How to get CredPal loans/Buy Now Pay Later(BNPL)

CredPal?

CredPal is a Nigerian fintech platform revolutionizing how you shop and manage your finances. Get loans up to 2 million Naira with their buy now, pay later (BNPL) feature, or grow your wealth with investments earning up to 18% interest.

What is CredPal’s Buy Now, Pay Later (BNPL)

CredPal’s Buy Now Pay Later allows you access to CredPal’s verified merchants to pay for purchases with your credit card or shopping limit.

For instance do you need a new phone or laptop right now but can’t afford to make an instant payment? CredPal’s CredPal’s Buy Now, Pay Later(BNPL) empowers you to shop and pay in flexible installments.

CreditPal loan/service Eligibility Requirements

To qualify, you must meet the following criteria:

- Be a Nigerian resident: These services are tailored to those living in Nigeria.

- Must be 18Years old or above the age of 18years .

- Have a valid BVN: Your Bank Verification Number is used for identity confirmation and security purpose in order to protect your CredPal account against fraud and impersonation.

- Must be a Business owners and salary earners, As long as you meet the requirements, you are eligible.

- Possess a valid debit card: Link a debit card (with at least 3 months of validity) to your account.

- Email account: This is needed for communication and setting up your account.

- Have a personal bank account.

- Must provide a valid National Identification number(ID card).

- Must Provide employment details as CredPal services is strictly for salary/business owners.

How to Apply for a CredPal Loan/Buy Now Pay Later(BNPL)

To apply for CredPal Loan/Buy Now Pay later service(BNPL), you need to:

- Download the CredPal mobile app and Sign Up: You can get the app on app store or google play store and create a free account.

- Provide Basic Information: Fill out your personal information(email, name, phone number, residential address, country etc.) and verify your BVN.

- Apply for CredPlal credit card and provide required details.

- Wait for your CredPal application to be approved, so as to get your buy now pay later credit card to shop and pay overtime.

Where/how can to use the CredPal Buy Now Pay Later(BNPL) card

- Install the CredPal mobile app

- Find and visit your favorite stores(e.g: Jumia) within the CredPal app or via the merchant payment link.

- Add your product information

- Then Split your bills(purchase) into 6 repayment periods at most.

- There are two payment options available; one-time payment and spread the payment

CredPal one-time payment

With the one-time payment option, you pay the merchant directly from your credit card balance. This must be paid back at the end of each statement period.

CredPal spread payment

With the spread payment option you are allowed access to credit above your credit card limit, which you can pay back over 2 – 6 months interval. This payment method can be very useful when making large purchases. For order approval, you’re required to make a 30% down payment.

A transaction receipt is generated for both types of payments, which you can share with the merchant for order fulfillment.

CredPal interest rates and benefits

- Loan limit for Buy now pay later(BNPL): This ranges from ₦100,000 minimum to ₦2,000,000 maximum.

- Flexible Repayment: Choose a plan from 60 to 180 days with 6 repayment period(interval) that makes repayment manageable.

- No Hidden Fees: Transparent pricing eliminates unpleasant surprises.

- Credit Score Building: On-time repayments boost your creditworthiness for larger loans in the future.

- Good Interest Rates: CredPal’s APR (Annual Percentage Rate), ranging from 2%(One-Off payment) to 83%.

Example:

- Loan Amount: ₦100,000

- Term: 180 days

- Interest (6.5%): ₦39,000

- One-time Fee (2%): ₦2,000

- Total Cost: ₦141,000

How to Use CredPal

- Download & Sign Up: Find the CredPal app and create your account.

- Apply & Get Approved: Provide required details to get your credit limit

- Shop & Pay Over Time: Use your CredPal credit card at partner stores or via their payment links.

Manage CredPal Repayments

CredPal gives you a clear overview of all purchases and installment plans, making it easy to stay on top of your payments. Timely repayments boost your credit limit and unlock exclusive offers.

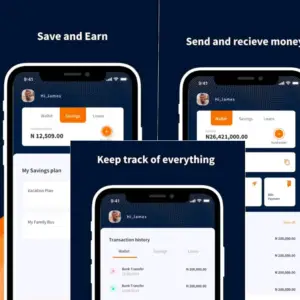

CredPal Invest: Grow Your Money

CredPal isn’t just about spending – it’s about financial growth, too. Invest with them and reap the benefits:

- Flexible Plans: Create multiple wallets tailored to your goals.

- High Returns: Earn up to 18% per annum.

- Start Small: Invest as little as 1,000 Naira.

- Security: Your investments are protected with bank-level encryption.

CredPal: Who are we?

- Business Name: Crednet Technologies Limited (DBA) CredPal

- Privacy Commitment: CredPal prioritizes data security and won’t share your information without permission.

CredPal Contact information

- Email: hello@credpal.com

- Social Media: (Include their Twitter, Facebook, Instagram links)

- Website: credpal.com

- Phone: 017007999

- Address: Lagos, Nigeria.