Of Course, financial stability plays a crucial role in our lives. Whether it’s for personal or business purposes, having access to quick and reliable loans can make a significant difference. One such option is the 9Credit Loan, a popular lending service that provides individuals with the opportunity to fulfill their financial needs. In this comprehensive guide, we will explore everything you need to know about the 9Credit Loan, including how to apply, eligibility criteria, requirements, benefits, and more. So, let’s dive in and discover the world of 9Credit Loan!

Table of Contents

- What is 9Credit Loan?

- How to Apply for 9Credit Loan

- Eligibility Criteria for 9Credit Loan

- Requirements for 9Credit Loan Application

- Benefits of 9Credit Loan

- Frequently Asked Questions (FAQs)

- How long does it take to get approved for a 9Credit Loan?

- Can I apply for a 9Credit Loan if I have a low credit score?

- What is the maximum loan amount I can get from 9Credit?

- Are there any hidden fees or charges associated with 9Credit Loan?

- Can I repay my 9Credit Loan before the due date without any penalties?

- e.t.c

What is 9Credit Loan?

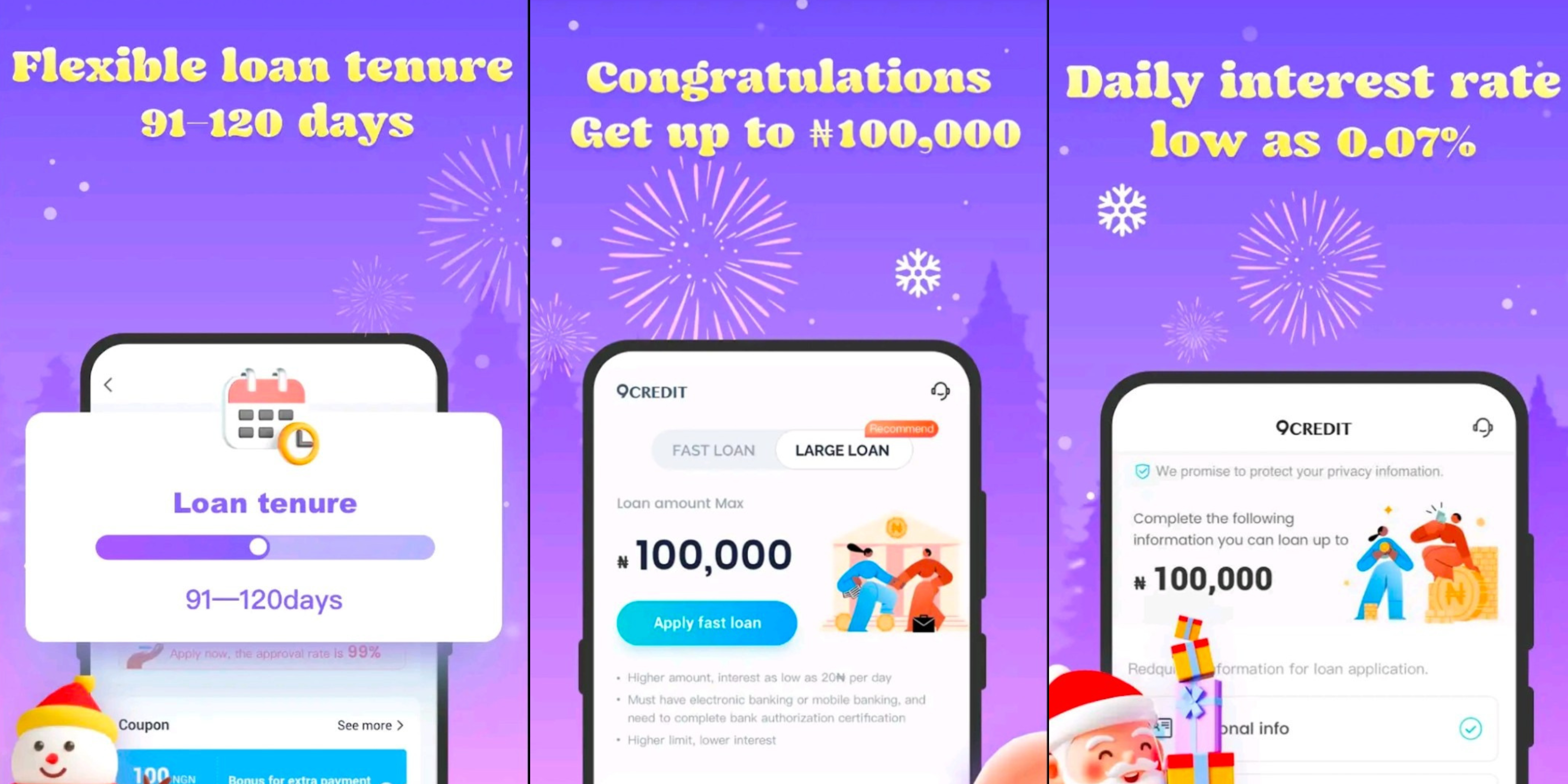

9Credit Loan is a leading online lending platform that offers quick and hassle-free loans to individuals in need of financial assistance. Whether you’re facing an unexpected expense, planning a vacation, or starting a new business venture, 9Credit Loan provides a convenient solution to meet your financial requirements. With a user-friendly interface and a seamless application process, 9Credit Loan has gained popularity among borrowers looking for a reliable and efficient lending service.

Eligibility Criteria for 9Credit Loan

To be eligible for a 9Credit Loan, you need to meet certain criteria set by the lending platform. The eligibility requirements may vary based on factors such as your location and the specific loan product you are applying for. However, here are some common eligibility criteria for 9Credit Loan:

- Age: You must be within the age of 18 to 56 years.

- Residency: You must be a legal resident of Nigeria.

- Document: You should have a valid government issued identification document(e.g. National ID card, International Passport or a Driver’s license).

- Income: You must have a stable source of income.

Top Requirements for 9Credit Loan

When applying for a 9Credit Loan, you will need to provide certain documents and information to support your application. While the specific requirements may vary depending on the loan amount and type, here are some common documents you may need to submit:

- Identity Document: Valid identification proof (e.g., passport, driver’s license or a valid National ID card )

- Income: Proof of income to verify your financial stability (e.g., salary slips, tax returns or preferably your most recent Bank Statement)

- Address: Proof of address (e.g., utility bills/NEPA bill or rental agreement)

- Phone Number: You should also have a valid Phone Number for registration and SMS purposes.

- BVN: Must have a valid Bank Verification Number(BVN).

- Account: You should have an active bank account(for loan disbursement).

Note: It’s important to ensure that all the documents provided are accurate and up to date to avoid any delays in the loan approval process.

How to Apply for 9Credit Loan

Applying for a 9Credit Loan is a simple and straightforward process. Follow the steps below to get started:

- App Installation: Begin by downloading and installing the 9Credit App on your mobile device. You can find the app on the Play Store by searching for “9Credit Loan” and selecting the official app from the search results or by using this link. Once you find the app, click on the “Install” button to initiate the download and installation process.

- Register an account: After successfully installing the 9Credit App, open it and proceed to register an account. You will be prompted to provide some basic information, such as your name, email address or phone number. Make sure to enter accurate details to ensure a smooth application process. Create a strong password to secure your account and proceed to the next step.

- Select the product you would like to apply for: Once you have registered and logged into your 9Credit account, you will be presented with a range of loan products to choose from. Carefully review the options available and select the product that best suits your financial needs. Each loan product may have different terms, interest rates, and repayment options, so take your time to make an informed decision.

- Fill out the contents, then submit the application: After selecting the desired loan product, you will need to provide the necessary information and complete the application form. The form will require details such as your personal information, employment details, income, and any other relevant information. Ensure that you fill out all the fields accurately and honestly. Double-check the information before submitting the application to avoid any errors.

- Verification and Application Result: After submitting your application, the 9Credit team will review it. In some cases, you may receive a call for verification purposes. This is a standard procedure to ensure the accuracy and authenticity of the information provided. Once the verification process is complete, the final application result will be shown in the app. Additionally, you will receive an SMS notification informing you of the approval status of your loan application.

- Provide consent with the loan agreement after approval: If your loan application is approved, you will need to provide consent with the loan agreement. Carefully review the terms and conditions of the loan agreement to ensure that you understand all the obligations and responsibilities associated with the loan. If you agree to the terms, proceed to provide your consent by following the instructions provided in the app.

- Disbursement of the approved loan amount: After confirming the loan agreement, the approved loan amount will be disbursed into your designated bank account. This process may take some time, depending on the specific procedures and policies of 9Credit. Once the funds are disbursed, you will receive an SMS notification confirming the transaction.

Top Benefits of 9Credit Loan

The 9Credit Loan offers several benefits to borrowers, making it an attractive choice for those in need of financial assistance. Here are some key advantages of choosing 9Credit Loan:

-

- No credit history required: Unlike traditional lenders, 9Credit does not solely rely on credit history when considering loan applications. This means that even if you have a limited or no credit history, you still have the opportunity to apply for a loan and get approved.

- Paperless and digital process on your mobile: With the 9Credit App, you can complete the entire loan application process digitally, right from your mobile device. This eliminates the need for paperwork and allows for a more convenient and efficient application experience.

- Get 24/7 access to a loan anytime, anywhere: The 9Credit App provides you with round-the-clock access to loan services. Whether it’s day or night, you can apply for a loan whenever you need it, from the comfort of your own home or wherever you may be.

- Efficient Application Review: 9Credit employs a streamlined application review process, ensuring that your loan application is reviewed promptly and efficiently. This means that you won’t have to wait for an extended period to receive a decision on your loan application.

- Disburse to your connected account once approved: Once your loan application is approved, the approved loan amount will be disbursed directly into your connected bank account. This eliminates the need for additional steps or visits to a physical location to collect your funds.

- Available Pan Nigeria: 9Credit is available throughout Nigeria, ensuring that individuals from various locations across the country can access their loan services. Whether you reside in Lagos, Abuja, or any other city in Nigeria, you can apply for a loan with 9Credit.

- As the credit score grows, the sanctioned amount gradually increases: 9Credit rewards responsible borrowers by gradually increasing the sanctioned loan amount as their credit score improves. This means that if you consistently make timely repayments and maintain a good credit history with 9Credit, you may be eligible for higher loan amounts in the future.

- Variety of convenient repayment options: 9Credit offers a range of convenient repayment options to suit your preferences and financial situation. Whether you prefer automatic deductions, bank transfers, or other methods, 9Credit strives to provide flexibility in repaying your loan.

- Don’t worry about forgetting repayment. We’ll send messages to remind you: To ensure that you never miss a repayment, 9Credit sends regular reminders via SMS to remind you of upcoming due dates. This helps you stay on track with your loan repayments and avoid any unnecessary penalties or charges.

By choosing 9Credit for your loan needs, you can benefit from a hassle-free application process, flexible repayment options, and the convenience of managing your loan digitally. Whether you have a strong credit history or not, 9Credit aims to provide accessible loan services to individuals across Nigeria.

9Credit Loan: Frequently Asked Questions (FAQs)

How long does it take to get approved for a 9Credit Loan?

Answer: The approval process for a 9Credit Loan is usually quick, and you can expect to receive a decision within a few hours of submitting your application. However, the exact time may vary depending on factors such as the completeness of your application and the volume of loan applications received by 9Credit Loan.

Can I apply for a 9Credit Loan if I have a low credit score?

Answer: Yes, 9Credit Loan considers applications from individuals with varying credit scores. While a low creditscore may affect the loan terms and interest rates, it does not necessarily disqualify you from obtaining a loan. 9Credit Loan takes into account various factors when assessing loan applications, including income stability and repayment capacity.

What is the maximum and minimum loan amount I can get from 9Credit?

Answer: The loan amount you can receive from 9Credit Loan ranges from a minimum of NGN 3,000 to a maximum of NGN 100,000. However, the specific loan amount you may be eligible for depends on various factors, including your income, creditworthiness, and the loan product you are applying for. To determine the maximum loan amount you can qualify for.

Are there any hidden fees or charges associated with 9Credit Loan?

Answer: 9Credit Loan aims to maintain transparency in its loan offerings. While there may be certain fees and charges associated with the loan, such as processing fees or late payment fees, these are typically disclosed upfront in the loan agreement. It’s essential to review the terms and conditions carefully and seek clarification from 9Credit Loan if you have any concerns about potential fees or charges.

Can I repay my 9Credit Loan before the due date without any penalties?

Answer: Yes, 9Credit Loan encourages responsible borrowing and allows borrowers to repay their loans before the due date without incurring any penalties. Early repayment can help you save on interest charges and improve your creditworthiness.

Can I apply for a 9Credit loan if I am a Nigeria resident?

Answer: Yes, 9Credit loans are available to residents of Nigeria. Whether you reside in Lagos, Abuja, or any other city in Nigeria, you can access 9Credit’s loan services and apply for a loan.

What are the age requirements to apply for a 9Credit loan?

Answer: To be eligible for a 9Credit loan, you must be between 18 and 56 years old. As long as you fall within this age range, you can apply for a loan and be considered for approval.

What is the required source of monthly income to qualify for a 9Credit loan?

Answer: To qualify for a 9Credit loan, you need to have a verifiable source of monthly income. This can include salary from employment, business income, Bank Statement or any other legitimate source of regular income. Providing proof of your monthly income is an essential requirement during the loan application process.

Can I apply for a 9Credit loan if I am self-employed?

Answer: Yes, self-employed individuals can apply for a 9Credit loan as long as they can provide proof of a regular source of income. This can include bank statements, business documents, or any other relevant documentation that demonstrates a consistent monthly income.

How can I contact 9Credit for further assistance or inquiries?

Answer: If you have any further questions or need assistance, you can reach out to 9Credit’s customer support team through the 9Credit App or their official website as listed below. They will be happy to provide you with the necessary information and address any concerns you may have.

9Credit Contact Details

Email: Customer@9credit.co

Office Address: lawal street, oregun, ikeja, Nigeria

Website

Phone: +234 9019-310-402

Mobile APP

These FAQs cover some common questions about 9Credit loans. If you have any additional inquiries or need further clarification, don’t hesitate to contact 9Credit’s customer support team. They are dedicated to providing excellent service and support to borrowers throughout Nigeria.

Conclusion

The 9Credit Loan offers a convenient and reliable solution for individuals seeking financial assistance. With its user-friendly interface, quick approval process, and flexible repayment options, 9Credit Loan has become a popular choice among borrowers. By understanding the application process, eligibility criteria, requirements, and benefits of 9Credit Loan, you can make an informed decision and take advantage of this lending service to meet your financial needs. Remember to review the terms and conditions carefully and reach out to 9Credit Loan for any further assistance.