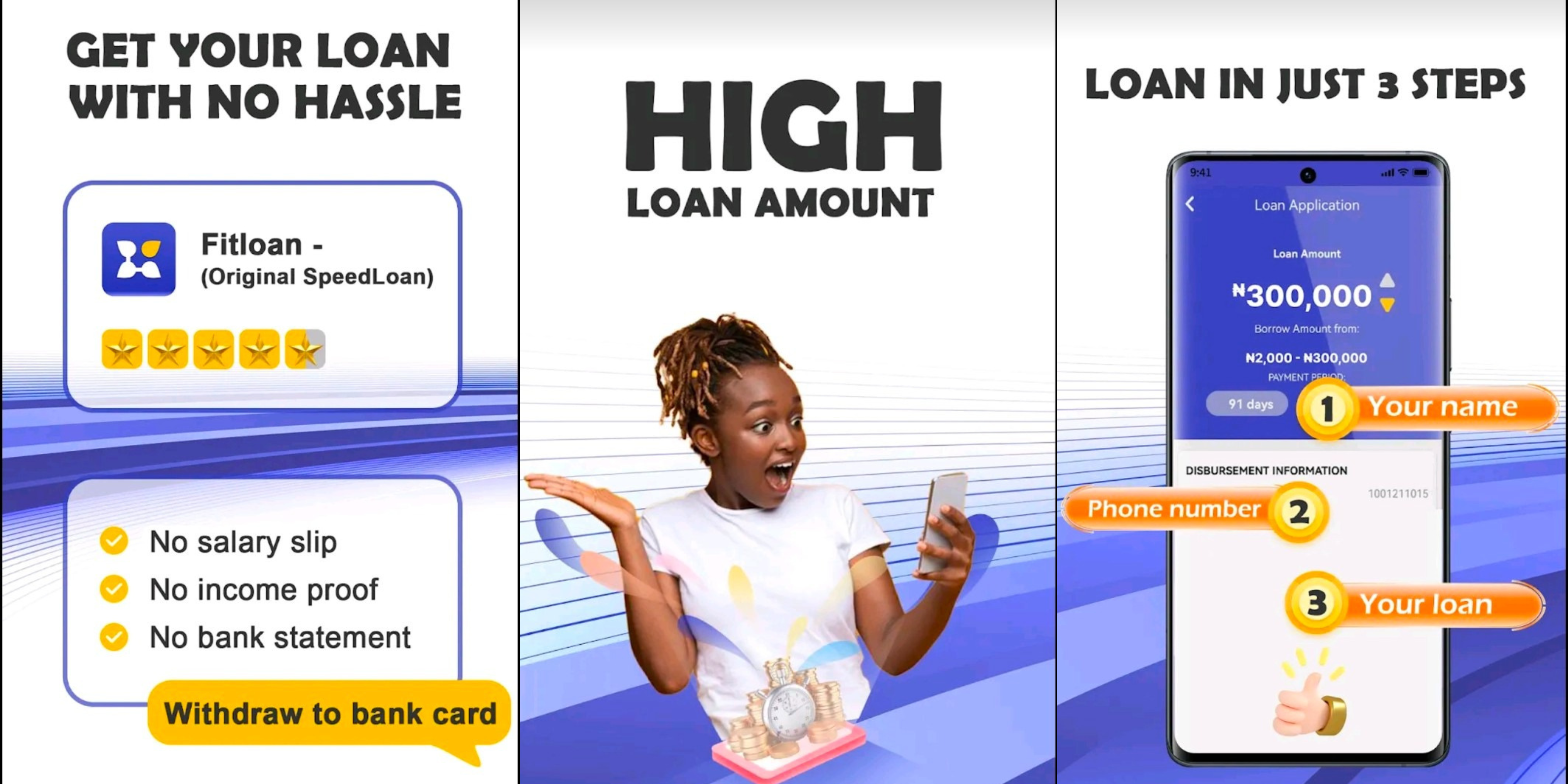

Are you in need of a quick and convenient loan service in Nigeria? Look no further than Fitloan – the original SpeedLoan app. With Fitloan, you can easily apply for a cash loan ranging from ₦2,000 to ₦600,000, with flexible repayment terms and competitive interest rates. In this comprehensive guide, we will walk you through the application process, eligibility criteria, requirements, and the numerous benefits of choosing Fitloan as your preferred lending platform.

How to Apply for a Loan with Fitloan

Getting a loan with Fitloan is super simple. Simply follow these steps to access the instant loan service:

1. Download the Fitloan app: Head to the Google Play Store, download the app, and install it on your Android device.

2. Fill out the application form: Open the app, complete the application form accurately, and submit it.

3. Evaluation process: Fitloan will swiftly evaluate your application to see if you qualify.

4. Choose your loan: Once approved, you’ll see various loan options based on your eligibility. Pick the one that fits your needs.

5. Get your cash: After selecting your loan, the approved amount will be sent straight to your bank account.

Eligibility Criteria for Fitloan

Although Fitloan aims to provide financial assistance to a wide range of individuals, you need to meet certain criteria to qualify for their services. To be eligible for a loan, you must meet the following criteria:

1. Age: You must be between 18 and 60 years old.

2. Identification: Possess a valid government-issued ID.

3. Bank Account: Have a valid Nigerian bank account.

4. Residency: Be a resident of Nigeria.

Fitloan Requirements

Fitloan keeps the loan application process simple. The requirements are minimal, ensuring that more individuals can access the financial support they need. The following are the basic requirements to apply for a loan with Fitloan:

1. Valid government-issued ID: You will need to provide a copy of your identification document.

2. Bank account details: Provide the details of your Nigerian bank account for loan disbursement and repayment purposes.

What are the benefits of Fitloan – Original SpeedLoan?

Answer: Fitloan offers numerous benefits that make it a preferred choice for borrowers in Nigeria. Here are some key advantages of using Fitloan:

1. Safe and fast online loan service: Fitloan provides a secure and efficient online loan service, ensuring that your personal and financial information is protected.

2. Quick approval: Fitloan offers 24/7 approval for cash loans, allowing you to access funds whenever you need them.

3. Flexible loan amounts: With Fitloan, you can borrow anywhere from ₦2,000 to ₦600,000, depending on your needs and repayment capacity.

4. Competitive interest rates: Fitloan offers competitive interest rates, with a maximum Annual Percentage Rate (APR) of 20% per year.

5. Transparent transaction fees: Fitloan charges a transaction fee ranging from 0.1% to 0.35%, ensuring transparency in the loan process.

6. Simple repayment structure: Fitloan provides a clear repayment structure, making it easier for borrowers to manage their loan repayments.

6. Excellent customer service: Fitloan has a dedicated customer support team that is ready to assist you with any queries or concerns.

FitLoan: Frequently Asked Questions (FAQ)

Is Fitloan available for iOS users?

Answer: No, Fitloan is currently only available for Android users. You can download the app from the Google Play Store.

What is the maximum loan amount I can borrow from Fitloan?

Answer: Fitloan offers loans ranging from ₦2,000 to ₦600,000, depending on your eligibility and repayment capacity.

How long does it take to get loan approval from Fitloan?

Answer: Fitloan provides 24/7 approval for cash loans, ensuring quick access to funds.

Are there any hidden fees or charges with Fitloan?

Answer: Fitloan maintains transparency in its loan process. The transaction fee ranges from 0.1% to 0.35%, and all fees are clearly communicated to borrowers.

What happens if I am unable to repay the loan on time?

Answer: If you are unable to repay the loan on time, Fitloan may charge additional fees or penalties. It is important to communicate with Fitloan’s customer support team to discuss any difficulties in repayment.

What is the minimum loan amount offered by Fitloan?

Answer: Fitloan offers loans starting from ₦2,000.

What is the minimum loan duration with Fitloan?

Answer: The minimum loan duration with Fitloan is 91 days.

What is the maximum loan duration with Fitloan?

Answer: The maximum loan duration with Fitloan is 365 days.

What are the transaction fees associated with Fitloan?

Answer: Transaction fees with Fitloan range from 0.1% to 0.35%.

What is the interest rate charged by Fitloan?

Answer: Fitloan charges an annual interest rate of 20%.

How Fitloan works: Example

Let’s break down how Fitloan works with an example:

Say you decide to borrow ₦10,000 from Fitloan for a period of 120 days.

1. First off, you’ll have to consider the interest and service fees.

2. The total interest over the loan period would be calculated like this: ₦10,000 * 0.05% * 120 = ₦600.

3. Then, there’s the service fee, which would be: ₦10,000 * 0.3% = ₦30.

4. Monthly payments: Each month, you’ll need to pay the interest on the loan. So, monthly interest would be: ₦10,000 * 0.05% * 30 = ₦150.

5. Pay Back: And then, you’ll also pay back a portion of the principal loan amount each month. Since the loan term is 120 days, it’s like dividing the principal by 4 for each month. So, monthly principal repayment would be: ₦10,000 / 4 = ₦2,500.

6. Monthly Repayment Amout: Adding the monthly interest and the portion of the principal repayment, your monthly repayment would be: ₦2,500 + ₦150 = ₦2,650.

7. Total repayment: Over the loan term, you’d pay back the original loan amount of ₦10,000, plus the total interest of ₦600, and the service fee of ₦30. So, the total repayment would be: ₦10,000 + ₦600 + ₦30 = ₦10,630.

That’s how Fitloan works in a nutshell. It’s important to understand these calculations before taking out a loan so you can manage your finances effectively.

FitLoan Contact deatails and address

Phone: +234 701-768-1069

Email: fitloanspeedloanhelpcenter@gmail.com or speedloanhelp@yahoo.com

Address: 49 Balogun St, Lagos Island, Lagos, Nigeria

Fitloan Mobile-App

Conclusion

In conclusion, Fitloan – the original SpeedLoan app – provides a safe,fast, and convenient loan service in Nigeria. With a user-friendly app and simple application process, Fitloan offers borrowers the opportunity to access cash loans ranging from ₦2,000 to ₦600,000. The eligibility criteria are straightforward, and the loan requirements are minimal, making it accessible to a wide range of individuals. The benefits of choosing Fitloan include competitive interest rates, transparent transaction fees, flexible loan amounts, and excellent customer service.

If you’re in need of a quick loan in Nigeria, Fitloan is your go-to solution. Download the Fitloan – Original SpeedLoan app from the Google Play Store and experience the convenience of instant cash loans. Remember to read and understand the terms and conditions before proceeding with a loan transaction.