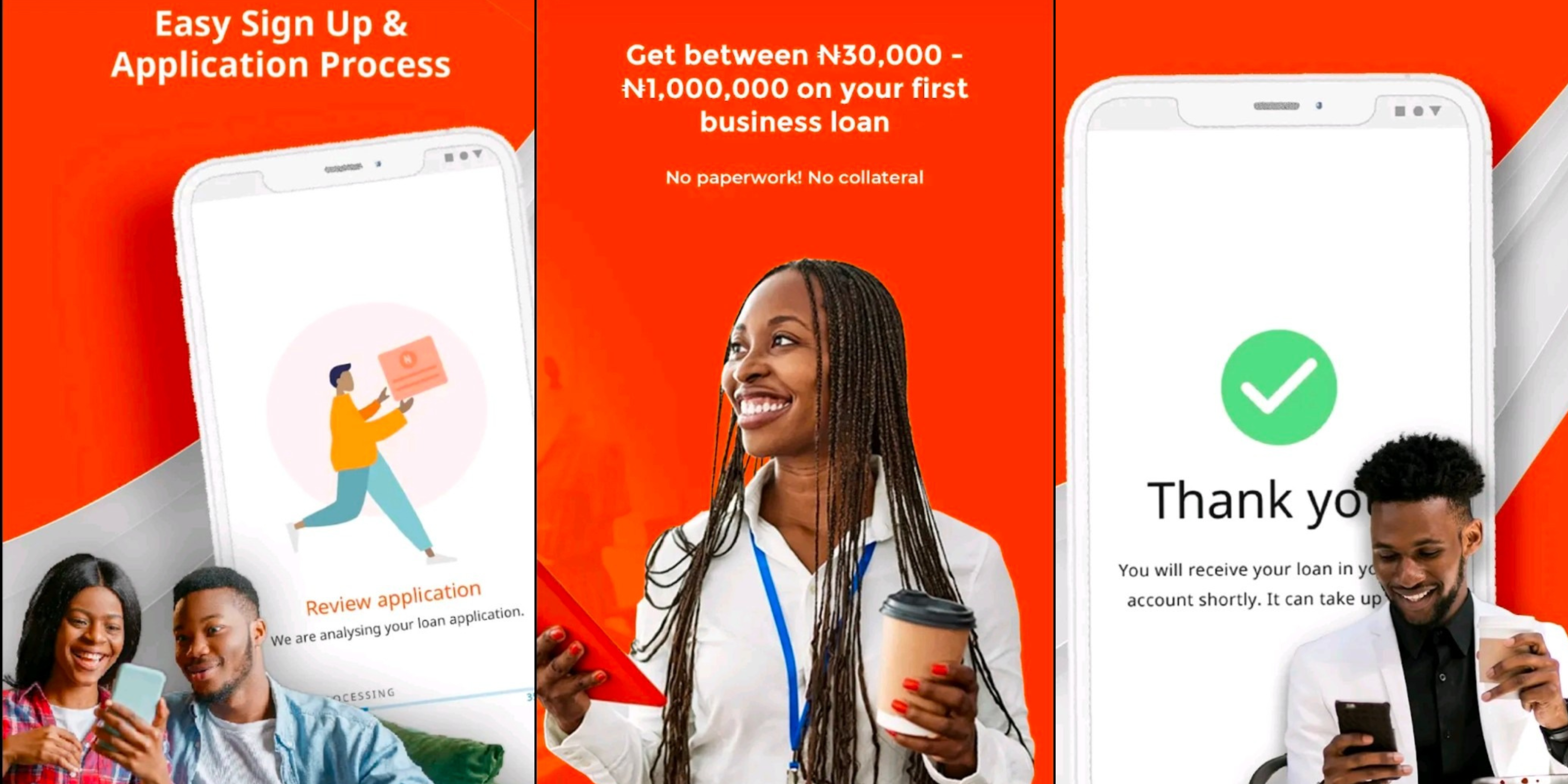

Are you in need of a quick loan in Nigeria? Look no further than QuickCheck, the reliable online loan app available on the Google Play Store. In this comprehensive guide, we will explore everything you need to know about QuickCheck loans, including how to apply, eligibility criteria, loan requirements, benefits, and more. So, let’s dive in and discover how QuickCheck can provide you with the financial support you need, anytime, anywhere.

What is QuickCheck?

QuickCheck is a trusted financial services provider that offers quick loans to individuals in Nigeria. With QuickCheck, you can access loans ranging from ₦1,500 to ₦500,000 with flexible repayment options. The app is designed to provide convenient and reliable financial services while ensuring the protection of your personal information. Whether you need funds for emergencies, bills, or any other financial needs, QuickCheck is here to assist you.

QuickCheck Loan Requirements

To be eligible for a QuickCheck loan, you need to meet certain requirements. These requirements include:

1. Age: You must be between 18 and 65 years old.

2. Citizenship & Residency: QuickCheck loans are available to Nigerian citizens and residence.

3. Bank Account: You must have a valid bank account in Nigeria(for loan disbursement).

4. Employment: QuickCheck offers loans to both salary earners and entrepreneurs.

5. Android User: Must be an android user, as quick loan app is currently only available on the google play store.

6. Credit score: You must have a good credit score history to apply for a quickcheck loan

Note: Meeting these requirements will increase your chances of getting approved for a loan with QuickCheck. It’s essential to have the necessary documents and information ready to expedite the application process.

How to Apply for a QuickCheck Loan

Applying for a loan with QuickCheck is a simple and straightforward process. Follow these steps to get started:

1. Install the QuickCheck app from the Google Play Store.

2. Create an account using your email address and password.

3. Complete the loan application form with accurate information.

4. Provide the necessary documents, including your ID card and bank statement.

5. Submit your application and wait for the loan approval.

Once your loan application is approved, the loan amount will be disbursed directly to your bank account. It’s important to note that QuickCheck offers loans to both salary earners and entrepreneurs, making it accessible to a wide range of individuals.

QuickCheck Loan Details

QuickCheck offers loans with repayment terms ranging from 4 to 12 weeks. The interest rates vary depending on the loan amount and repayment period. It’s important to carefully consider the loan amount and repayment terms to ensure you can comfortably meet the obligations.

Top Benefits of QuickCheck Loans

QuickCheck offers several benefits that make it an attractive option for individuals in need of quick financial assistance. Here are some key advantages of choosing QuickCheck:

1. Quick and Convenient: With QuickCheck, you can apply for a loan anytime, anywhere using your smartphone.

2. Fast Approval: QuickCheck provides fast loan approval, allowing you to access funds within a short period.

3. Flexible Loan Amount: You can choose the loan amount that suits your financial needs and capabilities.

4. Transparent Terms: QuickCheck ensures transparency in its loan terms, with no hidden charges or fees.

5. Credit Score Improvement: By repaying your QuickCheck loans on time, you can improve your credit score and increase your chances of accessing larger loans in the future.

These benefits make QuickCheck a reliable and convenient option for individuals seeking quick loans in Nigeria.

QuickCheck Loan: Frequently Asked Questions (FAQ)

Can I apply for a QuickCheck loan if I am self-employed?

Answer: Yes, QuickCheck offers loans to both salary earners and entrepreneurs, making it accessible to self-employed individuals.

What is the maximum and minimum loan amount I can get from QuickCheck?

Answer: QuickCheck offers loans ranging from ₦1,500 to ₦500,000, depending on your eligibility and financial circumstances.

How long does it take to receive the loan amount?

Answer: Once your loan application is approved, the loan amount will be disbursed directly to your bank account within a short period.

Are there any hidden charges or fees with QuickCheck loans?

Answer: No, QuickCheck ensures transparency in its loan terms, with no hidden charges or fees. All applicable fees will be clearly communicated to you during the loan application process.

Can I repay my QuickCheck loan before the due date?

Answer: Yes, you have the option to repay your QuickCheck loan before the due date without any penalties. Early repayment can also help improve your credit score.

For any further questions, feedback, or concerns, you can contact QuickCheck through the following channels:

Phone: +234 908 605 2045

Email: support@quickcheck.ng

Address: 2nd Floor, 19A Sinari Daranijo Street, Victoria Island, Lagos, Nigeria

Mobile app

Website

Conclusion

QuickCheck is a reliable and convenient online loan app that provides quickfinancial assistance to individuals in Nigeria. With its easy application process, flexible loan amounts, and fast approval, QuickCheck is a go-to option for those in need of immediate funds. By meeting the eligibility criteria and providing the necessary documents, you can access loans ranging from ₦1,500 to ₦500,000 with repayment terms of 4 to 12 weeks. The transparent terms and absence of hidden charges make QuickCheck a trustworthy choice for borrowers.

Repaying your QuickCheck loans on time not only ensures financial stability but also helps improve your credit score, opening doors to larger loan amounts in the future. Whether you’re a salary earner or a self-employed individual, QuickCheck caters to your financial needs.

If you have any questions or need assistance, QuickCheck’s customer support team is readily available to help. Contact them via phone, email, or visit their office address in Lagos, Nigeria.

Don’t let financial constraints hold you back. Download the QuickCheck app from the Google Play Store today and experience the convenience and reliability of quick loans at your fingertips.

Remember, QuickCheck is here to support you in your financial journey, providing the necessary funds when you need them the most. Apply now and take control of your financial future with QuickCheck.