As always, financial stability is very crucial for individuals and businesses alike. Whether it’s for personal expenses, starting a new venture, or dealing with unexpected emergencies, having access to quick and reliable funds can make a significant difference. This is where Minicredit Loan comes into play. Minicredit Loan is a leading financial service provider that offers hassle-free loans to individuals and businesses. In this comprehensive guide, we will walk you through the process of applying for a Minicredit Loan, discuss the eligibility criteria, highlight the requirements, and shed light on the numerous benefits that come with it.

What is Minicredit Loan?

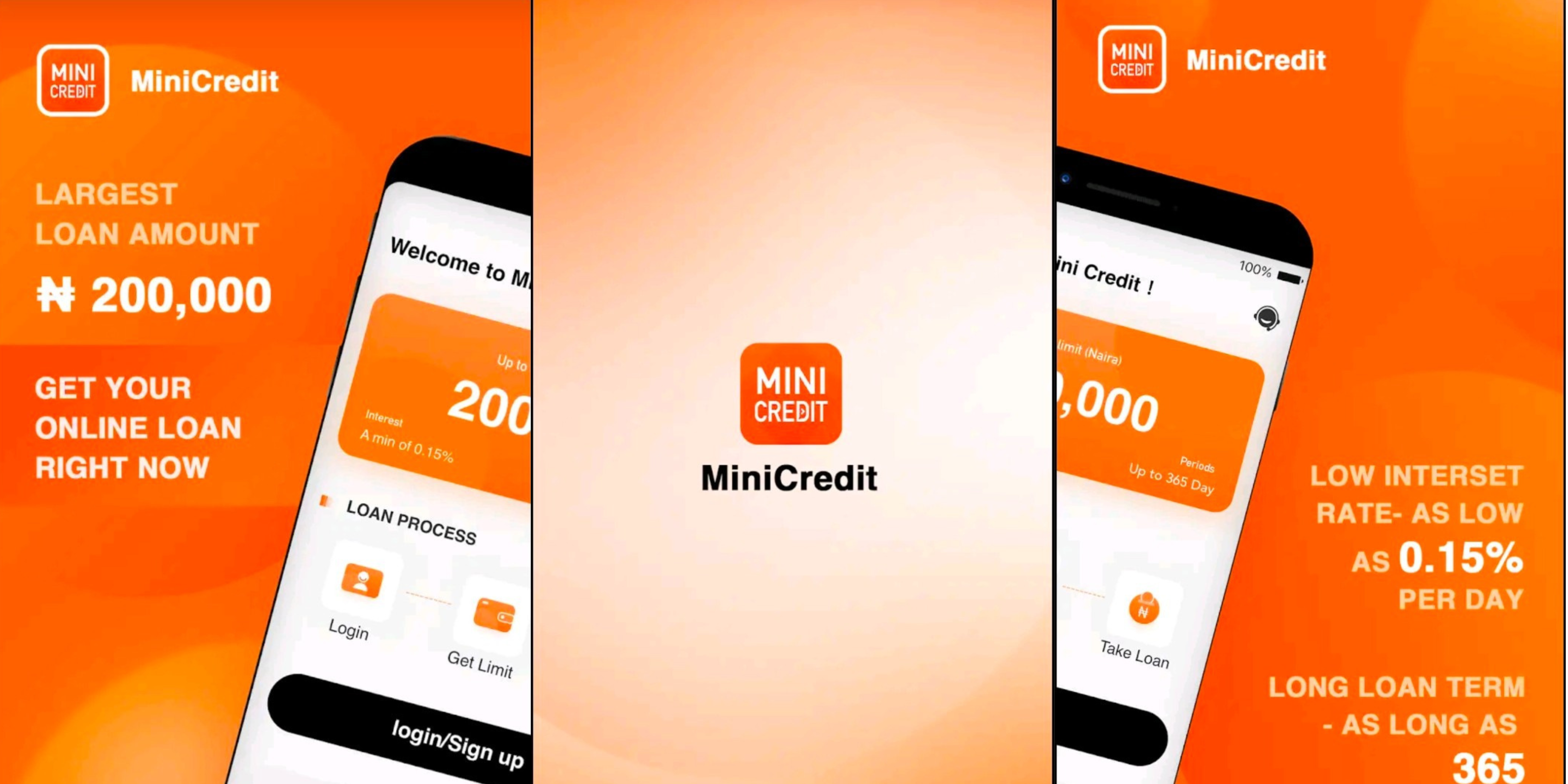

Minicredit Loan is a mobile application developed by Kash Money Palm. This innovative app allows users to apply for loans conveniently from their smartphones. With a user-friendly interface and a seamless application process, Minicredit Loan has become a go-to solution for individuals seeking quick financial assistance.

How to Apply for a Minicredit Loan: Comprehensive Guide

Applying for a Minicredit Loan is a simple process that can be completed in a few easy steps. Here’s a step-by-step guide to help you through the application process:

1. Download the Minicredit Loan App: Start by downloading the Minicredit Loan app from the Google Play Store. You can find the app by searching for “Minicredit Loan” or by following this link.

2. Create an Account: Once the app is installed, open it and create a new account. Provide the necessary details, such as your name, email address, and phone number. Make sure to choose a strong password to secure your account.

3. Complete the Profile: After creating an account, you will be prompted to complete your profile. Fill in the required information, including your personal details, employment information, and financial history. Providing accurate information will increase your chances of loan approval.

4. Choose Loan Amount and Duration: Once your profile is complete, you can select the loan amount and duration that best suits your needs. Minicredit Loan offers flexible loan options, allowing you to borrow amounts ranging from ₦10,000 to ₦500,000.

5. Submit Application: After selecting the loan amount and duration, review your application to ensure all details are accurate. Once you are satisfied, submit your application for review.

6. Loan Approval and Disbursement: Upon submission, your application will be reviewed by Minicredit Loan’s team of experts. If approved, the loan amount will be disbursed directly to your bank account within a short period.

Eligibility Criteria for Minicredit Loan

To be eligible for a Minicredit Loan, you need to meet certain criteria. While the specific requirements may vary, here are some general eligibility criteria to keep in mind:

1. Citizenship & Residency: You must be a Nigerian citizen or a legal resident of Nigeria.

2. Age: You must be between the ages of 20 and 60 years old.

3. Account: You must have a valid bank account.

4. Income: You must have a steady source of income.

Note: Meeting these eligibility criteria does not guarantee loan approval. Minicredit Loan’s decision is based on a thorough assessment of your application and creditworthiness.

Requirements for Minicredit Loan Application

When applying for a Minicredit Loan, you will need to provide certain documents and information. These requirements may include:

1. Valid identification (e.g., National ID card, International Passport, or Driver’s License).

3. Proof of address (e.g., utility bill or bank statement).

4. Proof of income (e.g., payslips or bank statements).

5. Bank account details (for loan disbursement).

Advice: Make sure to have these documents ready before starting the application process to avoid any delays.

Benefits of Minicredit Loan

Minicredit Loan offers a range of benefits to its borrowers, making it a preferred choice for many. Here are some key benefits of choosing Minicredit Loan:

1. Quick and Convenient: With the Minicredit Loan app, you can apply for a loan anytime, anywhere, without the need for lengthy paperwork or visits to a physical branch.

2. Fast Approval: Minicredit Loan’s efficient review process ensures quick loan approval, allowing you to access funds when you need them the most.

3. Flexible Loan Options: Minicredit Loan offers flexible loan amounts and durations, allowing you to tailor the loan to your specific needs and repayment capacity.

4. Competitive Interest Rates: Minicredit Loan offers competitive interest rates, ensuring that you can borrow funds at affordable rates.

5. Transparent and Secure: Minicredit Loan prioritizes transparency and security, ensuring that your personal and financial information is protected throughadvanced encryption and stringent security measures.

6. Build Credit History: By borrowing and repaying loans from Minicredit Loan responsibly, you can establish a positive credit history, which can be beneficial for future financial endeavors.

7. Customer Support: Minicredit Loan provides excellent customer support to assist borrowers throughout the loan application and repayment process.

MiniCredit Loan: Frequently Asked Questions (FAQ)

Can I apply for a Minicredit Loan if I have a bad credit score?

Answer: Minicredit Loan considers various factors when reviewing loan applications, and having a bad credit score does not automatically disqualify you. However, a poor credit history may affect the loan amount and interest rate offered.

How long does it take to receive the loan amount after approval?

Answer: Once your loan application is approved, the funds are typically disbursed to your bank account within 24 to 48 hours.

What happens if I miss a loan repayment?

Answer: It is crucial to make loan repayments on time to maintain a good credit standing. If you miss a repayment, late fees and penalties may apply, and it can negatively impact your credit score.

Can I repay the loan before the due date?

Answer: Yes, Minicredit Loan allows borrowers to repay the loan before the due date without any additional charges. Early repayment can also help you save on interest costs.

Is my personal and financial information safe with Minicredit Loan?

Answer: Yes, Minicredit Loan prioritizes the security and confidentiality of your personal and financial information. They employ advanced encryption and follow strict data protection protocols to ensure your information remains secure.

MiniCredit Contact Details

Website

Email: support@minicredit-ng.com

Mobile App

Conclusion

Minicredit Loan provides a convenient and accessible solution for individuals and businesses in need of quick financial assistance. By following the simple application process, meeting the eligibility criteria, and providing the necessary documents, you can apply for a Minicredit Loan with ease. With its numerous benefits, such as quick approval, flexible loan options, and competitive interest rates, Minicredit Loan stands as a reliable financial partner. Remember to borrow responsibly and make timely repayments to maintain a positive credit history. Download the Minicredit Loan app today and experience the convenience of obtaining funds at your fingertips.