convenient process. Follow the steps below to apply for a loan:

- Download the NewCredit App: Start by downloading the NewCredit app from the Google Play Store or Apple App Store by searching for “Newcredit” or use this link. The app is available for free and can be easily installed on your smartphone.

- Register an Account: Once you have downloaded the app, register an account using your phone number. This will create a secure and personalized account for you to access the loan services.

- Fill Out Basic Information: After registering, you will be prompted to provide some basic information about yourself. This may include your name, address, date of birth, employment details, and income information. Make sure to fill out the information accurately and honestly.

- Submit Loan Application: Once you have filled out the necessary information, submit your loan application through the app. The application will be reviewed by NewCredit’s team, who will assess your eligibility and determine the loan amount you qualify for.

- Receive Loan Disbursement: If your loan application is approved, the funds will be disbursed directly into your bank account. You will receive a notification on the app regarding the loan approval and the expected timeline for the disbursement.

Note: It’s important to note that the loan application process may vary slightly depending on the specific requirements and policies of NewCredit. Make sure to carefully read and follow the instructions provided within the app for a seamless application experience.

Top Benefits of NewCredit Loan in Nigeria

NewCredit Loan offers a range of benefits that make it an attractive choice for individuals in need of financial assistance. Here are some key benefits of opting for a NewCredit Loan:

1. Flexible Loan Options: NewCredit offers a variety of loan options to cater to different financial needs. Whether you require a small loan for a short period or a larger loan with a longer repayment term, NewCredit has options to suit your requirements.

2. Competitive Interest Rates: NewCredit strives to provide competitive interest rates, ensuring that borrowers can repay their loans without facing excessive financial burden. By offering favorable interest rates, NewCredit aims to make borrowing more affordable for its customers.

3. Quick Approval and Disbursal: NewCredit understands the urgency of financial needs and aims to provide quick approval and disbursal of funds. Once your loan application is approved, you can expect to receive the funds in your bank account within a short period.

4. Convenient Application Process: The application process for a NewCredit Loan is designed to be user-friendly and convenient. With the option to apply online through their website or mobile app, you can complete the application from the comfort of your own home.

5. Flexible Repayment Options: NewCredit offers flexible repayment options, allowing borrowers to choose a repayment plan that suits their financial situation. Whether you prefer monthly installments or a lump sum repayment, NewCredit provides options to accommodate your preferences.

6. Build Credit History: Timely repayment of a NewCredit Loan can help you build a positive credit history. By demonstrating responsible borrowing behavior, you can improve your credit score and enhance your future borrowing prospects.

7. Transparent Terms and Conditions: NewCredit believes in transparency and ensures that borrowers are aware of all the terms and conditions associated with their loan. This helps borrowers make informed decisions and avoid any surprises during the repayment period.

Understanding NewCredit Loan: Example

Let’s take a closer look at an example to understand how loan repayment works with NewCredit. Suppose you choose a 6-month loan term and borrow ₦100,000. NewCredit charges an interest rate of 4% per month, which translates to an annual interest rate of 48% (4% x 12 months).

Here’s a breakdown of the repayment details:

Loan Amount: ₦100,000

Interest Rate: 4% per month

Annual Percentage Rate (APR): 48%

Repayment Period: 180 days (6 months)

Monthly Repayment: ₦24,000 (₦100,000 divided by 6 months)

Total Amount Repaid: ₦124,000 (₦24,000 x 6 months)

In this example, you will need to make monthly repayments of ₦24,000 for a period of 6 months, resulting in a total repayment amount of ₦124,000. This includes both the principal loan amount of ₦100,000 and the interest charges.

Have it in mind that this example is for illustrative purposes only, and the actual loan terms, interest rates, and repayment amounts may vary based on individual circumstances and NewCredit’s policies. It is always recommended to carefully review the loan agreement and terms provided by NewCredit before accepting the loan offer.

Newcredit Loan: Frequently Asked Questions (FAQ)

Can I apply for a NewCredit Loan if I have a low credit score?

Answer: Yes, NewCredit considers loan applications from individuals with varying credit scores. While a low credit score may affect the terms of the loan, it does not necessarily disqualify you from obtaining a loan. NewCredit takes into account multiple factors when assessing loan applications.

How long does it take to receive the funds after loan approval?

Answer: Once your loan application is approved, NewCredit aims to disburse the funds quickly. In most cases, you can expect to receive the funds in your designated bank account within minutes.

Can I repay my NewCredit Loan before the scheduled repayment term?

Answer: Yes, NewCredit allows borrowers to repay their loans before the scheduled repayment term. However, it’s important to review the terms and conditions of your loan to understand any prepayment penalties or fees that may apply.

What happens if I miss a loan repayment?

Answer: If you miss a loan repayment, it’s crucial to contact NewCredit immediately to discuss your situation. Depending on the terms of your loan agreement, there may be late payment fees or other consequences. It’s always best to communicate with the lender to find a suitable solution.

Can I apply for a NewCredit Loan if I am self-employed?

Answer: Yes, self-employed individuals can apply for a NewCredit Loan. However, you may need to provide additional documentation to verify your income and financial stability. It’s recommended to contact NewCredit directly to understand the specific requirements for self-employed applicants.

What is the minimum and maximum loan amount offered by Newcredit?

Answer: NewCredit offers loan amounts ranging from ₦10,000 to ₦300,000. Whether you need a small amount for emergency expenses or a larger sum for a specific purpose, NewCredit provides flexibility in choosing the loan amount that suits your needs.

What is the repayment period for NewCredit loans?

Answer: The repayment period for NewCredit loans ranges from 91 days to 365 days. This allows borrowers to select a repayment term that aligns with their financial situation and ability to repay the loan comfortably.

Is it possible to get a loan from NewCredit without providing any mortgage or collateral?

Answer: Yes, NewCredit offers easy-to-get loans without requiring any mortgage or collateral. This means that you can access the funds you need without having to pledge any valuable assets as security. NewCredit understands that not everyone has assets to use as collateral, and they aim to provide accessible and safe loan options.

What is the Annual Percentage Rate (APR) for NewCredit loans?

Answer: The Annual Percentage Rate (APR) for NewCredit loans ranges from 24% to 56% per annum. The specific APR offered to individual borrowers may vary based on factors such as creditworthiness, loan amount, and repayment term. It is important to carefully review the loan terms and conditions, including the APR, before accepting the loan offer.

What are the age and residency requirements for NewCredit loans?

Answer: To be eligible for a NewCredit loan, you must be a resident of Nigeria and be between 18 and 60 years old. Meeting these age and residency requirements is essential to qualify for a loan from NewCredit.

Newcredit Contact Details

Office Address: 45c Sobo Arobiodu St, Ikeja GRA, Ikeja, Lagos, Nigeria

Email: deeoemmah4098@gmail.com

Website

Mobile App

Conclusion

NewCredit Loan offers a reliable and convenient solution for individuals in need of financial assistance. With a simple application process, competitive interest rates, and flexible repayment options, NewCredit aims to make borrowing accessible and affordable. By understanding the eligibility criteria, requirements, and benefits of NewCredit Loan, you can make an informed decision and take a step towards achieving your financial goals. Remember to review the terms and conditions carefully before applying for a loan and ensure that you have a repayment plan in place to manage your finances responsibly.