Have you heard of Flexi Cash Loan?

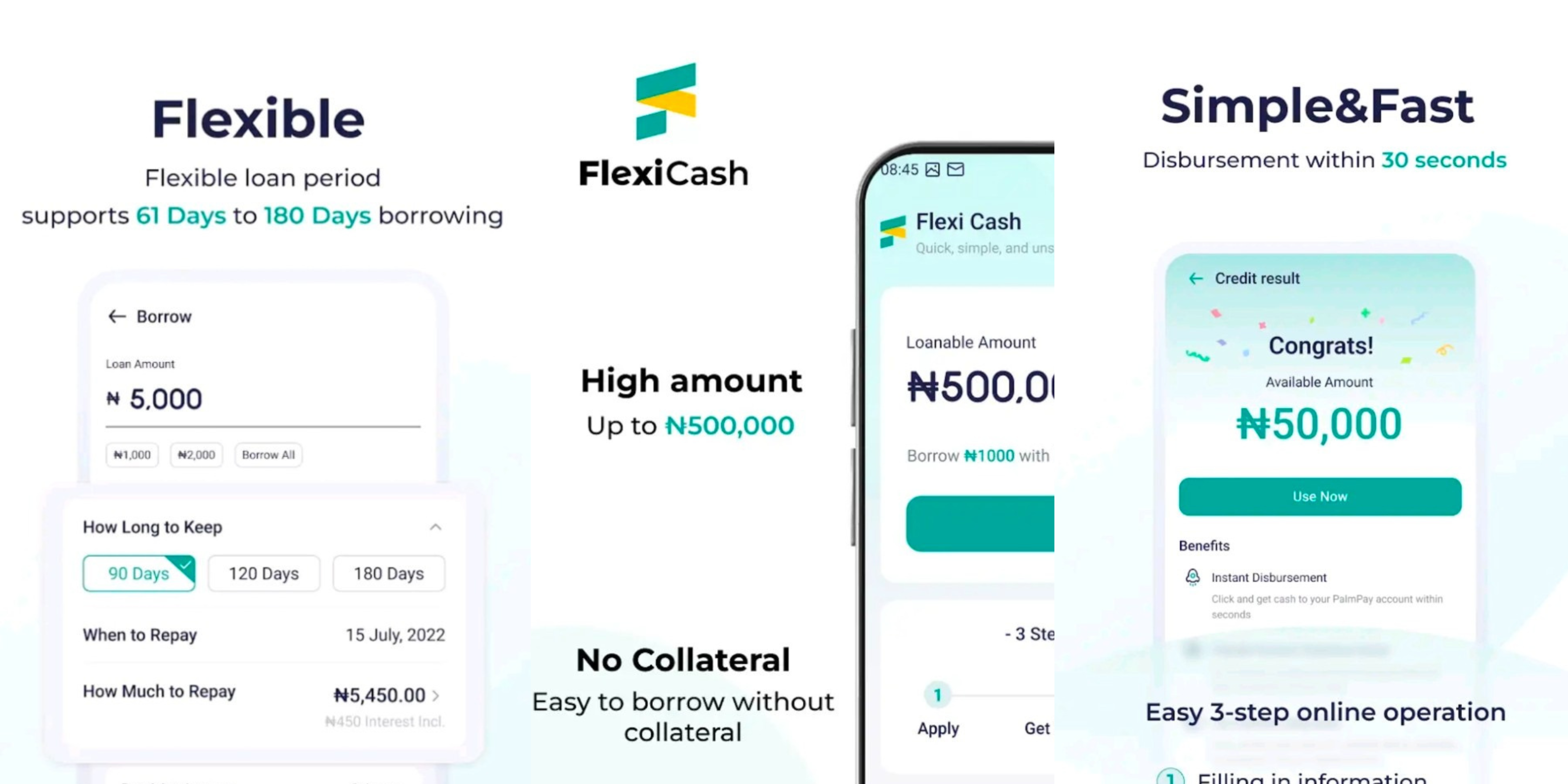

If not! Let me introduce you to flexi cah loan. Flexi Cash Loan is a convenient and flexible loan option offered by the Legend Cash app. It is designed to provide instant access to funds for individuals in need of immediate financial assistance. The app can be downloaded from the Google Play Store and offers a hassle-free loan application process with competitive interest rates.

Eligibility Criteria for Flexi Cash Loan

To be eligible for a Flexi Cash Loan, you need to meet the following criteria:

1. Age: You must be within the age of 18 to 55 years old at the time of application.

2. Income: A steady source of income is required to demonstrate your ability to repay the loan. Employment details and income proofs may be required during the application process.

3. Citizenship: Flexi Cash Loan is available to Nigerian citizens residing in Nigeria.

4. Credit History: While a good credit history is preferable, individuals with a less-than-perfect credit score may also be considered for a loan.

Requirements for Flexi Cash Loan Application

To complete your Flexi Cash Loan application, you will need to provide the following documents and information:

1. Personal identification: Valid proof of identification such as Goovernment issued ID card, Passport, or driver’s license.

2. Address proof: Documents such as a utility bill, passport, or rental agreement to verify your residential address.

3. Income proof: Salary slips, bank statements, or income tax returns to establish your income stability.

4. Bank account details: Provide your bank account information for loan disbursement when approved and repayment purposes.

How to Apply for Flexi Cash Loan

Applying for a Flexi Cash Loan is a straightforward process. Here’s a step-by-step guide to help you through the application process:

1. Download the Legend Cash app:

Visit the Google Play Store and search for the Legend Cash app or use this link. Download and install the app on your Android device.

2. Create an account:

Launch the app and create a new account if you haven’t done so, by providing the required information, including your name, contact details, and email address. Ensure that you provide accurate information to avoid any complications during the verification process.

3. Complete the profile:

After creating an account, you will be prompted to complete your profile. This involves providing additional personal and financial details, such as your employment information, monthly income, and bank account details.

4. Choose loan amount and repayment terms:

Specify the loan amount you require and select the repayment terms that suit your financial situation. The app will provide you with a clear breakdown of the repayment schedule, including the interest rates and total repayment amount.

5. Submit the application:

Carefully review all the details you have provided and submit your loan application. The Legend Cash team will review your application and notify you of the decision within a short period.

Benefits of Flexi Cash Loan

Flexi Cash Loan offers numerous advantages to borrowers, including:

1. Instant Approval:

The loan application process is quick, and you can receive approval within a short period, allowing you to address your financial needs promptly.

2. Flexible Repayment Options:

The app provides various repayment terms, allowing you to choose a plan that suits your financial situation best.

3. Competitive Interest Rates:

Flexi Cash Loan offers competitive interest rates, ensuring that you can repay the loan without excessive financial burden.

3. Minimal Documentation:

The loan application requires minimal documentation, making it convenient and hassle-free.

4. Free application

All Flexi cash loan application processes are free no hidden payment or charges.

5 . No paper document.

All Flexi Cash Loan operations are online, simple and convenient. Complete process in 2 minutes with a phone, with paper documents.

6. Data security

High compliance with industrial data encryption laws, aims to provide the highest level of data and privacy protection.

7.High quality customer service

Flexi cash gives a wide range of customer service provisions such as; email, phone number, in-app chat, etc., committed to serve you 24/7.

FlexiCash Contact Details:

phone:018886888

Email: support@fleximfb.com

Office Address: 1, COURT ROAD, OPPOSITE ECWA CHURCH, KARU, Abuja, Federal Capital Territory, 900108, Nigeria

Website

Moblie App

FlexiCash Loan: Frequently Asked Questions (FAQ)

What are the repayment periods for FlexiCash Loan?

Answer: The loan offers flexible repayment periods, ranging from 61 days to 180 days, designed to accommodate your individual financial circumstances.

What is the maximum and minimum loan amounts available on Flexicash loan?

Answer: Flexicash loans cater to diverse needs, allowing you to borrow amounts anywhere between ₦2000 and ₦500,000.

What is the Annual Percentage Rate (APR) for the loan?

Answer: Flexiloan Annual Percentage Rate (APR) ranges from 36% to 300% per annum, ensuring transparency and providing clear insight into the borrowing process.

Conclusion

Flexi Cash Loan, offered through the Legend Cash app, is a reliable solution for individuals seeking immediate financial assistance. With a simple application process, flexible repayment options, competitive interest rates, and quick approval, it provides the convenience and peace of mind you need during unexpected financial situations. Download the Legend Cash app today and take advantage of the benefits of Flexi Cash Loan to meet your financial needs effortlessly.