Of course, Financial needs can arise at any moment. Whether it’s for personal expenses, emergencies, or business ventures, having access to quick and reliable loans can make all the difference. This is where TLoan comes into play. TLoan is a leading loan app in Nigeria that provides individuals with a convenient and efficient way to apply for loans. In this comprehensive guide, we will explore everything you need to know about TLoan, from the application process to eligibility requirements, benefits, and more. So, let’s dive in!

What is TLoan?

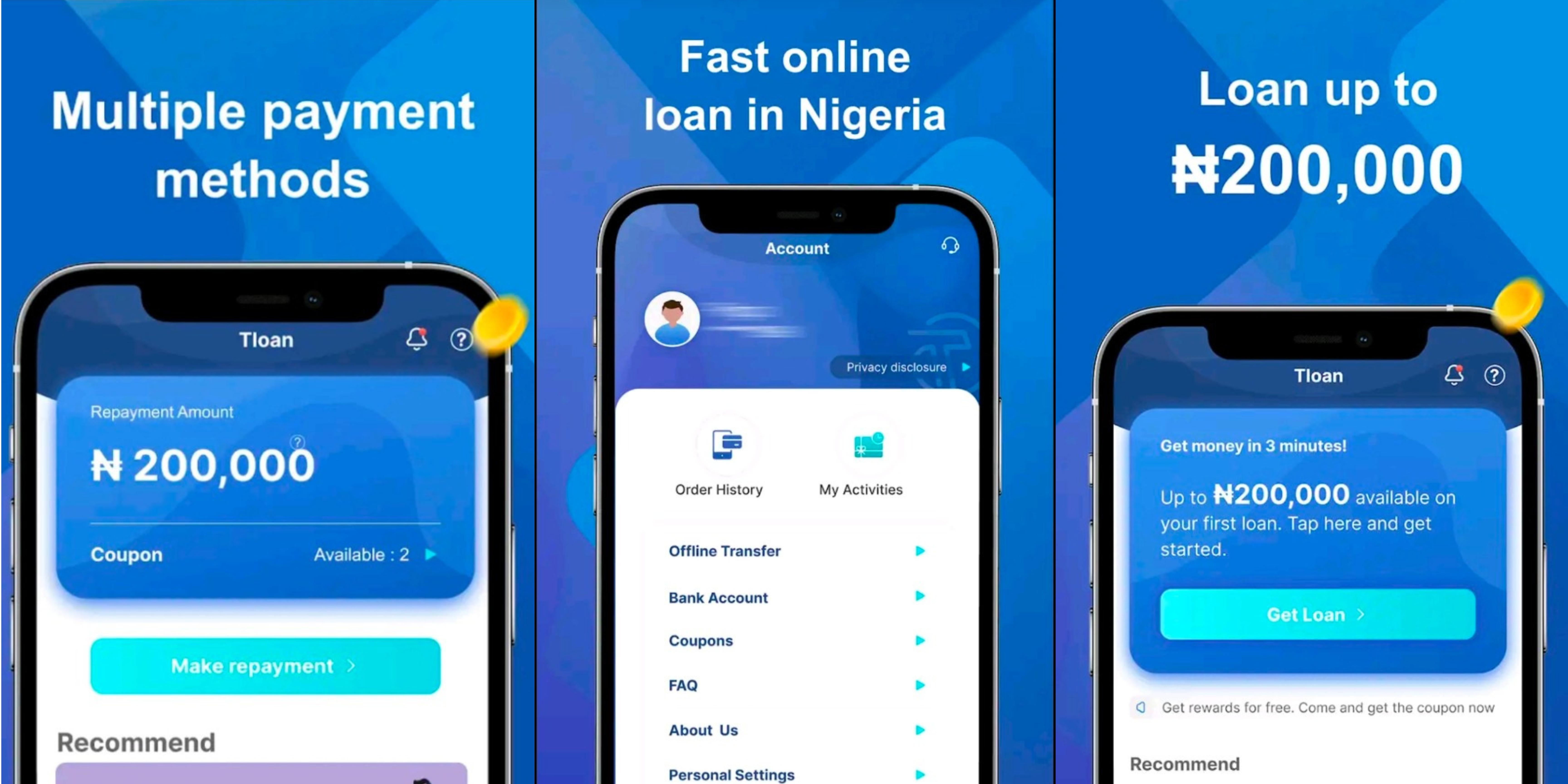

TLoan is a mobile application developed by Tingo Credit that offers instant loans to individuals in Nigeria. With TLoan, users can access quick cash loans directly from their smartphones, eliminating the need for lengthy paperwork and traditional banking processes. This innovative app is designed to provide a seamless borrowing experience, allowing users to apply for loans anytime, anywhere, and receive funds directly into their bank accounts within minutes.

Eligibility Requirements for TLoan

To be eligible for a loan with TLoan, you need to meet certain criteria. Here are the key eligibility requirements:

1. Citizenship & Residency: You must be a Nigerian citizen or legal resident.

2. Age: You must be at least 18 years old.

3. Account: You must have a valid bank account for loan disbursement.

4. Income: You must have a steady source of income.

5. Phone: You must have a smartphone with internet access.

6. Credit Score: You must have a good credit history.

Note: Meeting these requirements increases your chances of getting approved for a loan with TLoan. However, even if you don’t meet all the criteria, TLoan still considers applications on a case-by-case basis.

How to Apply for a Loan with TLoan: Complete Guide

Applying for a loan with TLoan is a simple and straightforward process. Here’s a step-by-step guide to help you get started:

1: Download and Install TLoan App

To begin, visit the Google Play Store and search for “TLoan” or use this clink. Click on the app and select “Install” to download it onto your smartphone. Once the installation is complete, open the app to proceed with the loan application.

2: Create an Account

Upon opening the TLoan app, you will be prompted to create a new account. Provide the required details, including your name, phone number, email address, and create a password. Make sure to double-check the information for accuracy.

3: Complete Your Profile

After creating an account, you will need to complete your profile by providing additional information such as your employment details, monthly income, and bank account information. This information helps TLoan assess your eligibility for a loan and determine the loan amount you qualify for.

4: Choose Loan Amount and Duration

Once your profile is complete, you can proceed to select the loan amount and duration that best suits your needs. TLoan offers flexible loan options, allowing you to borrow amounts ranging from ₦2,000 to ₦100,000 with repayment periods of 90 to 365 days.

5: Submit Your Loan Application

After choosing the loan amount and duration, review your application details and ensure everything is accurate. Once you are satisfied, click on the “Submit” button to send your loan application for processing.

6: Loan Approval and Disbursement

TLoan’s advanced algorithms will assess your application and provide an instant decision on your loan approval. If approved, the loan amount will be disbursed directly into your bank account within minutes. You will receive a notification on the app and via SMS regarding the status of your loan application.

Top Benefits of Using TLoan

TLoan offers numerous benefits to its users, making it a preferred choice for quick and hassle-free loans. Here are some of the key benefits:

1. Instant Approval and Disbursement

With TLoan, you can receive loan approval within minutes of submitting your application. Once approved, the funds are disbursed directly into your bank account, ensuring quick access to the cash you need.

2. No Collateral Required

Unlike traditional loans that often require collateral, TLoan offers unsecured loans. This means you don’t need to pledge any assets or provide a guarantor to secure your loan.

3. Flexible Loan Options

TLoan provides flexible loan options, allowing you to choose the loan amount and duration that best fits your financial needs. Whether you need a small loan for a few days or a larger loan for an extended period, TLoan has you covered.

4. Convenient Repayment Options

Repayment of your TLoan is made easy with flexible repayment options. You can repay your loan directly from the app using your bank account or debit card. TLoan also offers the option to set up automatic repayments, ensuring you never miss a payment and maintain a good credit history.

5. Competitive Interest Rates

TLoan understands the importance of affordability, which is why they offer competitive interest rates on their loans. This ensures that you can borrow money without being burdened by exorbitant interest charges.

6. Transparent and Secure

TLoan prioritizes transparency and security. They provide clear terms and conditions, ensuring that you understand the loan agreement before accepting it. Additionally, TLoan uses advanced security measures to protect your personal and financial information, giving you peace of mind.

How long does it take to receive loan approval from TLoan?

Answer: TLoan provides instant loan approval. Once you submit your application, you can expect to receive a decision within minutes.

Can I apply for a loan with TLoan if I have a poor credit history?

Answer: Yes, TLoan considers applications on a case-by-case basis. Even if you have a poor credit history, you may still be eligible for a loan.

What is the maximum and minimum loan amount I can borrow from TLoan?

Answer: TLoan offers loan amounts ranging from ₦2,000 to ₦100,000 as at May 14, 2024. Allowing you to borrow according to your financial needs.

Are there any fees associated with applying for a loan with TLoan?

Answer: TLoan does not charge any application fees. However, there may be certain service fees associated with loan disbursement and repayment. These fees will be clearly stated in the loan agreement.

Can I repay my TLoan before the due date?

Answer: Yes, TLoan allows early repayment without any penalties. In fact, early repayment can positively impact your credit history and increase your chances of getting approved for future loans.

How can i contact TLoan customer care service?

You can contact TLoan customer service using either of the methods below:

Email: tingoserviceng@gmail.com or GiasunTechnology@gmail.com

Phone: +234 8034-063-318

WhatApp Number: +234 8101-108-193

Website

Mobile APP

Conclusion

TLoan is revolutionizing the lending landscape in Nigeria by providing individuals with a convenient and efficient way to access quick cash loans. With its user-friendly mobile app, instant loan approval, flexible loan options, and transparent terms, TLoan is a reliable solution for your financial needs. Whether you’re facing an unexpected expense or need funds to pursue your dreams, TLoan is here to support you. Download the TLoan app today and experience the ease of borrowing at your fingertips.

Remember, financial responsibility is key when borrowing money. Only borrow what you can afford to repay and make timely repayments to maintain a good credit history. TLoan is your trusted partner in your journey towards financial stability and growth.