Are you in need of quick cash to cover unexpected expenses or bridge a financial gap? Look no further than Blinkcash Loan! In this comprehensive guide, we will walk you through the process of applying for a Blinkcash loan, discuss the eligibility criteria, highlight the necessary requirements, and shed light on the benefits of choosing Blinkcash. So, let’s dive in and explore the world of Blinkcash loans!

Introducing Blinkcash Loan

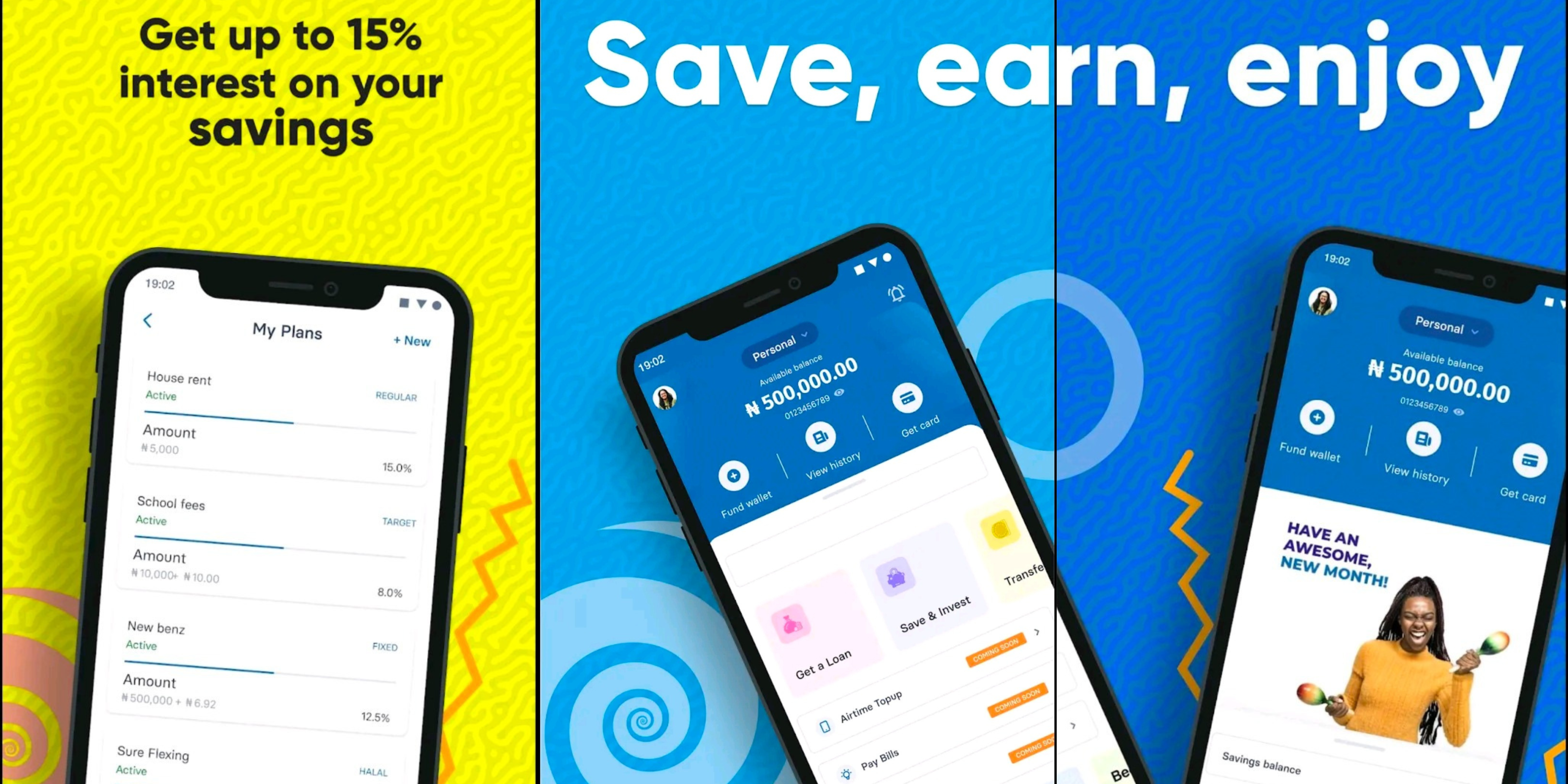

Blinkcash Loan is a leading financial service provider that offers hassle-free and convenient loans to individuals in need. With their user-friendly mobile application, Blinkcash has revolutionized the lending industry by providing quick access to funds without the complexities associated with traditional loans. Whether you need money for emergencies, medical expenses, education, or any other purpose, Blinkcash Loan is here to assist you.

How to Apply for a Blinkcash Loan: Complete guide

Applying for a Blinkcash loan is a simple and straightforward process. Follow the steps below to get started:

1. Download the Blinkcash app: Download the Blinkcash Loan mobile application from the Google Play Store and install on your mobile phone, then open it.

2. Account: Create a new account by providing the required information, such as your name, email address, and phone number.

3. Password: You’ll be asked to set a secure password for your account to ensure the safety of your personal information.

4. Verification: Complete the verification process by providing the necessary documents, such as your identification proof, proof of income, and bank statements.

Once your account is verified, you can proceed to the fifth step which is the loan application.

5. Apply for loan: Fill in the required details, such as the loan amount, repayment term, and purpose of the loan.

Note: Review the terms and conditions of the loan agreement carefully before submitting your application.

6. Loan Approval: After submitting your application, wait for the Blinkcash team to review and process your request.

Note: If approved, the loan amount will be disbursed to your bank account within a short period.

Eligibility Criteria for Blinkcash Loan

To be eligible for a Blinkcash loan, you need to meet the following criteria:

1. Age: You must be at least 21 years old.

2. Residency/Citizenship: You must be a citizen or a permanent resident of the country where Blinkcash operates.

3. Income: You should have a stable source of income to ensure repayment of the loan.

4. Account: You must have a valid bank account for loan disbursement.

Note: Please note that meeting the eligibility criteria does not guarantee loan approval. The final decision is subject to the discretion of Blinkcash Loan.

Requirements for Blinkcash Loan

To complete your Blinkcash loan application, you will need the following documents:

1. Valid identification proof (e.g., passport, driver’s license, or national ID card)

2. Proof of income (e.g., salary slips, bank statements, or tax returns)

3. Bank account details for loan disbursement

Ensure that you have the above documents ready before starting the application process to avoid any delays.

Benefits of Choosing Blinkcash Loan

Opting for a Blinkcash loan comes with several advantages, including:

1. Quick and convenient application process through the mobile application.

2. Fast loan approval and disbursal, ensuring you get the funds you need in a timely manner.

3. Flexible repayment options tailored to your financial situation.

4. Competitive interest rates and transparent fee structure.

5. No collateral or guarantor required, making it accessible to a wide range of individuals.

6. Dedicated customer support to assist you throughout the loan process.

Blinkcash Loan strives to provide a seamless borrowing experience, ensuring customer satisfaction and financial empowerment.

Blinkcash Loan: Frequently Asked Questions (FAQs)

How long does it take to get a Blinkcash loan?

Answer: The time taken to process and disburse a Blinkcash loan may vary depending on various factors. However, Blinkcash aims to provide quick loan approval and disbursal, often within 24 to 48 hours.

Can I apply for a Blinkcash loan with bad credit?

Answer: Yes, Blinkcash considers applications from individuals with varying credit histories. While a good credit score may increase your chances of approval, having bad credit does not automatically disqualify you from obtaining a Blinkcash loan.

What is the maximum loan amount I can apply for on Blinkcash app?

Answer: The maximum loan amount available through Blinkcash Loan may vary based on your eligibility and financial profile. However, the maximum loan amount available through Blinkcash Loan is NGN 500,000.

What is the minimum loan amount I can apply for on Blinkcash app?

Answer: The minimum loan amount available through Blinkcash Loan is NGN 5,000. Although you can still get more NGN 5000. It all depends on your finacial status and eligibility.

Can I repay my Blinkcash loan before the due date?

Answer: Yes, Blinkcash allows early repayment of loans. In fact, repaying your loan before the due date can help you save on interest charges. However, it is advisable to check the terms and conditions of your loan agreement for any applicable prepayment penalties.

What is the loan tenure for Blinkcash Loan?

Answer: Blinkcash Loan offers flexible repayment periods typically ranging from 30 to 90 days, allowing borrowers to choose a tenure that best fits their financial needs.

Is my personal information safe with Blinkcash?

Answer: Blinkcash takes the security and privacy of your personal information seriously. They employ industry-standard security measures to protect your data from unauthorized access or misuse. Additionally, Blinkcash adheres to strict confidentiality policies to ensure the confidentiality of your information.

BlinkCash Contact Information

Phone: +234 903-111-1888

Email: support@blinkcash.ng

Blinkcash Mobile-App

Website

Conclusion

In conclusion, Blinkcash Loan provides a convenient and efficient solution for individuals in need of quick funds. With their user-friendly mobile application, streamlined application process, and flexible repayment options, Blinkcash aims to make borrowing hassle-free and accessible to all. Whether you have an urgent financial need or want to fulfill your dreams, Blinkcash Loan is here to support you.

Remember, when applying for a Blinkcash loan, ensure that you meet the eligibility criteria, have the necessary documents ready, and carefully review the terms and conditions. By doing so, you can make the most of the benefits offered by Blinkcash and embark on your financial journey with confidence.

So, why wait? Download the Blinkcash Loan app today and experience the ease of obtaining a loan at your fingertips!