In today’s fast-moving world, having stable finances and being able to get credit when needed are super important for reaching our goals and dreams. Whether it’s starting a business, going to college, or handling unexpected expenses, having money you can count on makes a huge difference. That’s where EaseMoni Loan steps in. In this guide, we’ll cover everything you need to know about EaseMoni Loan, like how to apply, who can apply, what you need, the perks, and more. So, let’s get started!

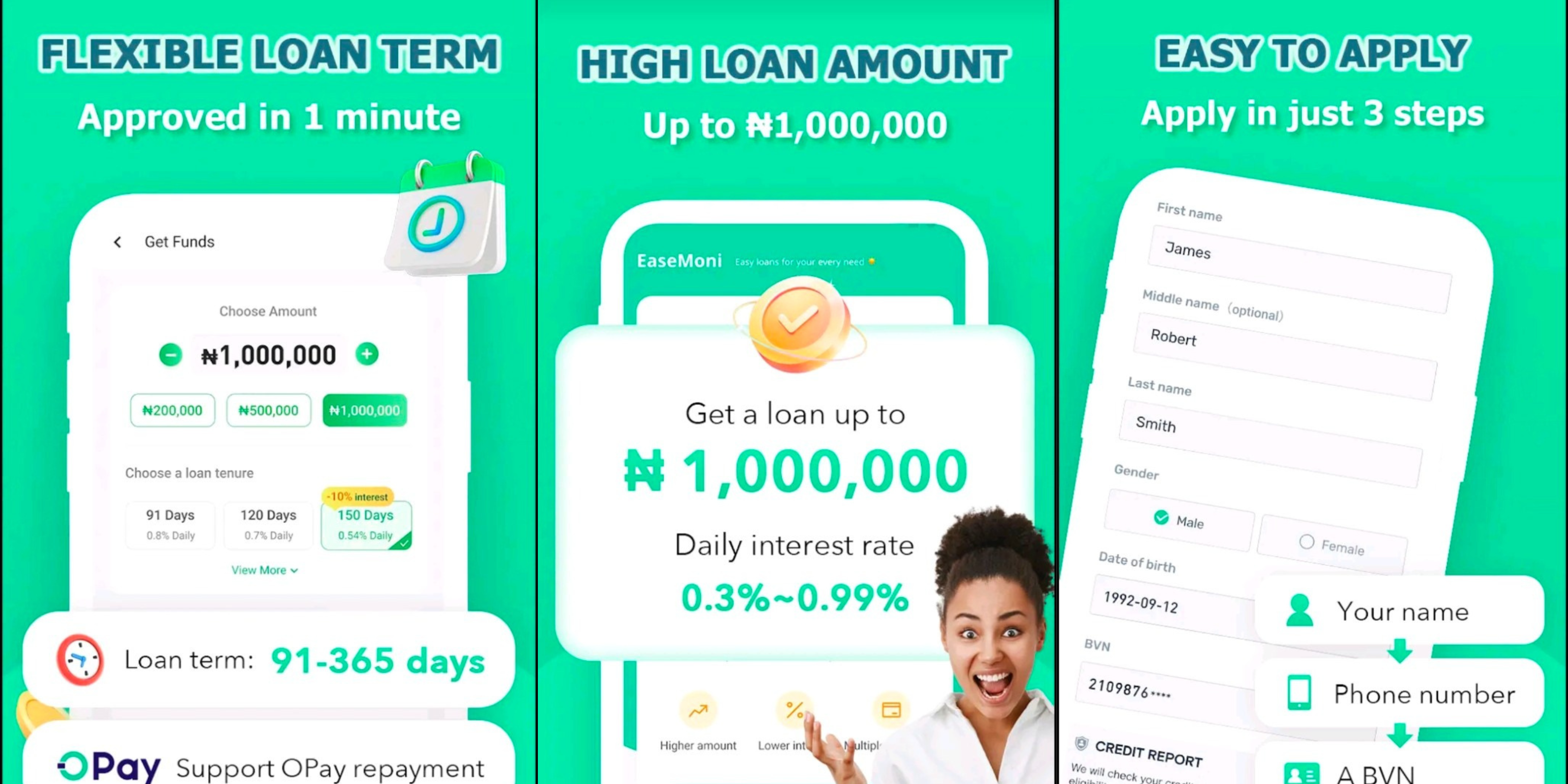

So, what exactly is EaseMoni Loan? Well, it’s a game-changer in the financial world, offered through the EaseMoni mobile app. Made especially for folks in Nigeria, EaseMoni Loan is all about giving people easy and fast access to money. Thanks to its simple interface and easy application process, lots of Nigerians love using EaseMoni Loan when they need a hassle-free loan.

How to Apply for EaseMoni Loan

Applying for an EaseMoni Loan is a straightforward process that can be completed in a few simple steps. Here’s a step-by-step guide to help you through the application process:

1. Download the EaseMoni mobile application from the Google Play Store. The app is exclusively available for Android devices.

2. Install the app on your smartphone and create a new account by providing the required information, including your name, phone number, and email address.

3. Once your account is set up, log in to the EaseMoni app using your credentials.

4. Complete the necessary verification process, which may include providing identification documents, proof of income, and other relevant information.

5. After successful verification, you can proceed to apply for a loan within the app. Specify the loan amount and repayment duration based on your requirements.

6. Submit your loan application and wait for the approval process to be completed. EaseMoni Loan offers a quick approval process, ensuring that you receive a response promptly.

7. If your loan application is approved, the funds will be disbursed directly to your registered bank account.

8. Repay the loan as per the agreed-upon terms and conditions. EaseMoni Loan provides flexible repayment options, making it convenient for borrowers to manage their finances.

Eligibility Criteria for EaseMoni Loan

To be eligible for an EaseMoni Loan, you need to meet certain criteria set by the platform. While the specific requirements may vary, here are some general eligibility criteria to keep in mind:

1. Nationality: You must be a Nigerian citizen or a legal resident of Nigeria.

2. Age: You should be at least 18 years old or above.

3. Bank Account: You must have a valid bank account in your name.

4. Income: A steady source of income is preferred, although specific income requirements may vary.

5. Smart Phone: You need to have a smartphone running on the Android operating system to access the EaseMoni mobile application.

Note: It’s important to note that meeting the eligibility criteria does not guarantee loan approval. EaseMoni Loan evaluates each application on various factors, including creditworthiness and risk assessment.

Requirements for EaseMoni Loan Application

When applying for an EaseMoni Loan, you will need to provide certain documents and information to complete the application process. While the specific requirements may vary, here are some common documents and information you may be asked for:

1. Documents: Personal identification documents such as a valid national ID card, driver’s license, or international passport.

2. Income: Proof of income, such as bank statements, pay slips, or tax returns.

3. Address: Proof of address, which can be a utility bill, tenancy agreement, or any official document displaying your residential address.

4. Account Details: Your bank account details, including the bank name, account number, and account statement.

Ensure that you have all the necessary documents and information readily available to expedite the application process. Providing accurate and up-to-date information is crucial for a smooth loan application experience.

Benefits of EaseMoni Loan

EaseMoni Loan offers a range of benefits that make it an attractive choice for individuals in need of quick and reliable financing. Here are some key benefits of choosing EaseMoni Loan:

1. Convenience: The EaseMoni mobile application allows you to apply for a loan anytime, anywhere, without the need for lengthy paperwork or visiting physical branches.

2. Quick Approval: EaseMoni Loan offers a swift approval process, ensuring that you receive a response promptly. This is particularly beneficial when dealing with urgent financial needs.

3. Flexible Repayment: EaseMoni Loan provides flexible repayment options, allowing borrowers to choose a repayment duration that suits their financial situation.

4. Competitive Interest Rates: EaseMoni Loan offers competitive interest rates, making it an affordable choice for borrowers.

5. BuildCredit History: By responsibly repaying your EaseMoni loans, you can build a positive credit history, which can be beneficial for future financial endeavors.

6. Transparent Terms and Conditions: EaseMoni Loan operates with transparency, ensuring that borrowers are aware of the terms and conditions of their loans upfront.

7. Customer Support: EaseMoni provides dedicated customer support to address any queries or concerns you may have during the loan application or repayment process.

Understanding how EaseMoni Works: Example

Suppose you take a 91-day loan with a monthly interest rate of 5%. Let’s say the principal amount you borrowed is ₦3,000.

1. Interest Calculation:

– Monthly Interest: ₦3,000 * 5% = ₦150

– Total Interest for 91 days: ₦150 * 3 = ₦450

2. Total Amount Due:

– Principal + Total Interest = ₦3,000 + ₦450 = ₦3,450

3. Repayment Schedule:

– First Month: ₦3,450 / 3 = ₦1,150

– Second Month: ₦3,450 / 3 = ₦1,150

– Third Month: ₦3,450 / 3 = ₦1,150

So, each month for three months, you would repay ₦1,150 until the total amount due is cleared.

EaseMoni: Frequently Asked Questions (FAQ)

How long does it take for EaseMoni Loan to approve an application?

Answer: EaseMoni Loan offers a quick approval process, and in most cases, you can expect to receive a response within a few hours of submitting your application.

Can I apply for an EaseMoni Loan if I have a low credit score?

Answer: Yes, EaseMoni Loan considers applications from individuals with varying credit scores. While a low credit score may affect the loan terms, it does not necessarily disqualify you from obtaining a loan.

What is the maximum loan amount I can apply for with EaseMoni Loan?

Answer: The maximum loan amount you can apply for with EaseMoni Loan depends on various factors, including your creditworthiness and income. It is recommended to start with a loan amount that aligns with your repayment capacity.

What is the minimum loan amount i can get from EaseMoni?

Answer: EaseMoni offers loans starting from ₦3,000.

What is the maximum loan amount I can borrow from EaseMoni?

Answer: EaseMoni offers loans ranging from ₦3,000 to ₦1000,000, depending on your eligibility and repayment capacity.

Can I repay my EaseMoni Loan before the agreed-upon repayment duration?

Answer: Yes, EaseMoni Loan allows borrowers to repay their loans before the agreed-upon duration. However, it’s important to review the terms and conditions regarding early repayment to understand any associated fees or penalties.

Is the EaseMoni mobile application safe and secure?

Answer: EaseMoni prioritizes the security and privacy of its users. The mobile application utilizes advanced encryption technology to safeguard your personal and financial information.

EaseMoni Contact Information

Email: easemoni@blueridgemfb.com

Phone: +234 700-998-7769

Whatsapp: (234)8179658371

Head Office Address: No.77 Opebi road, Ikeja, Lagos, Nigeria

Website

Conclusion

EaseMoni Loan provides a convenient and reliable solution for individuals in Nigeria seeking quick access to funds. With its user-friendly mobile application, quick approval process, and flexible repayment options, EaseMoni Loan has become a popular choice among borrowers. By understanding the application process, eligibility criteria, requirements, and benefits of EaseMoni Loan, you can make an informed decision when considering this financial service. Remember to review the terms and conditions carefully and borrow responsibly to maintain a healthy financial profile.