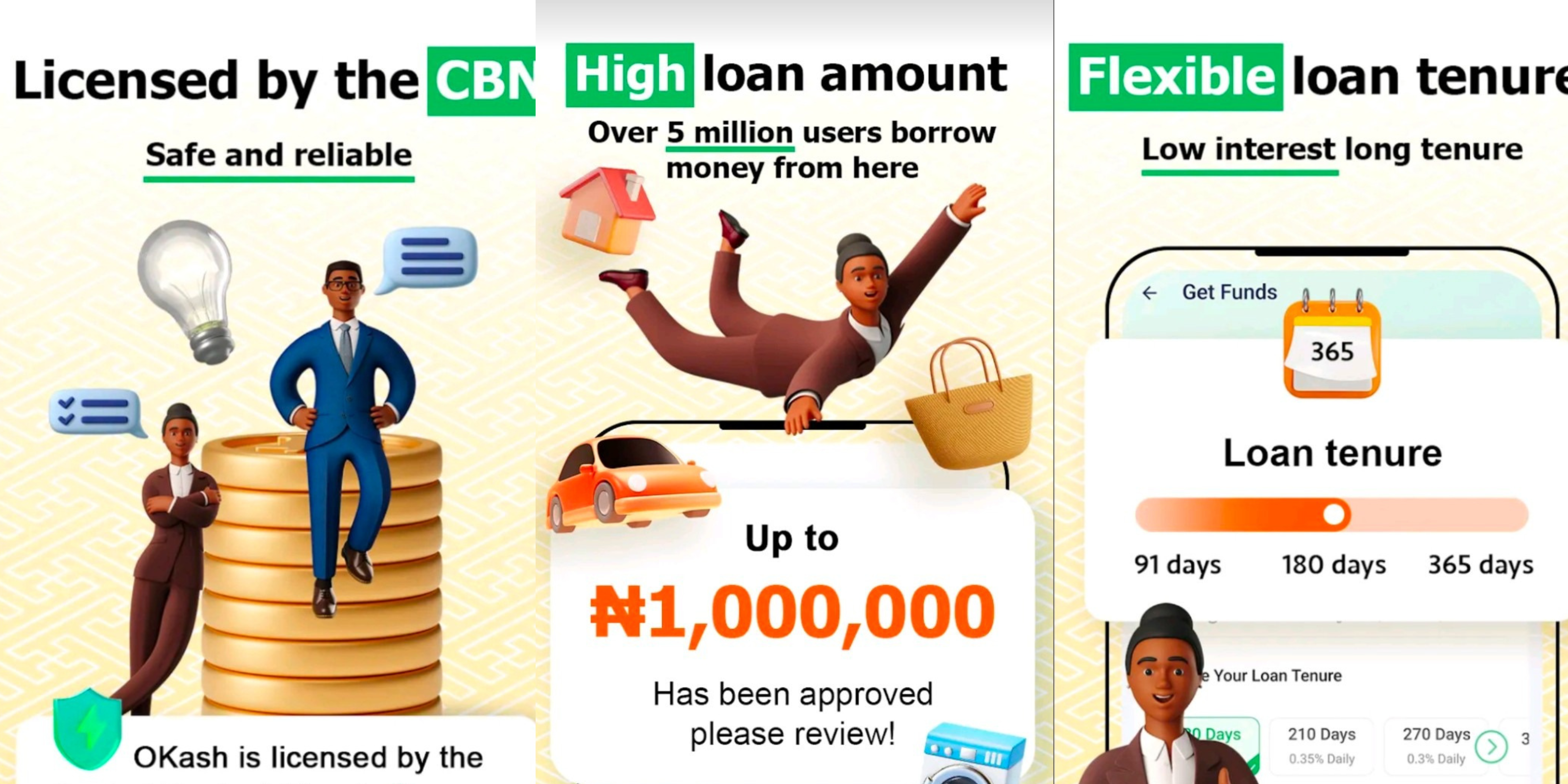

Are you in need of a quick loan in Nigeria? Look no further than OKash, one the reliable online loan provider with their mobile app available on Google Play store .

In this Article, we will detail everything you need to know about OKash loans, including how to apply, eligibility criteria, loan requirements, benefits, and many more. So, let’s dive in and discover how OKash can provide you with the financial support you need, anytime, anywhere.

What is OKash?

OKash is a trusted financial services provider that offers quick loans to individuals in Nigeria. With OKash, you can access loans ranging from ₦1,500 to ₦50,000 with flexible repayment options. The app is designed to provide convenient and reliable financial services while ensuring the protection of your personal information. Whether you need funds for emergencies, bills, or any other financial needs, OKash is here to assist you.

OKash Loan Requirements

To be eligible for an OKash loan, you need to meet certain requirements. These requirements include:

1. Age: You must be between 20 and 55 years old.

2. Residency: OKash loans are available to Nigeria Residents.

3. Bank Account: You must have a valid bank account in Nigeria.

4. Income: You must provide a valid monthly source of income(e.g. Bank statement of account).

Note: Meeting these requirements will increase your chances of getting approved for a loan with OKash. It’s essential to have the necessary documents and information ready to expedite the application process.

How to Apply for an OKash Loan

Applying for a loan with OKash is a simple and straightforward process. Follow these steps to get started:

1. Open your google playstore application and search for “OKash” or use this link. After that Downloand and Install the OKash app in your mobile device.

2. Create an account using your email address and password.

3. Complete the loan application form with accurate information.

4. Provide the necessary documents, including your ID card or international passport or permanent voters card or a valid driving licence and bank statement.

5. Select your prefered loan option.

6.Submit your application and wait for the loan approval, you may receive a call for verification as well.

7. The final application result will be shown in the APP and you will be informed by SMS if approved

8. Then you’ll be prompted to sign(E-sign) the loan agreement after the approval.

9. After the E-sign(electronic-signature), the approved loan amount will be sent into your account shortly and a SMS notification will be sent your mobile phone as well.

Note: It’s important to note that OKash offers loans to both salary earners and entrepreneurs, making it accessible to a wide range of individuals.

OKash Loan Details

OKash offers loans with repayment terms ranging from 91 to 365 days, with loan amounts ranging from ₦3,000 to ₦1,000,000. The interest rates vary depending on the loan amount and repayment period, typically falling within the range of 0.1% to 1% (minimum, calculated on a daily basis) and 36.5% to 360% (maximum, expressed as an Annual Percentage Rate).

It’s crucial to carefully consider both the loan amount and repayment terms to ensure you can comfortably meet the obligations.

Example of an OKash Loan

For example, let’s consider a 91-day loan term with an interest rate of 9.1%. For a loan processed with a principal amount of NGN 3,000, the interest would be NGN 273, making the total amount due NGN 3,273.

Top Benefits of OKash Loans

OKash offers several benefits that make it an attractive option for individuals in need of quick financial assistance. Here are some key advantages of choosing OKash:

1. Quick and Convenient: With OKash, you can apply for a loan anytime, anywhere using your smartphone.

2. Fast Approval: OKash provides fast loan approval, allowing you to access funds within a short period.

3. Flexible Loan Amount: You can choose the loan amount that suits your financial needs and capabilities.

4. Transparent Terms: OKash ensures transparency in its loan terms, with no hidden charges or fees.

5. Credit Score Improvement: By repaying your OKash loans on time, you can improve your credit score and increase your chances of accessing larger loans in the future.

These benefits make OKash a reliable and convenient option for individuals seeking quick loans in Nigeria.

OKash: Frequently Asked Questions (FAQ)

Can I apply for an OKash loan if I am self-employed?

Answer: Yes, OKash offers loans to both salary earners and entrepreneurs, making it accessible to self-employed individuals.

What is the maximum and minimum loan amount I can get from OKash?

Answer: OKash offers loans ranging from ₦3,000 to ₦1,000,000, depending on your eligibility and financial circumstances.

How long does it take to receive the loan amount?

Answer: Once your loan application is approved, the loan amount will be disbursed directly to your bank account within a short period.

Are there any hidden charges or fees with OKash loans?

Answer: No, OKash ensures transparency in its loan terms, with no hidden charges or fees. All applicable fees will be clearly communicated to you during the loan application process.

Can I repay my OKash loan before the due date?

Answer: Yes, you have the option to repay your OKash loan before the due date without any penalties. Early repayment can also help improve your credit score.

OKash Contact Details

For any further questions, feedback, or concerns, you can contact OKash through the following channels:

Phone: 018884549

Email: support@okash.ng

Address: 3rd Floor, 27A Adeyemo Alakija Street, Victoria Island, Lagos, Nigeria

Mobile App

Website

Conclusion

OKash is a reliable and convenient online loan app that providesquick financial assistance to individuals in Nigeria. With its easy application process, flexible loan amounts, and fast approval, OKash is a go-to option for those in need of immediate funds. By meeting the eligibility criteria and providing the necessary documents, you can access loans ranging from ₦1,500 to ₦50,000 with repayment terms of 7 to 30 days.

The benefits of choosing OKash include its convenience, transparency, and the opportunity to improve your credit score. Whether you’re a salary earner or an entrepreneur, OKash is here to support you in your financial journey.

So, if you find yourself in need of a quick loan in Nigeria, don’t hesitate to download the OKash app from the Google Play Store and apply today. Remember to have all the required documents ready and provide accurate information to expedite the loan approval process. With OKash, you can have the financial support you need, anytime, anywhere